Bonds, Stocks Slammed As Hot Wages, Unemployment Data Sparks Surge In Rate-Hike Odds

A hotter than expected wage growth print and tumbling unemployment rate have been greeted by selling in bonds and stocks as no obvious ‘dovish’ excuse can be gleaned from the data.

Bloomberg’s Riccadonna says the biggest news from this report, without doubt, is the fact that the labor market has now arrived at (and surpassed) the Federal Reserve’s estimate of full employment (which the Fed pegs at 4.0%).

“As we are already beyond that level (3.9% reported), this will compel any lingering fence sitters on the FOMC to the view that the threshold for interest rate liftoff has been met — thereby titling policy makers’ inclination toward March vs. June liftoff.”

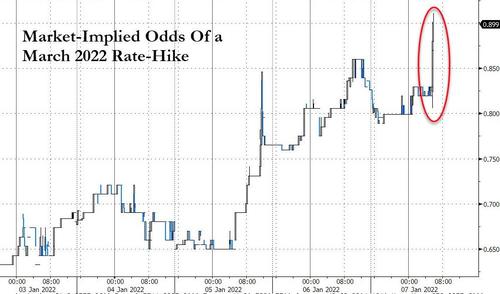

And that is now priced in with the odds of a March hike now above 90%…

Treasuries were dumped with the short-end surging most…

Stocks tanked on the print…

So, we are back at the “good news is bad news” period of the monetary/market panic-cycle.

Tyler Durden

Fri, 01/07/2022 – 09:06

via ZeroHedge News https://ift.tt/3q4bVjD Tyler Durden