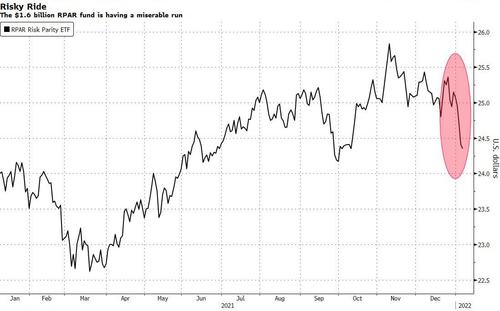

Risk Parity ETF Suffers Biggest Drop Since Covid Crash

Earlier today we joked that while many on Wall Street were lamenting their fate, it could be even worse: they could be running a risk-parity fund.

It could be worse, you could be running a risk-parity fund

— zerohedge (@zerohedge) January 6, 2022

But for investors in one particular fund, however, this wasn’t a joke.

While secretive risk-parity hedge funds such as Bridgewater will reveal their losses from the recent market turmoil in due time, there is one investment vehicle which invests in portfolios of stocks and bonds and which reveals in real time just how much pain its has suffered as a result of the concurrent plunge in equities and Treasuries in recent days.

The $1.6 billion RPAR Risk Parity exchange-traded fund (ticker RPAR) – the biggest of its kind – has dropped 3.4% in the five trading days through Thursday, on course for the worst five-day streak since March 2020. Its systematic strategy, popularized by Bridgewater’s Ray Dalio, allocates across asset classes based on risk and tends to suffer outsize losses when markets fall together.

According to Bloomberg, the cross-asset volatility is also bad timing for RPAR’s new sister fund launched this week, which seeks to amp up returns with extra leverage (yes, that’s leverage upon leverage). The RPAR Ultra Risk Parity ETF (UPAR) has fallen in each of its first three trading days, including a 1.5% slump on Wednesday — a drop that equals some of RPAR’s worst moves in the past year.

Both funds traded lower on Thursday in New York as the S&P 500 fluctuated and Treasuries extended their retreat.

While risk-parity indexes hit records in 2021 as reopening optimism fueled stocks and commodities while dovish central banks kept bond yields in check, runaway inflation and the Fed’s hiking intentions are disrupting the “everything rally” and making life for balanced portfolio investors mierable.

Worse, since risk parity funds target a level of risk by allocating across assets based on their volatility and then levering up, that means that during times of market turbulence they can be forced to unwind positions exacerbating price moves. That’s what happened during March 2020 when Treasury yields first exploded then crashed.

RPAR and its levered cousing, UPAR, are actively managed but seek to match the returns of an index across four major asset classes: global equities, commodities, Treasuries and Treasury Inflation-Protected Securities, or TIPS.

Tyler Durden

Thu, 01/06/2022 – 22:40

via ZeroHedge News https://ift.tt/32Oq0sR Tyler Durden