Same ARKK, Different Year: Cathie Wood’s Flagship Fund Starts 2022 Down 9.5%

Submitted by QTR’s Fringe Finance

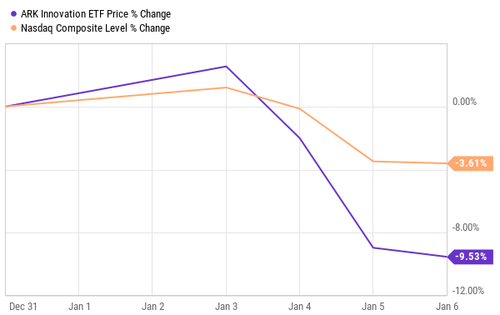

After finishing up 2021 underperforming her benchmark (the NASDAQ) by more than 40%, then alluding to the idea of potentially returning 40% per annum for the next five years, Cathie Wood’s ARK Fund has had an equally odious start to 2022 over the first three trading days of the year.

Wood’s flagship has already fallen -9.5% in just three sessions since assurances that her “innovation” stock picks were in “deep value territory”. It looks like “deep value” just became “deeper value”.

In addition to horrific returns to start the year, Wood is once again underperforming her benchmark, already -5.92% lower than the NASDAQ is tracking.

In the words of George Costanza: “It really didn’t take very long, either.”

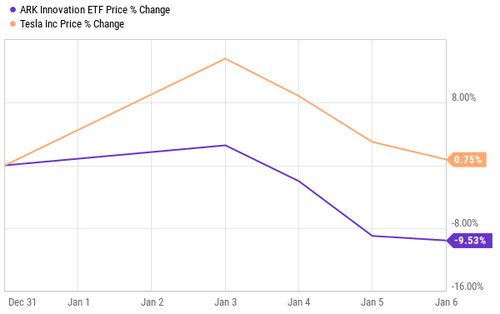

Even more frightening is the fact that ARKK’s biggest weighting, Tesla, is up 0.75% for the year. ARKK is underperforming its top weighted holding by -10.28% already.

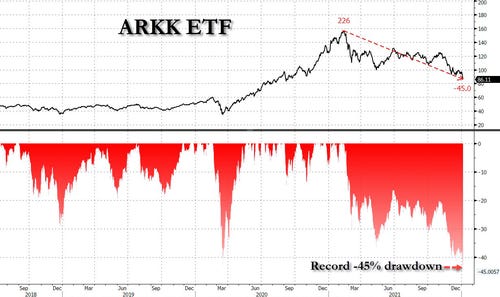

Zero Hedge also noted after the closing bell on Wednesday that the fund has started off the year with a record 45% drawdown from highs. That drawdown extended to about 48% on Thursday when ARKK tapped prices in the $83’s.

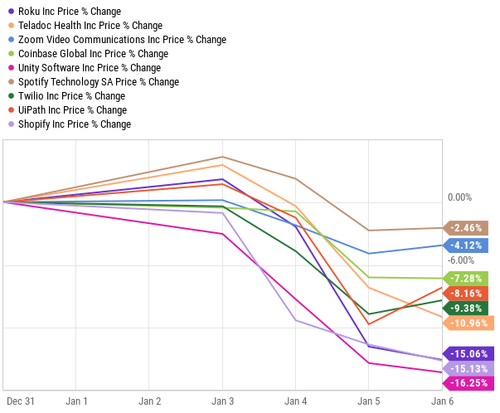

Other than Tesla, here’s how the rest of ARKK’s Top 10 holdings have fared in the two trading days since the New Year.

0 of the 9 holdings are in positive territory and all are down between -2.46% and -16.25%.

This brings me back to a point I have been making enough for readers to e-mail and tell me that it’s actually annoying them: Tesla remains the only string Wood is holding onto at this point. If Tesla goeth, so goeth ARKK.

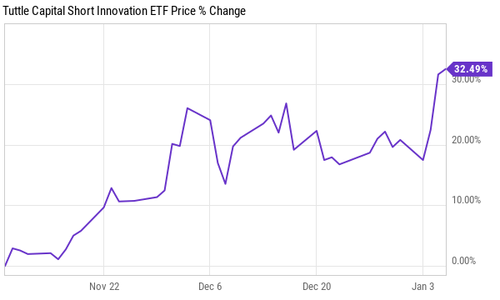

Speaking of returning 40% per year, the Tuttle Capital Short Innovation ETF, which seeks to do the inverse of what ARKK does, has had an incredible 3 months since its inception, already returning 32.49%

“It’s only two trading day into the New Year, Chris, lay off,” you’re probably thinking to yourself right now.

While you’re right, I believe that, as they say in science, “extraordinary claims require extraordinary evidence”.

I can’t think of many more extraordinary claims than asserting stocks with Price/Sales ratios routinely over 100x are somehow some type of “deep value” proposition. Actually, I take these “extraordinary” claims personally. You see, I’m one of those pesky old school investors that judges a company by the amount of free cash it generates and how solid its balance sheet is.

There’s simply something about my firmware that won’t allow the syntax “deep value” to register when speaking about companies that consistently burn cash, must sell equity to survive and have little meaningful prospects of generating net income.

Ergo, I intend on making sure that the evidence winds up telling the story this year, and not the talk.

I’m also writing about this again because ARKK’s performance over the last 6 weeks has run parallel to my contentions that:

-

We could be on the cusp of another 1999-style crash for the NASDAQ

-

When it comes to the Fed tapering, for the stock market, there’s no silver lining

-

Markets could be in for a rough ride to start 2022

-

ARKK could plunge disproportionately to the rest of the market in a crash

“Normally, the market would expect the Fed to respond to bad news, but this time, it’s the Fed’s own inaction that is the bad news,” I wrote in December while making the case that the Fed taper would wreck markets . “And so, I forsee a wake up call for those who have adopted this backwards ass strategy over the last decade.”

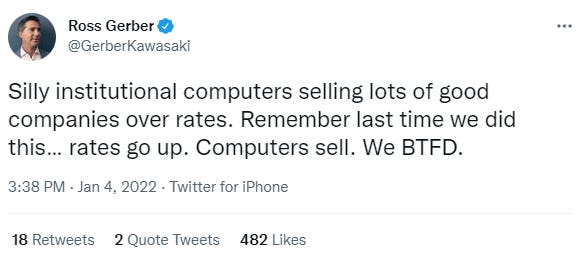

That means, specifically, a wake up call for any lobotomized market participant who has been conditioned to “buy the dip”, at any time, for any rhyme or reason, without any regard for valuation or the overall market environment.

Do we know anybody like that?

It’s the type of strategy just simple enough to garner praise from cult-like followers who don’t necessarily have tons of experience in the market, but have plenty experience following “influencers” who do their thinking for them.

“I’m not the Messiah!”

“I say you are, Lord, and I should know, I’ve followed a few!”

Hell, Cathie even has her own merch section on ARKK’s website (I highly recommend the “Truth Wins Out” t-shirt), and on Etsy!

Finally, I’m writing today because the action to start the year this is exactly what I would expect to see from a coming tech wreck.

“It would certainly take a special confluence of factors for us to be staring down the barrel of a an unprecedented crash in tech stocks without noticing it’s coming,” I wrote in November 2021.

Then, I argued the bubble could be more dangerous than decades past due to people weaponizing options, I said that the factors were there for a selloff to “surprise” the market and I cited inflation as the catalyst that would change the macroeconomic picture.

“Even the slightest of rate moves and the slightest of tech market selling could catalyze massive aftershocks in equity markets – especially if it catches people bit by surprise and the aforementioned bid under tech stocks rests on the air pocket that I think it does,” I wrote.

One month later, Jerome Powell retired the word “transitory” and put the Fed on a straight-line course toward tapering and rate hikes at accelerated rates.

I have been warning about the potential pitfalls of the ARK Innovation Fund for the last couple of months,

-

January 2022: I wrote The Elon Musk Elevator Down, a piece that reiterated how reliant ARKK has been – and may continue to be – on Tesla for positive returns.

-

January 2022: In my 22 Stocks to Watch for 2022, I noted that I believed ARKK was “a name that could plunge disproportionately to the rest of the market”.

-

December 2021: I wrote Cathie Wood is Playing With Fire, a blog post that was first to break the story of Wood backtracking on language used to set expectations for her fund’s returns in coming years.

-

November 2021: In November 2021, I wrote a piece called Cathie Wood’s Sweet Superficial Success that detailed how Tesla was the only string that ARKK was hanging on by.

-

September 2021: I spoke to Vanity Fair / Airmail columnist William Cohan on a podcast about Cathie Wood, whom he referred to as a “charlatan”.

—

Special deal for Zero Hedge readers: I am extending a 20% off subscription price that literally never changes for as long as you have your subscription, regardless of inflation: Get 20% off forever

Disclaimer: I own ARKK, QQQ, IWM, TSLA puts and am routinely short all of these names and sometimes other names that Cathie Wood has exposure to. Readers should assume I am short Cathie Wood at any given time. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Fri, 01/07/2022 – 12:09

via ZeroHedge News https://ift.tt/3t6PAnm Tyler Durden