The Homeownership Dreams Of Zoomers And Millennials Shattered By Prices

Authored by Mike Shedlock via MishTalk.com,

Home prices and rent are soaring faster than wages. This shattered home buying plans of generations Y and Z and put them in a rent squeeze as well.

Dreams Change

Things have really changed in three years according to Yardi’s latest Generational Survey on Homeownership Dreams.

Three years ago Yardi found that Gen Z was enthusiastic about the prospect of owning a home, whereas Millennials were pessimistic about their homeownership outlook.

Nearly two years into the COVID-19 pandemic and its economic and societal fallout Yardi has different findings.

Key Takeaways From Latest Survey

-

Affordability concerns have noticeably risen in the past 3 years, with home prices unaffordable for 66% of renters.

-

1 in 5 adults living with family say they can’t afford rental costs while 56% of non-owners have nothing saved for down payment.

-

Gen Z’s expectations for homeownership tempered in last 3 years with increasing concerns around credit scores & job security.

-

Millennials are still behind homeownership, with 55% of them dissatisfied with their current home – the lowest of any generation.

-

Nearly 40% of Millennials & Gen Z postponed buying a home due to the pandemic.

-

Suburbia becomes top option for Gen Z and even formerly city-minded Millennials, while Gen X’s interest in rural living grows

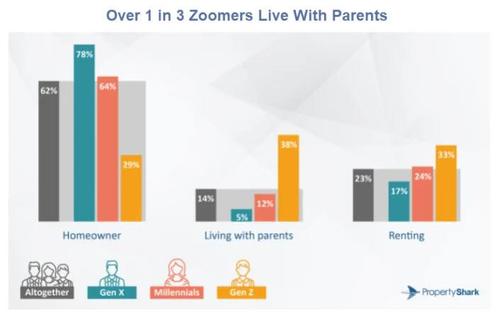

Zoomer Stats

-

38% Live With Parents

-

33% Rent

-

29% are Homeowners

Optimism Shattered

In the previous survey 83% of Zoomers expressed a desire and planned to buy a home within five years of 2018.

Only 29% of adult Zoomer respondents are now homeowners.

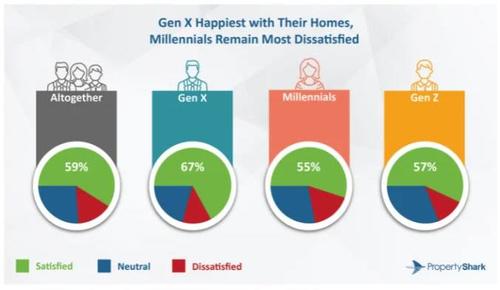

Millennials the Most Disgruntled Generation

-

Millennials remain the most disgruntled generation, with respondents from this generation reporting the lowest levels of satisfaction with their homes (55%), as well as the highest levels of outright dissatisfaction (17%).

-

For Gen Xers, the home’s state of repairs is the most significant worry with one in five dissatisfied with it, while more than one in five Millennials and Gen Xers are unhappy with the size of their home.

-

26% of all respondents who were unhappy named the home being too small as the main factor. This was closely followed by insufficient space for work and insufficient space for recreational activities, while one in five named overcrowding as the main factor. Only 3% of our pool of respondents said that their home was too large.

Covid Delays

Just over half (52%) reported no effects on their homeownership plans, while 41% of Millennials and 36% of Gen Z non-owners had to delay buying their own homes. Furthermore, 4% of all non-owners reported losing their homes due to COVID-19, with Millennials most affected at 5%.

Affordability

With the eldest Gen Xers now 56 years old, elder Millennials looking at 41 this year, and the forefront of Gen Z hitting 27 in 2022, homeownership rates among respondents from the three generations stand at 78%, 64% and 29%, respectively.

So, what’s keeping 22% of Gen X, 36% of Millennials and 71% of adult Zoomers out of the housing market?

The main issue is affordability. Of all non-owners who participated in our survey, 53% view today’s housing market as just as inaccessible or even more inaccessible than in 2018, with Millennials most pessimistic. And, for those living with parents or other family members, the outlook is even more stark than it is for renters, with 59% of Millennials who live at home feeling that the prospect of homeownership is now even further removed.

Is Covid Responsible?

No, but it sure didn’t help either.

The real issue is wages have not kept up with prices making saving a nonpayment difficult if not impossible.

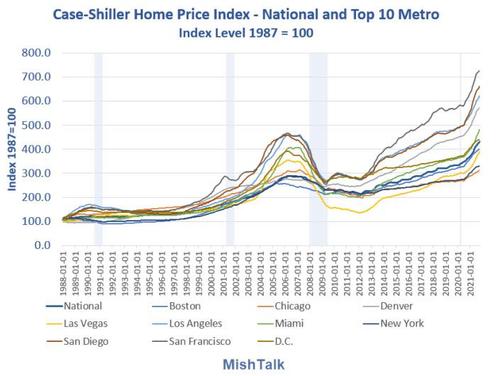

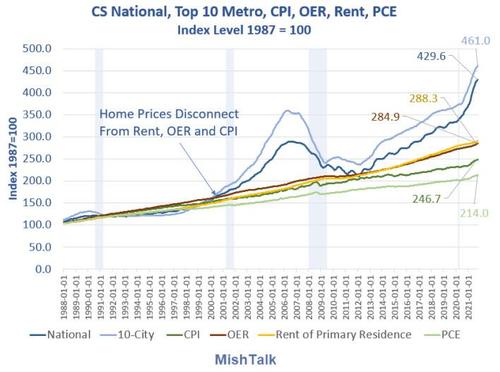

My charts show the problem.

Home prices have soared out of site. But rents are rising so fast that Zoomers and Millennials want out.

Home prices have seriously disconnected with rent.

But compounding the problem for Zoomers and Millennials, rent and OER (Owners’ Equivalent Rent) have been rising way faster than the CPI and wages since 2013.

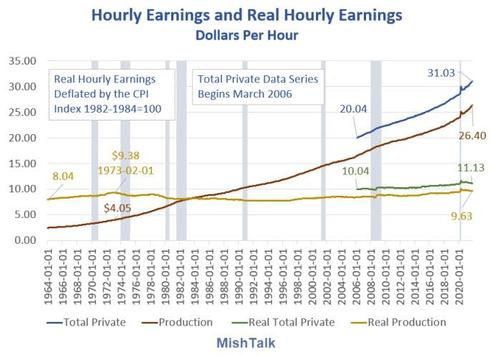

Real Hourly Wages Have Risen Less Than a Penny a Year Since 1973

Earlier today I noted Real Hourly Wages Have Risen Less Than a Penny a Year Since 1973

In real (inflation-adjusted) terms, people are making no more than they did 48 years ago (yellow line).

Nominal wages have soared but have barely kept up with inflation, assuming of course you believe inflation is not understated.

Every Measure of Real Interest Rates Shows the Fed is Out of Control.

My housing-adjusted CPI measure stands at 9.31%.

Try buying a house now on an additional half-penny per hour. It was actually possible factoring in a second wage earner per household until the year 1999 or so.

For details, please see Every Measure of Real Interest Rates Shows the Fed is Out of Control.

Meanwhile most Zoomers have to find a partner, live at home, or have roommates. I will see if I can get Yardi to conduct a survey on roommates.

* * *

Like these reports? If so, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Thu, 01/06/2022 – 11:52

via ZeroHedge News https://ift.tt/3t41eiX Tyler Durden