EU NatGas Rally Continues Amid Russian Shipment Plunge; More LNG Tankers Come To Rescue

European natural gas prices soared for the third consecutive session as Russian shipments to the fuel-starved continent remain muted. Elevated gas prices have slapped a hefty price premium, opening up massive arbitrage opportunities for international commodity traders.

Dutch month-ahead gas, the European benchmark, has rallied as much as 42% this week from 65 euros a megawatt-hour to 92 euros on slumping pipeline supply from Russia.

For context, this shift is the BTU/Barrel of oil equivalent of a move from $100 to a $180 barrel of oil…

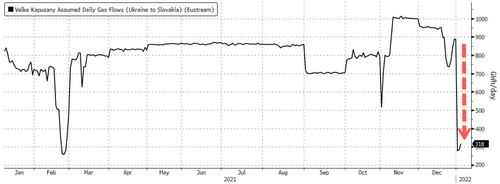

On Monday, we first discussed this issue in a commodity note titled “European NatGas Prices Soar As Supply Constraints From Russia Build.” Three days later, Russian supplies via Ukraine remain curbed, while the Yamal-Europe pipeline is flowing in the reverse direction from Germany to Poland, according to Bloomberg.

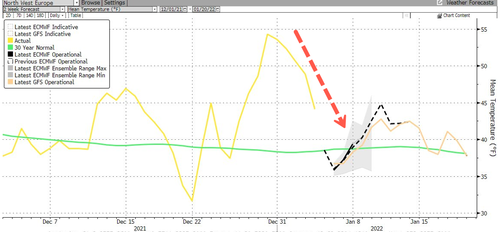

Russia’s ability to control the European gas market comes as the continent has mismanaged its power grid through green initiatives. With cold weather returning, Europe will deplete even more gas inventories. This may suggest gas is headed back over 100 euros.

Europe’s energy crisis has been a boon for energy traders who have access to liquefied natural gas (LNG) and LNG cargo vessels.

We first reported a flotilla of US LNG tankers were headed to Europe a few weeks ago. Now shipping data from Kpler and Bloomberg show 13 LNG carriers from the U.S. and West Africa are rerouting to Europe instead of Asia. Gas prices in Europe are more expensive relative to Asia, which is why LNG ships are being rerouted to collect a hefty premium. It’s called arbitrage.

Here’s one ship that recently rerouted from Asia to Europe.

So the question Europeans want to know is when will the energy crunch end. Well, the saving grace for the fuel-starved continent is Russia’s Nord Stream 2 pipeline that might not come online until July. It seems like the energy crisis in Europe is far from over.

Tyler Durden

Wed, 01/05/2022 – 11:45

via ZeroHedge News https://ift.tt/3pV5bnZ Tyler Durden