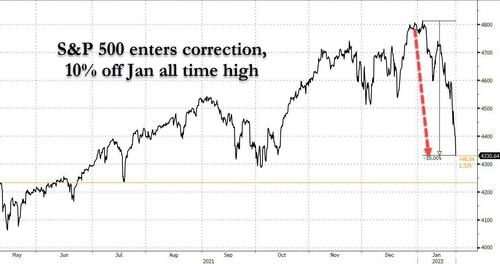

Capitulation Bloodbath: Stocks Crash After Most Negative Opening TICK Of 2022, Russell Enters Bear Market As VIX Explodes

It’s official: as of this morning, the S&P is in a correction, having tumbled 10% from its all time high recorded at the start of the month…

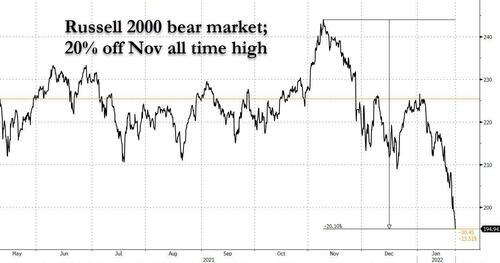

… with the Russell suffering an even more humiliating fate, as it entered a bear market at roughly the same time, tumbling 20% from its early November all time high.

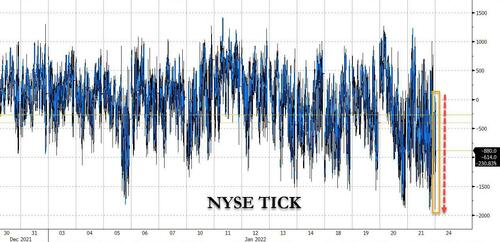

The opening puke was precipitated by a marketwide flush, manifesting in the most negative opening TICK in a year at -1,897…

… which was also the 2nd most negative TICK of 2022 as everyone hit the sell button at the same time.

And as stocks (and cryptos) crash, and yields tumble, the VIX is exploding above 35, the highest since Jan 2021, and the level which DataTrek said would likely mark the bottom in sentiment.

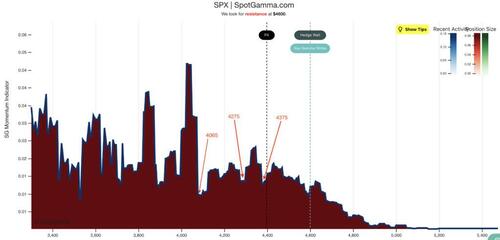

Commenting on today’s market technicals, SpotGamma writes that Fridays expiration leads to a reduction in gamma, but we still anticipate high volatility for today. Resistance is at 4400 followed by 4453. Support lies at 4356 and 4330. We are now clearly below both supports.

As SG warns, “This is a very fragile, unstable market which is likely prone to large, directional swings” and continues:

As there was a substantial expiration on Friday, we expect that many hedges need be settled across indicies and single stocks. Based on this we anticipate some opening chop due to these hedge adjustments. For example TSLA, which had nearly $20bn in call deltas expiring Friday, is quoted in premarket trading at ~$900 (-4.5%)

However, we generally believe that the expiration of large put options can lead to a short cover rally in markets. Due to large negative gamma position, we think these rallies could be violent, but offer little stability and could mean revert quickly.

Echoing Goldman, SpotGamma notes that it does not think there can be a material rally in stocks until after Wednesdays FOMC. Aside from investors waiting to assess various policy implications, its likely that traders are hedging the event which will hold implied volatility high. This limits the positive vanna flows that could enter the market.

With this in mind, both short dated S&P options & the VIX are at 30 which implies a 1.8% 1 day move. This places the term structure in a backwardated position, which suggests a fair amount of fear in markets. Again, given the FOMC, we think that traders may look to sell very short dated “pre-FOMC” IV which could provide a brief market tailwind, too.

And with stocks taking out low after low, SpotGamma cautions that there are essentially 2 zones for support. One is at 4275, and the other is well south at 4080. If traders elect to initiate new put positions that would pressure markets lower, and increase elevated IV levels. This could accelerate the velocity of any downside move.

Tyler Durden

Mon, 01/24/2022 – 10:02

via ZeroHedge News https://ift.tt/3H1sSBi Tyler Durden