Morgan Stanley Says US Omicron Wave Will Peak In 3 Weeks

Morgan Stanley has called the top on Omicron, or at least offered a range of when the peak might arrive.

In their latest note to clients, a team led by equity analyst Matthew Harrison projected that the omicron wave in North America would likely peak within 3-6 weeks, which would place the peak of this wave at a slightly later point than last year’s winter top in new cases identified.

By using an “established relationship” between the virus’s effective reproduction rate and the number of new case, the bank’s analysts can look at the situation in South Africa, and help postulate what might happen in Europe and the US.

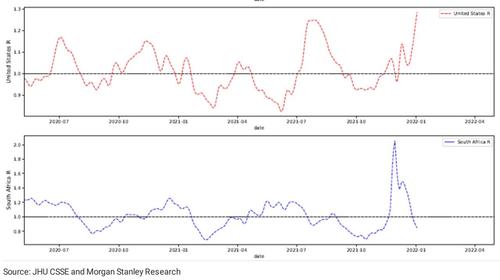

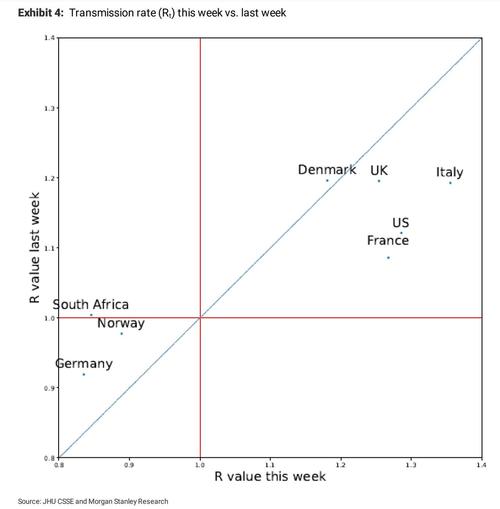

The case wave reaches a peak when R returns to 1. Currently in South Africa, R is below 1 and lower than last week, reflecting the steep decrease in cases. R is still growing (and thus cases are as well) in the US, UK,and EU, so, according to Morgan Stanley, the peak isn’t in yet.

The bank used data from South Africa as a basis for its projections for the US and Europe. For example, it took South Africa 4-5 weeks to reach peak cases (mid-Nov to mid-Dec), which is faster than Delta (~9 weeks). And R peaked ~2-3 weeks ahead of the case peak and decreased from ~2 to ~1 in 20 days.

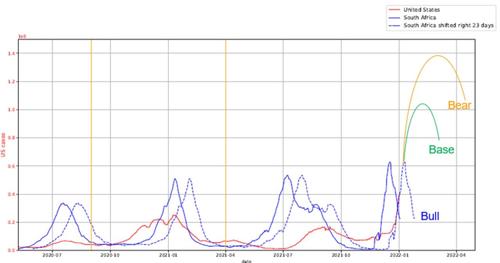

Assuming a similar trajectory in the US, Morgan Stanley laid out its bull base and bear cases for the omicron wave in the US.

And here’s a comparison of the rate of viral reproduction in the US and South Africa.

The MS team explained that their bull case assumes a peak 1-2 weeks from now, while their bear case would mean the peak might be as many as 8 weeks distant.

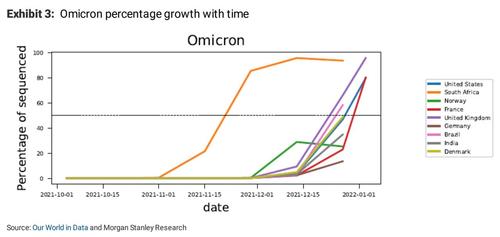

The note also included some insights about omicron’s ability to crowd out the competition. Using the strain sequencing data from GISAID, the MS team was able to determine that omicron displaced delta as the dominant strain in under two weeks.

Finally, here’s a comparison of the rate of transmission in various countries this week vs. last.

* * *

Source: Morgan Stanley

Tyler Durden

Mon, 01/10/2022 – 23:30

via ZeroHedge News https://ift.tt/3f8sl4j Tyler Durden