Risks To The Bullish Thesis In 2022

Authored by Lance Roberts via RealInvestmentAdvice.com,

The market outlook for 2022 remains bullish, as Wall Street veterans suggest that Fed tightening won’t hurt stocks bullish advance. From JP Morgan’s target of 5050 to BMO’s forecast of 5300 on the S&P index, there is little concern that stocks could be lower next year.

Such is undoubtedly understandable after more than a decade of advancing markets, with the last 3-years seeing the market advance more than 50%. The market has weathered 20% corrections from a Fed “taper tantrum” to a 35% rout from a pandemic-driven shutdown. Each time the market rebounded quickly as the Fed jumped into the fray providing accommodative policies.

Our market outlook for 2022 is a bit more conservative than much of Wall Street. While 2022 could be another bullish year for stocks, as bull markets are tough to kill, my job as a portfolio manager is to ensure our clients don’t suffer a permanent impairment to their investment capital.

Given that our client’s portfolios remain allocated toward equity risk, our market outlook focuses on what could go wrong. Such seems a more pragmatic approach than just “hoping” things go right.

While we should always “hope for clear skies and calm seas,” a captain navigates away from the risks to his vessel.

So, what are the risks in 2022 that we should steer clear of?

Market Outlook – The Risk To The Bullish Thesis

Over the last few years in particular, as valuations have become more extreme, the consistently bullish media continue to invent rationals for higher stock prices.

-

Low interest rates justify high valuations.

-

There is no alternative (T.I.N.A.)

-

Monetary policy supports higher prices.

-

Low inflation supports higher prices

Notably, those rationalizations appeared correct due to the massive flood of monetary and fiscal policy during that period.

So, as we head into 2022, here is a shortlist of the things we are either currently hedging portfolios against or will potentially need to in the future.

-

Economic growth slows as year-over-year comparisons become far more challenging.

-

Inflationary pressuresremain more persistent than anticipated which impedes consumption and compresses profit margins.

-

Rising wage and input costs reduce corporate earnings disappointing earnings growth expectations.

-

Valuations begin to weigh on investor confidence.

-

Corporate profits weaken due to slower economic growth, reduced monetary interventions, and rising costs.

-

Consumer confidence continues to weaken as consumption is crimped by rising costs and slowing economic growth.

-

Interest rates rise which trips up heavily leveraged consumers and corporations.

-

A credit-related event causes a market liquidity crunch.

-

The Fed makes a “policy error” by tightening monetary accommodation as the economy slows suddenly.

-

A mid-term election resulting in a broad sweep by Republicans in both houses further reduce liqudity.

-

The “housing bubble 2.0” implodes.

-

Corporate stock buybacks, which accounted for 40% of the market’s appreciation since 2011, slow as companies begin to hoard cash as the economy slows.

-

The massive inflows into US equity markets over the last year slows.

-

The avalanche of M&A activity, IPO’s, and SPAC’s of poor quality companies results in negative outcomes.

-

Market breadth remains incredibly week, with5-stocks supporting the major market.

I could go on, but you get the idea.

You Can’t Have It Both Ways

While analysts on Wall Street are confident the bull market will continue uninterrupted into 2022, there are more than enough risks to derail that market outlook. Importantly, none of these independently suggest a significant correction is imminent. However, the risk is that they will undermine the bullish “psychology” of the market.

The critical component of the “bullish thesis” has been the psychology of the “Fed put.” Regardless of valuation levels, deteriorating fundamentals, or simple logic, the excuse for continuing to take on increasing levels of risk was “Don’t fight the Fed.”

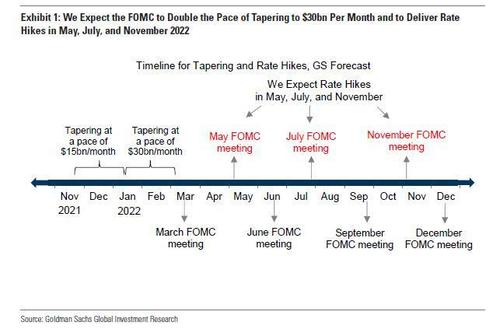

However, therein lies the irony as we head into 2022, the Fed is expected to tighten policy rather quickly. If the logic of rising prices was “don’t fight the Fed’s liquidity,” the argument now is to “fight the Fed’s tightening regime.”

As is always the case, you can’t have it both ways.

A Reversal Of Fortune?

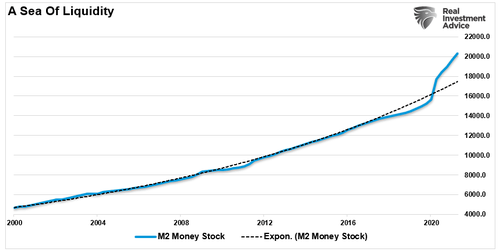

As noted, the unexpected “pandemic-driven economic shutdown” sent the Federal Reserve and Government into fiscal and monetary policy overdrive. Such led to an unimaginable influx of $5 trillion into the economy, sending the “money supply” surging well above the long-term exponential growth trend.

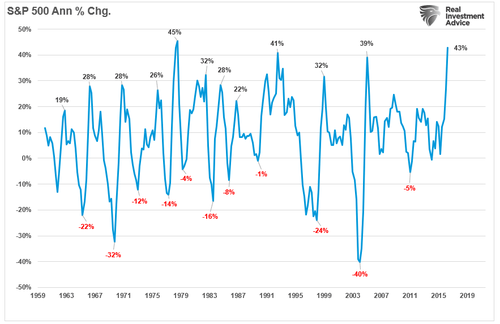

The importance of that “sea of liquidity” is both positive and negative. In the short term, that liquidity supports economic growth, the surge in retail sales into this year, and the explosive recovery in corporate earnings. That liquidity is also flowing into record corporate stock buybacks, retail investing, and a surge in private equity. With all that liquidity sloshing around, it is of no surprise we have seen a near-record surge in the annualized rate of change of the S&P 500 index.

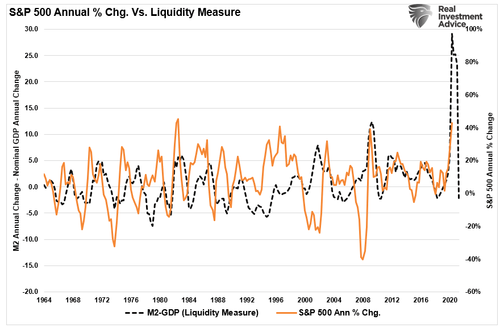

However, as stated, there is a dark side to that liquidity. With the Democrats struggling to pass another stimulus bill, a looming debt ceiling, and the Fed beginning to “taper” their bond purchases, liquidity will reverse next year. As shown below, if we look at the annual rate of change in the S&P 500 compared to our “measure of liquidity” (M2 less GDP), it suggests stocks could be in trouble heading into next year.

While not a perfect correlation, it is high enough to warrant attention. With global central banks cutting back on liquidity, the Government providing less, and inflationary pressures taking care of the rest, it is worth considering increasing risk-management practices.

Sailing In Unchartered Waters

Returning to our “navigation” metaphor, trying to predict what will happen in 2022 is a futile exercise. There are too many variables that can occur that could change outcomes for the better or worse. As I discussed previously, risk management is a process:

First, the only certainty is that there is no certainty. Second, every decision, as a consequence, is a matter of weighing probabilities. Third, despite uncertainty we must decide and we must act. And lastly, we need to judge decisions not only on the results, but on how they were made.

If there are no absolutes, then all decisions become matters of judging the probability of different outcomes, and the costs and benefits of each. Then, on that basis, you can make a good decision.

Managing risk does not mean “being all in cash;” it only means navigating the risks that could cause permanent impairment to your financial plans.

If nothing happens and 2022 is another bullish year. Fantastic. Such will make my job very easy.

However, if an unexpected storm appears on the horizon, taking some actions to navigate safety will provide a much better outcome.

There is no value in “going down with the ship.”

Tyler Durden

Wed, 01/05/2022 – 11:27

via ZeroHedge News https://ift.tt/3n1pdeG Tyler Durden