Here Are The Best And Worst Performing Hedge Funds Of 2021

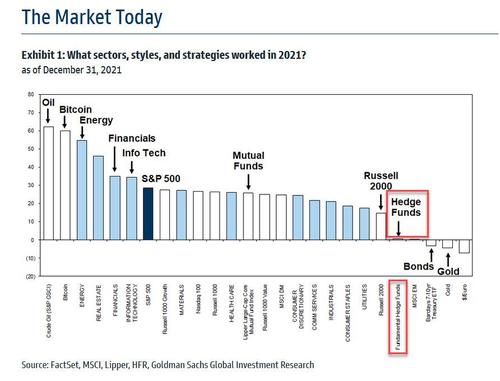

It was another painful year for most hedge funds, with many suffering the pain of their short books shooting up during periods of heightened retail trading such as the start of 2021, followed by a just as painful rotation in and out of the growth to value (and vice versa) rotation. As a result hedge funds as an industry were one of the worst performing asset classes of 2021, trailed only by emerging markets, Treasurys, gold and the euro.

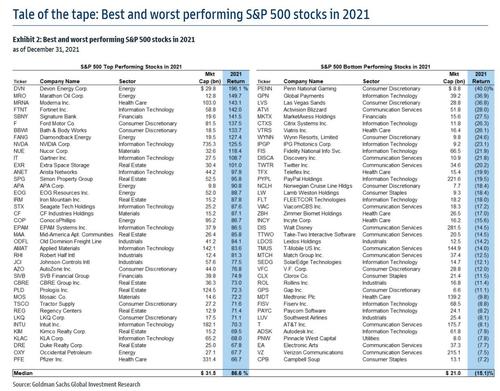

And incidentally, here are the best and worst performing S&P stocks of 2021.

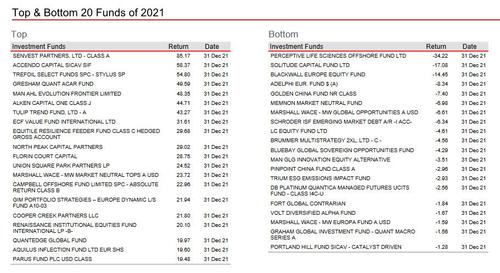

But while most hedge funds underperformed their benchmark for yet another year, some stood out. Here, courtesy of the HSBC Hedge Weekly is a list of the best and worst performing hedge funds of 2021 (and yes, any year when the Tulip Trend Fund is the top 10 you just know markets were micromanaged by central banks).

Not surprisingly, the best performing hedge fund tracked by HSBC, Senvest, is also the one that quietly orchestrated the Gamestop short squeeze mania (the fund was extremely long the stock around the time it became a Reddit sensation then quietly sold out its entire stake in January just as the stock was surging lifted by retail daytraders).

That said, and demonstrating just how challenging 2021 was, not even half of the Top 20 funds managed to outperform the S&P500. And while the typical response is that they are not supposed to outperform the S&P500, when they fail to do so every year for a decade, well… no surprise why launching a new fund has become virtually impossible. Then again, 2022 is a year when there will be little if any Fed support for the market (at least until the whole tightening frenzy fades away) so all these underperforming hedge funds will surely be able to prove themselves… right?

In any case, digging among these names, what stands out is that event-driven and stock-picking hedge funds were the best-performing strategies last year, according to preliminary figures from the Bloomberg hedge fund indexes. Funds such as the iconic Renaissance Technologies and Senvest Management (noted above) posted double-digit gains for their investors.

Event-driven hedge funds rose 16% last year, while equity-focused managers gained nearly 13%, the indexes show. Hedge funds broadly returned nearly 10%. Still, they all trailed the S&P 500 Index which rallied 27%.

In addition to Senvest, another prominent hedge funds that made the list was Jim Simons’ Renaissance Technologies, which made a comeback after a lousy 2020. The firm posted double-digit gains across all three of its public hedge funds. The equity-focused quant funds had their worst year in 2020 when the algorithms struggled with the pandemic-driven market tumult.

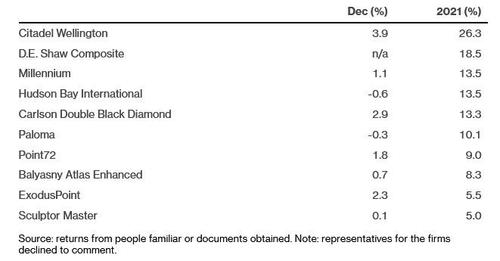

In the world of multi-strat, or “pod” funds, Citadel bested its peers, posting a 26% return for 2021. The $43.1 billion firm’s Wellington fund, which runs a market neutral strategy, beat D.E. Shaw & Co. and Millennium Management even as their hedge funds had double-digit gains.

As a group, multistrats rose 8.3% last year through November, and they saw more inflows than any other strategy, attracting $28 billion from investors for the period, according to eVestment. Investors flocked to these funds to diversify their portfolios and to gain exposure to investments that aren’t correlated to the stock market.

ExodusPoint Capital Management and Sculptor, formerly Och Ziff, came in at the bottom of the group with gains of about 5% last year.

“There has been a range of performance from stellar to well below average among these capital raising powerhouses,” eVestment researchers wrote in a report. “How does this bode for the group heading into 2022? Frankly I’m on the fence between ‘we’ll have to wait and see,’ and ‘I’m not concerned.’”

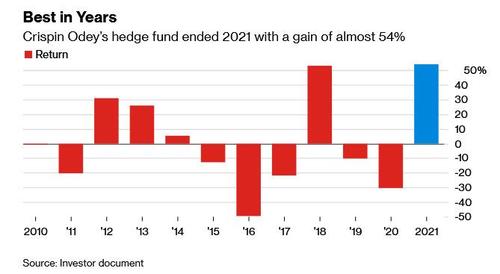

And while 2021 had its share of emotional rollercoasters in the world of 2 and 20, with Russell Clark Investment Management – the fund we had once dubbed the world’s most bearish – shutting down in November after losing the fight with central banks, one fund that stood out was Crispin Odey’s funds which made a roaring comeback after years of underperformance.

According to Bloomberg, in 2021 the London-based money manager enjoyed both his best-ever monthly return and suffered his worst monthly loss, before ending the year with a gain of almost 54%. Odey’s fund was up as much as 108% through September before giving up half those gains in the last quarter of 2021. February marked the fund’s best month, largely on the back of a massive government bond short, while October was its worst.

Alas, gone are the days when Odey managed billions: his strategy has shrunk over the years and ran about $383 million at the end of November. That’s because a dollar invested in the fund at the start of 2015 is still worth only about 51 cents now.

The annual return, Odey’s best since 2007, comes as a welcome respite for the hedge fund manager, who stepped down from running his eponymous firm to focus on trading in 2020 and has faced public scrutiny for years for his stunning losses and support for Brexit.

As Bloomberg notes, at least two bets helped power the fund’s surge. The first targeted long-dated government bonds amid expectations that a post-pandemic economic recovery will fan inflation. The fund’s short exposure to bonds totaled 902% of its net asset value at the end of November. The second was a stake in Oxford Nanopore, which surged in value after the DNA-sequencing company listed in London in September.

As noted here in the past, Odey has for years predicted a market collapse and been one of the most vocal critics of QE.

The full weekly HSBC hedge fund performance presentation is available to professional subscribers.

Tyler Durden

Fri, 01/07/2022 – 19:40

via ZeroHedge News https://ift.tt/3F7tsfd Tyler Durden