JPM Trading Desk: After Yesterday’s Systematic Selling, Let’s See If This Bounce Can Hold

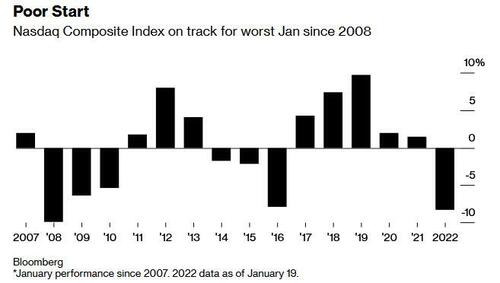

After the worst start to a year for the Nasdaq since 2008…

… stocks are finally rebounding solidly and are posting what may be the strongest day for markets in 2022. But the question on everyone’s mind is whether the solid early action will persist. Indeed, as JPM writes in its market summary note today, “today’s pre-market setup is similar to yesterday. Let’s see if we can hold pre-market gains throughout the session as yesterday afternoon felt like systematic selling. If 1.90% was a buy-level in bonds, then we may have a relief rally being initiated led by Tech.”

However, as JPM’s Andrew Tyler notes, “I would not take this as a sign that the rotation is over, though. I think investors are still figuring out which elements of Tech will be resilient to a tightening cycle while also taking profits on multi-year investments. Add to that the selling and shorting within the most speculative sectors and you have an interpretation for 2022 market behavior.”

With that in mind, here is the latest JPM trading desk commentary on yesterday’s market action, and into today:

Consumers:

- 1) PG shaking off the margin weakness is a good(albeit surprising) sign as we head into the bulk of staples earnings season. EPS flow-through is minimal despite sales beats = multiples stretching. Until the growth sell-off subsides it seems $ will continue to hide in large cap staples. HFs have been fighting shorts in the space and seems they may be throwing in the towel at the wrong time. Will be interesting to see if PG can hold… I’m watching CHD, KMB etc closely as these charts looks incredibly stretched.

- 2) RETAIL finally seeing a bounce. Luxury data points in Europe (Burberry,Richemont etc) helping sentiment in CPRI, TPR etc. Additionally continue to hear anecdotally that the Jan CC data is re-accelerating (we are seeing the same in our Chase Spend data). Not sure if the bounce will sustain but maybe enough to improve some pretty poor sentiment in the space.

TMT:

- We are seeing a bit more demand in megacap tech….and that’s helping buttress the broader tape heading into the afternoon. Megacap positioning continues to be near a 4-year low across HFs (and we continue to see sporadic shorts within the cohort…mostly to hedge out broader growth risk along with private investment exposure).

- Yields aren’t higher….for the moment …but the largest trend we’re seeing in tech today is the prevalence for larger cap stocks…and a lot of today’s trading activity (and hedging) coming through ETFs.

- Separately, an interesting article on Google’s payment’s strategy…which also discusses them getting more comfortable with crypto

Financials:

- BAC. Conf call over. Much more reassuring message on nearer term expense trajectory than the peers, clarifying the flat y/y expense guide incorporates inflation, investments, and markets strength. Small positive on the NI side, with Q1 NII up couple hundred million from Q4, implies NII in the $11.7bn range vs consensus at $11.4bn. Loan growth comments also bullish, broad based and recently accelerating, with high single digit the aim vs the street closer to 5%.

- MS. Q4 conf call over. Constructive message on the markets trajectory, with the banking pipeline healthy and the year starting well – mgmt. expect advisory results to benefit from a broadening of transactions across sectors.Expenses clearly an area of focus after the GS disappointment yesterday,MS emphasizing the inherent operating leverage in the model (more wealth/asset mgmt. focused) vs the markets franchise of Goldman. Nointention/need to change risk tolerance to hit the newly outlined targets(street already there). No color on the $225m strategic investment gain inequities but solid call.

Tyler Durden

Thu, 01/20/2022 – 12:38

via ZeroHedge News https://ift.tt/3GP3ZZk Tyler Durden