Bonds & Bullion Surge As Equity Purge Escalates

Today’s market was brought to you by the number 1.90 (the exact reversal point of the 10Y Yield), and the words “sell the f**king rip” and “I love goooold…”

It was ugly again today in equity land despite every algo doing its best to ramp the shit out of stocks and ignite some momentum. Small Caps were clubbed like a baby seal every time they attempted to get their head above water. The last hour was a shitshow…

As value outperforms growth once again (outperformed by an impressive +750bps YTD)…

Source: Bloomberg

…we’re seeing a “relatively” predictable playbook at a sector level with Tech, Comm Srvc, Discretionary dragging markets lower as investors are leaning into the perceived ‘safety’ of Consumer Staples and Utilities…

Source: Bloomberg

The S&P and Dow closed below the 100DMA, Nasdaq below its 200DMA (and Russell 2000 continues to charge lower from its 200DMA)…

Small Caps are now actually lower on a Year-over-Year basis (down 4.2%) and just suffered a ‘death cross’ – the first since the spring of 2020…

Source: Bloomberg

Bank stocks were mixed today with MS bouncing back a little (BofA opened notably higher but reversed it all) as the rest of the sector continued to slide…

Source: Bloomberg

AAPL closed below its 50DMA for the first time since October…

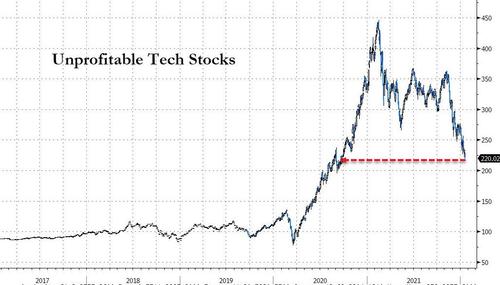

Unprofitable tech stocks are now down a perfect 50% from their record high

Source: Bloomberg

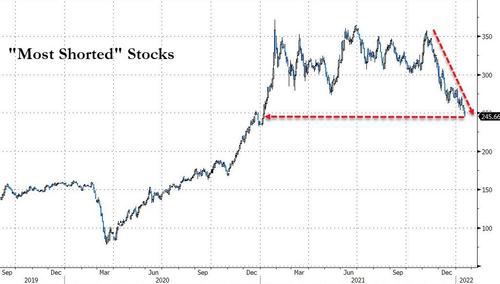

“Most Shorted” Stocks are down over 30% from the Nov 2021 highs (and is now down on a YoY basis)…

Source: Bloomberg

10Y Bund yield went positive for the first time since 2019…

Source: Bloomberg

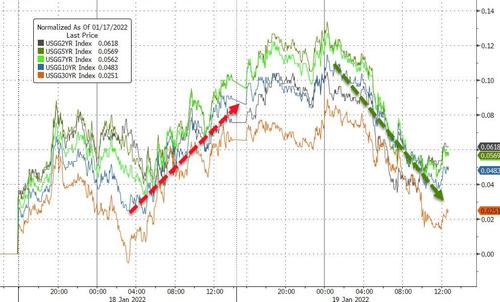

Very strong 20Y auction helped push yields even lower on the day. The short-end underperformed with 2Y-1.5bps while the rest of the curve was down around 4-5bps…

Source: Bloomberg

10Y yields reversed perfectly today at 1.90% (TY $127)

Source: Bloomberg

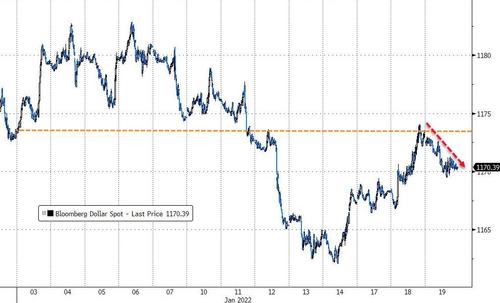

The dollar extended yesterday’s reversal off the YTD unch line…

Source: Bloomberg

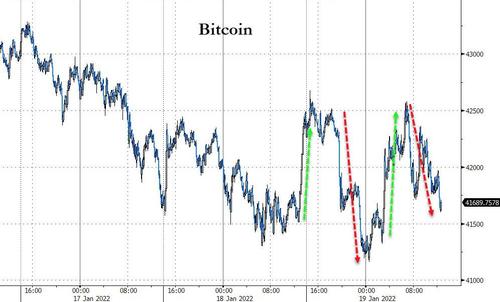

Bitcoin was extremely choppy today but ended lower…

Source: Bloomberg

Gold surged back above $1840 – recovering all the losses since Omicron and the Powell Pivot plunge…

Oil continued its march higher, with WTI topping $86 passing Oct 2021 highs to reach back to 2014 (after the Turkey pipeline explosion) ahead of tonight’s inventory data from API…

NatGas tumbled 6% today, testing back towards $4.00…

Finally, was today’s rotation from stocks into bonds prompted by this…

Source: Bloomberg

TINA is dead!

The big question is – Will Powell fold?

Source: Bloomberg

Judging by today’s dovish shift in Dec 2022 rate-expectations, traders are starting to bet on it

Tyler Durden

Wed, 01/19/2022 – 16:01

via ZeroHedge News https://ift.tt/3AePJqs Tyler Durden