Peter Schiff: 2022 Will Be Even Worse Than 2021

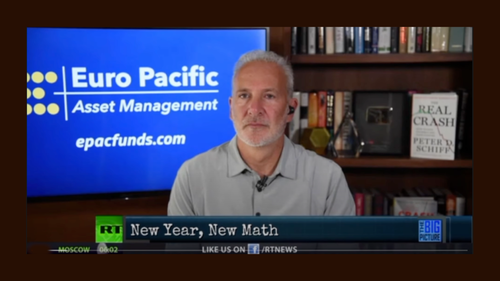

How are the dollars and cents of your life changing as we move into 2022? Peter Schiff joined University of Miami Business School Dean John Quelch and host Holland Cooke on RT’s “Big Picture” to talk about the year ahead. Peter left us with an ominous warning. 2022 will be worse than 2021 as inflation continues to mount.

The first question posed to Peter was have Americans’ prospects for prosperity become less likely? Peter said he thinks they’ve diminished dramatically and will get even worse as the decade progresses. He pointed out that in the 50s, Americans had much more economic freedom. The government was much smaller. The US was a large industrial nation with big trade surpluses. We had a sounder economy and more savings.

We’re the mirror image of that now. We’re the world’s biggest debtor nation — record trade deficits. We’ve got no savings. We have a complete bubble economy based on artificially low interest rates, excess consumption financed by debt and money printing. And we’re about to pay the piper for that.”

Peter said we’re just now seeing the tip of an inflationary iceberg. And despite pulling back a little bit, the Federal Reserve is still pursuing a highly accommodative monetary policy.

He is throwing more gasoline on the inflationary fire that the Fed lit. So Americans, I think, are going to be dealing with a dramatically diminished standard of living as this decade unfolds. I think the dollar goes down a lot. The cost of living goes up dramatically.”

Quelch sounded a more optimistic tone. He said Americans’ propensity to innovate and competition with China will help drive the US economy forward. He said the US has always done a tremendous job of innovating itself out of difficulty.

Yet we have this inflation problem. Cooke reminded us that the Fed has called inflation “transitory.” Peter said it’s intractable.

And despite what a lot of people think, the economy wasn’t strong before the pandemic. It was a great big fat ugly bubble.

We really couldn’t survive the economic downturn. So, the Fed bailed us out with more money printing. You know, we haven’t been innovating our way out of crisis. We’ve been printing our way out. But we’ve printed out way into an even bigger crisis because now we’re paying the piper. Because this inflation acts as a lag. In fact, I think we’re still dealing with the inflation that was created before the pandemic. Wait until we catch up to the even greater inflation that we created after.”

Peter pointed out the true definition of inflation – the expansion of the money supply.

Prices going up are merely a result of inflation.”

Prior to the pandemic, much of the inflation was manifesting itself in asset prices – real estate, stocks and bonds. Consumer prices didn’t go up as much. (Although they went up more than the government admitted with its rigged CPI.)

I think right now prices are rising at a faster rate than in any year during the 1970s. But instead of being on the verge of doing something to contain inflation, we’re just getting ready to make it worse.”

The Fed can’t do anything about inflation because of the level of debt in the economy.

Peter also pointed out that you can’t consume if you don’t produce.

Our productivity is collapsing and America is reliant now more than ever before on the productivity of foreign countries because our trade deficits are exploding. Wait until the dollar implodes. Because the only thing that’s been keeping a lid on inflation has been a relatively strong dollar. Well, I think the dollar is going to roll over and fall dramatically over the next several years, and that is going to cause this inflation problem to be much much worse because it’s really going to push up the price of all of our imports.”

Quelch said he thinks about 30 to 40% of the current inflation is due to supply chain disruptions caused by the pandemic, not underlying forces.

Peter took issue with the “supply chain” disruption excuse for rising prices.

Sure, when you shut down an economy, it’s obvious that you’re going to have less supply. You’re producing less. You’re working less. But what should have happened is demand should have gone down too. But unfortunately, the Fed did not allow a healthy decline in demand to meet up with the decline in supply. The Fed made the mistake of showering the economy with money — the worst monetary policy probably in history. When people were not at work and home, the Fed was printing money so the government could mail them checks so they could go out and buy stuff even though they weren’t working to help produce stuff. And so that is the problem. It is all a demand problem created by the Fed — created by money printing. And the money that the Fed is printing is going to continue to lose value, and that’s going to be reflected in rising prices.”

Tyler Durden

Wed, 01/05/2022 – 12:09

via ZeroHedge News https://ift.tt/34iIotX Tyler Durden