WTI Slides Back Below $78 As Gasoline Demand Plunges

Oil prices extended their recent gains overnight with WTI topping $78 after very mixed data from API. The recent rally comes as OPEC+ continue to drip-feed production output at 400,000 barrels a day, as the cartel estimates a crude surplus in the first quarter.

Concerns about the Covid-19 omicron variant effect on demand may be somewhat overblown if it broadly continues to yield less-severe illness, which bodes well for crude-oil demand in the long term.

Still Bloomberg Intelligence Senior Energy Analyst Vince Piazza may face near-term headwinds from U.S. monetary policy.

API

-

Crude -6.432mm (-3.65mm exp) – biggest draw since Aug 2021

-

Cushing +2.268mm

-

Gasoline +7.061mm – biggest build since April 2020

-

Distillates +4.38mm – biggest build since June 2021

DOE

-

Crude -2.144mm (-3.65mm exp)

-

Cushing +2.577mm – biggest build since Feb 2021

-

Gasoline +10.128mm – biggest build since April 2020

-

Distillates +4.418mm – biggest build since June 2021

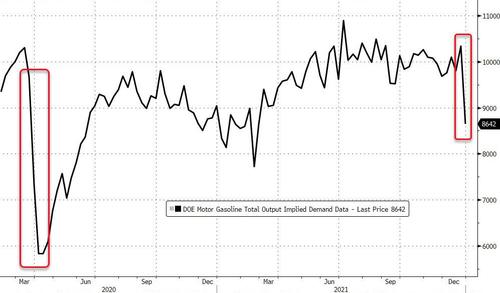

Airline staffing shortages and weather disruptions forced thousands of flight cancellations over the past two weeks appear to have impacted product inventories dramatically, along with the plunge in gasoline demand…

Source: Bloomberg

US gasoline demand fell by the most since April 2020…

Source: Bloomberg

Cushing crude stocks grew another week, making it now two months of growing inventories at the commercial storage hub. The storage depot is now sitting at the largest volume since July, after the biggest increase since February.

Crude production was flat week over week, at its highest since May 2020…

WTI slipped back below $78 after the big surprise product builds….

Will this Omicron anxiety be short-lived?

Tyler Durden

Wed, 01/05/2022 – 10:41

via ZeroHedge News https://ift.tt/3zpV120 Tyler Durden