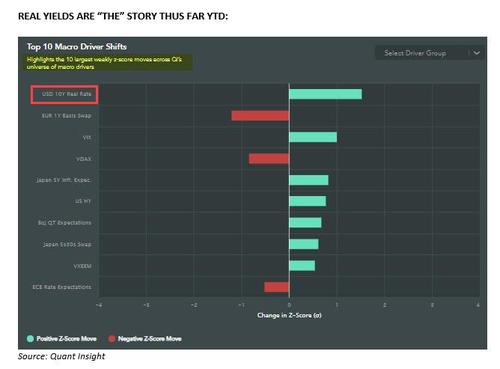

The Surge In Real Yields Is The Story So Far In 2022, But What Does It Mean

Something remarkable has happened in just the past 7 days: whereas real Treasury rates had been trading at multi-month lows on the last day of 2021, hitting a low of -1.13% – an indication that markets viewed the economy’s future prospects as dismal and indicative of a chronic disbelief in the Fed’s ability to decisively raise rates – in the four trading days since New Year’s Day, real rates have surged to -0.788%, the highest level since June, while breakevens have slumped despite the surge in oil.

The result has been a sharp move higher in nominal rates, which today hit 1.75%, surpassing the highest level last year, in March 2021, and the highest since pre-covid, because the drop in breakevens has been more than offset by the surge in real rates.

So what is going on here? Has the market, in just four short days, reversed its dour outlook on the economy’s prospects and now sees far more growth upside in the coming years?

That’s also the question other strategists are tackling today: in his note from this morning, Nomura’s Charlie McElligott writes that he cares little about the sharp move in nominals but is instead focused on Real Yields—where as he noted yesterday, “much of the recent move higher (less negative) in Reals has been driven by market confidence that US economic growth can withstand a short hike-cycle via such a low terminal/neutral rate (much lower than implied by Fed Dots).”

Extending on this, CME today writes that yesterday’s FOMC Minutes did indeed “crystalize and even accelerate the full-circle “hawkish pivot” of the Fed from the post-COVID response era, to now”, an FOMC which is:

- 1) not only going to lift-off sooner upon wrap-up of Taper (with the March mtg priced ~80% now)…but now too with

- 2) the market moving closer to 3.5 hikes in ’22 (likely going to 4 all-in), and

- 3) most critically from a “4Q18 QT Risk-Asset Scar Tissue” perspective, will too now likely begin a simultaneous balance-sheet runoff, starting mid-year 2022

Meanwhile, as we discussed extensively overnight, whereas Powell’s prior testimony at the Dec meeting laid the hawkish groundwork — the recent introduction from Waller and Daly (post the Dec Fed meeting) of support for balance-sheet runoff alongside policy rate hiking (as an alternative to “over-hiking” which would also help avoid yield curve “over-flattening” as well) has emerged as “a new battlefront” for traders according to

So, Charlie continues, after 2021 proved to be such a vicious P&L year for many (particularly in back-half of ’21) in the Rates / Macro space, “I do want to reiterate my view that much of this “bearish Rates / USTs” move in 2022 is effectively “pent-up” Flow / re-positioning which was waiting for the new year’s “risk-budget” to be deployed….and here we are…”

As such, yesterday’s uber hawkish minutes were the final “green light,” where:

- the FOMC was even more explicit about broken supply chains taking longer to solve (extending deep into this new year);

- FOMC commentary was that Omicron, on the margin, is potentially a further inflation catalyst;

- that several Fed members believe we are already near “full employment”; and of course…

- the aforementioned “smoke signal” on their comfort with balance-sheet unwind going simultaneously as rate hikes

So as Treasurys broke to new local lows/Yields to new highs, this time it wasn’t driven by the recent “confidence on growth” from perception of a short-tightening cycle in conjunction with a world getting more comfortable “living with COVID” as an endemic; instead, according to the Nomura quant, “it was outright risk-premium being added back into Real Rates on this multi-fronted FOMC attack on easy “financial conditions” to rein in their (now politically bipartisan) inflation problem, which has them effectively “boxed-in”

This is how Nomura’s rates analysts summarizes the dynamic suggested by the Fed:

Altogether, we believe the comments on rates are consistent with our expectation of March liftoff, followed by three additional hikes in 2022 (June, September and December), before slowing to a pace of two hikes per year in 2023 and 2024. However, the minutes also underscore upside risk to our policy rate forecast. If inflation does not moderate as we expect this year, the Fed may ultimately hike rates more quickly – resulting in more than four rate hikes in 2022 – and to a higher terminal rate relative to our expectation of 2.00-2.25%.

Then there is pure muscle memory, of course: as Charlie notes, traders (especially Equities folks) do not like the backtest of QT (balance sheet runoff, but alongside liftoff / policy rate hikes, e.g. 4Q18) as it pertains to the risk-asset environment and enhanced trading swings & volatility.

And this is where further nuance in yesterday’s minutes gets even more interesting, because as Nomura Economist Rob Dent stated last night, “A sizeable faction appears to prefer a May runoff announcement and a more aggressive runoff path for MBS…”

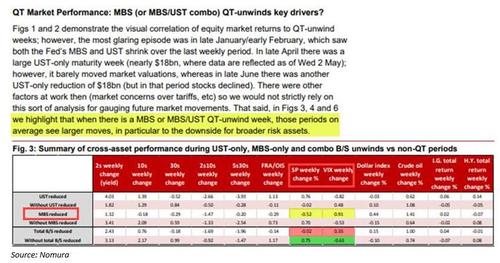

Curiously, when one looks at Nomura’s original analysis of impact from the Fed balance sheet unwind upon cross-asset markets from the “last QT” (back in 2017/2018) in comparing UST, MBS and combo SOMA balance-sheet reductions (the bank’s original study was Oct ’17 through Jul ’18 of QT weeks vs non-QT weeks)—the eye-opening ‘hard data’ takeaway (beyond the usual ‘anedcotes’) was that “…when there is a MBS or MBS/UST QT–unwind week, those periods on average see larger moves, in particular to the downside for broader risk assets.”

Yes, “truly shocking” that the market hates liquidity drains. How does McElligott rationalize this observation? His explanation:

My finger-in-the-air theory is that MBS is a risk-asset with a massively outsized portion of the market being “held” by the Fed, and when we widen there (likely because of the “source of demand” transfer from “price-insensitive Fed hands” back to private investors—which will require far-greater “price-discovery”), it can negatively impact everything from other spread products (i.e. Credit), to reverberating into the collateral chain, to spill-over into the cost of capital & leverage

So putting it all together, the now rubber-stamped from the FOMC “outright QT/balance-sheet runoff” path (one that may favor “…more aggressive runoff path for MBS”) alongside simultaneous rate hiking—is absolutely an escalation of risks to Interest Rates, according to McElligott, hence building-in greater risk premium, and with that, a cross-asset “risk,” as formerly placid “easy financial conditions” are set to inflect into something which risks “putting back” Vol into the market instead of previously “absorbing” it

Translation: the Fed has just sown the seeds of the market’s next destruction (which will inevitably lead to even more stimulus down the road but we’ll cross that bridge when we get to it) and as McElligott concludes, in his eyes, this is the largest part of why yesterday saw said knee-jerk “correlation 1” de-risking in Equities (meaning a “risk parity” or 60/40 fund type “deleveraging cascade” potential) off the back of a good ole-fashioned “financial conditions tightening tantrum.”

Expect more pain until stocks once again approach the strike price of Powell’s put, which could be a while: as Morgan Stanley estimated in mid-December, this time around, the Fed put will be 20% below the highs, compared to just 10% on all previous occasions.

Tyler Durden

Thu, 01/06/2022 – 13:22

via ZeroHedge News https://ift.tt/3JJuEsy Tyler Durden