ARK’s Entire Suite Of ETFs Has Been Slammed By Rising Yields

Rising yields are the culprit-du-jour to explain Cathie Wood’s cringe-worthy start to 2022.

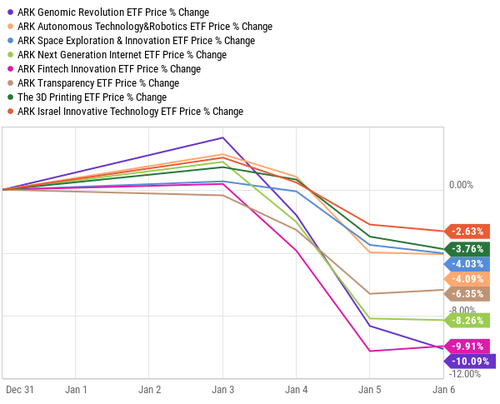

The manager has seen her flagship ARK Innovation Fund fall almost 10% to start 2022 and all of her eight other ETFs have fallen in the three trading sessions since the start of 2022 after continued hawkishness from the Fed has pushed rates higher, according to Bloomberg.

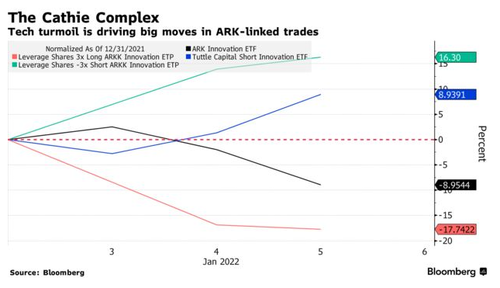

European leveraged notes that launched last month and were put in place to magnify ARK’s returns were down as much as 17% intraday during the week the week. Instruments put in place to track ARK’s returns have fallen, while those set up to deliver the inverse of ARK’s performance are starting the year off on the right foot.

ARK’s ETF palette has fallen between -2.63% and -10.09% in the first three trading days of the year.

Of these ETFs, only one has a positive 1 year return. MTD, YTD and 1 year returns for almost all other instruments show a sea of red.

Todd Rosenbluth, head of ETF and mutual fund research at CFRA, said: “Loyal investors to the ARK strategies hoped 2022 would be more like 2020 and not a repeat of 2021. But they are being reminded that past performance success is not indicative of future results and are being forced to decide if the risk is worth the reward in a rising rate environment.”

In what appears to be at least somewhat of a pivot by the mainstream financial media, who has been instrumental in touting Wood’s “strategies”, Bloomberg referred to some of Wood’s trades as “controversial” in a report this week.

Heading into Friday’s session, the ARKK team is likely hoping for a NFP miss that would increase the chance of the Fed backing off its hawkish stance. And Cathie is likely hoping for a shred of respite after surviving the first trading week of the year.

51 weeks to go…

Tyler Durden

Fri, 01/07/2022 – 09:29

via ZeroHedge News https://ift.tt/3Ghn0TW Tyler Durden