“Retiring Early” Is The New American Dream: Why This Is A Problem

While today’s jobs report showed another striking drop in the unemployment rate (which clearly had a political mandate, so Joe Biden could claim it was the lowest rate achieved in the first year of any president), the participation rate remained stubbornly lower, and far below pre-covid levels.

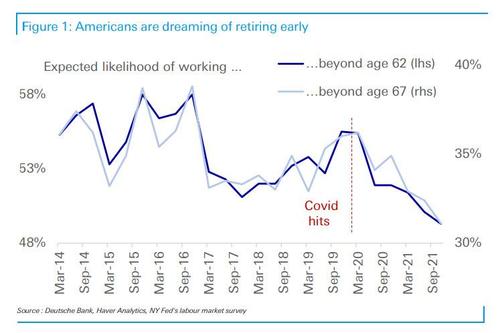

One possible explanation for the sticky participation rate is that many more Americans – boomers and Gen-Xers – are retiring earlier than expected, a shift facilitated by covid and higher asset prices.

Picking up on this tangent, in his chart of the day, Deutsche Bank’s Jim Reid shows that the expected likelihood of retiring early is now the highest on record and for the first time, the average American worker believes they are more likely than not to retire by the age of 62.

This, as another DB strategist, Robin Winkler notes, “is a problem.”

The reason why, put simply, is that earlier retirement requires a larger nest egg. In the last two years households propped up their nest eggs with income not spent during lockdowns and with cash handouts from government. This goes a long way toward explaining why household consumption failed to go as “gangbusters” this year as many expected, with excess savings instead being channelled into safe assets such as US Treasuries and, of course, meme stonks.

As Winkler notes, “this was hardly surprising” and does not even take a massive shift in preferences for households to squirrel away large but one-off windfalls; there is plenty of evidence in empirical economics that households have always done so.

The much more difficult question is how households will go about financing early retirement plans now that the windfalls are becoming less plentiful. If they are serious about it, households will have to resort to the old-fashioned way of financing early retirement: reducing consumption and saving more out of their actual work income. Absent continued windfalls, households must be prepared to spend less now if they plan to reduce their lifetime earnings but also want to smooth consumption levels as much as possible.

The most likely outcome is that saving more out of work income will prove too arduous for many households planning for early retirement, and they will simply shelve their plans. Perhaps early retirement was just a fancy idea fuelled by helicopter money, rather than a serious change in lifetime plans. But, as Winkler cautions, he would not discount the possibility that Western societies have seen a genuine if marginal shift in preferences from consumption toward leisure, with plans of early retirement being just one manifestation.

If so, he concludes, “new American Dream adds to the risk of the economy slipping back into secular stagnation.”

Tyler Durden

Fri, 01/07/2022 – 15:00

via ZeroHedge News https://ift.tt/3qWShW7 Tyler Durden