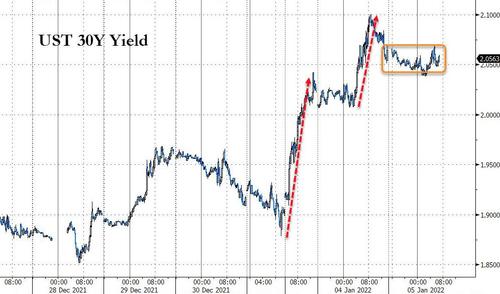

Is The Bond Bloodbath Over? Technicals, Inflation, & Fed Whispers

Bond bulls had the jam stolen from their donut to start 2022, but the question is – with today’s relative stability – is the bond bloodbath over… for now?

Source: Bloomberg

To answer that question, we need to consider what drove this sudden unrelenting two-day scream higher in yields.

Bloomberg’s Mark Cudmore highlights two significant drivers that are feeding off each other right now.

One is only temporary and the other will likely evolve into something different.

First, new year investment-grade bond issuance is putting upward pressure on yields, exacerbated by still poor liquidity.

As we noted earlier, this was the heaviest calendar since the first week of September meaning rate-lock demand was an extremely significant driver of yield-upside in the last two days…

So many theories about the blow up in yields, meanwhile the real reason is much more simple: rate locks:

thirteen borrowers priced $23.1BN across 30 tranches Tuesday, making it the largest single day volume for U.S. high-grade corporate bonds since first week of September.

— zerohedge (@zerohedge) January 5, 2022

This can become a short-term self-feeding dynamic, but it’s not a fundamental driver that can sustain over the medium term.

Second, Cudmore notes that a consensus is building that omicron’s economic impact will be more about exacerbating supply-side issues, hence boosting inflation rather than hurting aggregate demand too much.

The corollary is that if rate hikes do need to be stalled due to omicron’s growth impact, then more will ultimately be needed and hence a steeper curve.

There is a third potential driver of higher rates, as The Washington Post claims that “US lawmakers have held early talks on new COVID relief”. Nomura’s Rob Dent pours cold water all over that idea…

“I would interpret this headline with caution for three reasons.

First, we have heard very little about this from Congressional leadership. The House is out, the Senate is bogged down with Build Back Better and voting rights. There is not a lot of momentum for another round of stimulus, and even the package that these two lawmakers discussed in December was only $68bn (vs about $5tn of pandemic-related fiscal relief since 2020).

Second, there’s a growing consensus that Omicron is different from earlier waves in how mild it is, and growing speculation that it could mark a turning point for when the pandemic becomes endemic. The fast spread of Omicron means cases could subside just as quickly, dampening the need for additional stimulus as early as February.

Third, the broader appetite in Congress for enacting additional stimulus is low. That has been reflected in Democrats’ inability to extend some of the pandemic-related programs like enhanced unemployment benefits and the expanded Child Tax Credit (which expired this month). If the US is forced to go into another lockdown, there may be renewed interest in another package, but so far we do not appear to be on that track.

The bottom line is that we probably shouldn’t expect much out of Washington this year unless things get really bad, i.e., a new, completely vaccine resistant variant. Outside of that, there may be narrow efforts to do something very simple like pass airline aid (a few billion) but that may be it.”

One final suggestion for the rise in yields is a narrative that highlights a confidence that the economy (and the market) can handle policy tightening.

However, as Nomura’s Charlie McElligott notes, the bond market is still going to be VERY susceptible to fits-and-starts, particularly with the Fed’s clear messaging trial-balloons on balance-sheet run-off taking a step-further yesterday with the WSJ’s “Fed Whisperer” Nick Timiraos piece yday

Additional comments of said WSJ balance sheet run-off piece, again from Nomura Economist Rob Dent:

“He (Timiraos) usually has good “preview” pieces for messages the Fed wants out ahead of key releases. The timing – one day before the Dec FOMC minutes are released – is probably not a coincidence. The article notes that Fed officials began to debate runoff at the Dec meeting. Powell alluded to this, so we are largely expecting discussions on it in tomorrow’s minutes release, but the FOMC may not want to surprise people with that section. It’s possible the minutes will be more hawkish than what Powell suggested at the press conference, similar to Nov. We continue to believe the Fed will announce balance sheet runoff at the July meeting, effective August, with larger caps and a faster scale up relative to the post-GFC period ($12bn for TSY, $8bn for MBS, reaching $60bn and $40bn by Dec, respectively).”

However, as McElligott has made clear previously, the back-test of Fed policy-tightening running simultaneously with balance-sheet run-off has not been kind – see 4Q18; meaning there is still absolutely room for this hopeful “Pro-Cyclical” rally to get washed-out in a “Risk-Off” / FTQ / Duration type trade at the first sign of a harder economic slowdown, OR, “markets tantruming” with enhanced volatility (i.e. when Powell’s facepalm “long way from neutral” plus balance-sheet unwind on “auto-pilot” comments absolutely NUKED the S&P -20% btwn Oct to Dec 2018, before he infamously ‘bent the knee’ to markets under the guise of the unspoken “financial conditions” 3rd mandate)

As McElligott notes, obviously, if this above “financial conditions tightening tantrum” scenario were to play-out in true “policy error” fashion, we would expect the polar opposite trade to develop from what we are currently seeing this first week of 2022–from what is now “risk-seeking” Pro-Cyclical positioning into something that would be more “risk-off” and likely, Duration-sensitive.

Put simply, any jawboning on more aggressive policy-tightening and balance-sheet shrinkage will prompt a rapid test of the Powell Put strike and with it a knee-jerk bid for bonds, rejecting the ongoing rise in yields that has already become a theme for many this week.

So – is the bond bloodbath over? We suspect yes, for now. Heavy issuance technicals are done, omicron’s upside inflationary impact may quickly morph into greater fears about the short-term growth impact, any hope for new COVID relief is just wishful thinking, and belief in the narrative that ‘higher rates prove the ec9onomy is resilient’ will be shrugged off rapidly as long-duration stocks continue to get monkey-hammered and the Powell-Put is tested.

Tyler Durden

Wed, 01/05/2022 – 10:24

via ZeroHedge News https://ift.tt/3eQV5hR Tyler Durden