IBM Jumps On “Strongest Revenue Growth In A Decade”, But A Closer Looks Reveals Same Old Accounting Gimmicks

Another quarter, and another masterclass by IBM at obfuscating financial reality, only this one actually worked unlike the last few quarters.

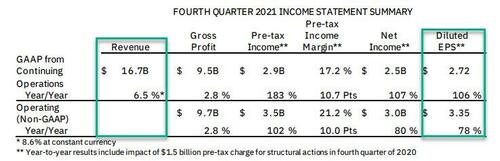

Moments ago IBM, which had seen its stock tumble after catastrophic Q3 earnings, then bounced near one-year highs only to slide over the past month into earnings alongside the rout in the broader market as traders seemingly forgot that the company is the biggest melting ice cube of all, reported non-GAAP operating EPS of $3.35, a number that as usual, has been exquisitely goalseeked to just beat expectations, which this quarter were $3.23.

More surprisingly, the company’s GAAP EPS was not that far off, at $2.72. This is unexpected for a company which traditionally had applied about a 100% “improvement” between its GAAP and non-GAAP Results.

First a quick reminder that today’s results were the first since IBM completed the spinoff of a large portion of its legacy infrastructure services unit in November into a new company called Kyndryl, which includes service operations like managing client data centers and traditional information-technology support. The divestment marked IBM’s fourth major transformation and a significant step in Chief Executive Officer Arvind Krishna’s plan to pivot Big Blue into cloud and artificial intelligence

So what’s going on here? Has IBM miraculously changed course, and is it no longer a melting ice cube? Of course not – one just has to look at the fine print to understand what is going on: as IBM reveals, the $2.5BN in net income (which translates into $2.72 in GAAP EPS), consisted of $1.5 billion in pre-tax charges for structural actions in Q4. Translation: more than half of the company’s Q4 earnings was an pro forma addback!

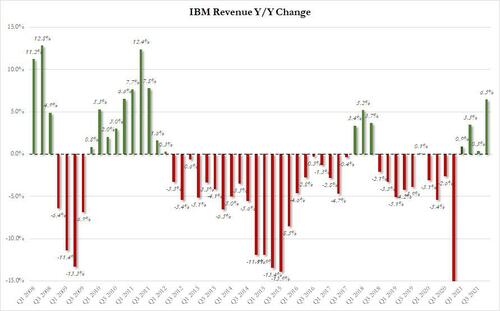

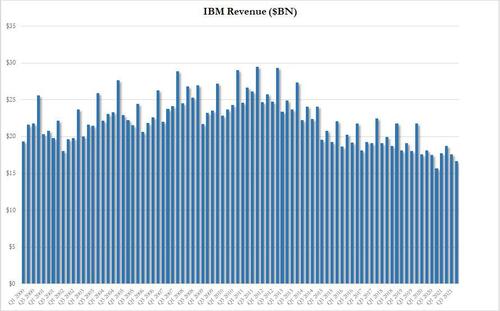

And since all the historical data is apples to oranges with the separation of Kyndryl (which was completed on Nov 3, 2021) serving as the divider line, and since historical data prior to the separation remains unadjusted, IBM was proud to boast that its Q4 revenue was $16.70 billion, beating the estimate of $16 billion and up 6.5% compared to Q4 2020…

… even though in absolute terms IBM’s revenue looks like this.

Suffice to say, wait until we have a full breakdown of historical revenues excluding Kyndrul before making any investment decisions based on top line changes.

“This is the start of the new IBM and perspective on what we look like going forward,” Chief Financial Officer Jim Kavanaugh said in an interview. “We saw a very healthy acceleration in cloud and consulting which are key growth areas.”

Of course, the obfuscation would only be complete if IBM also changed the reporting segments which it of course did, as follows:

- Consulting segment (includes Business Transformation, Technology Consulting and Application Operations) revenue $4.75 billion, +13% y/y

- Software (includes Hybrid Platform & Solutions, Transaction Processing) revenue $7.27 billion, +8.2% y/y

- Infrastructure (includes Hybrid Infrastructure, Infrastructure Support) revenue $4.41 billion, -0.2% y/y

- Financing revenue $172 million, -30% y/y

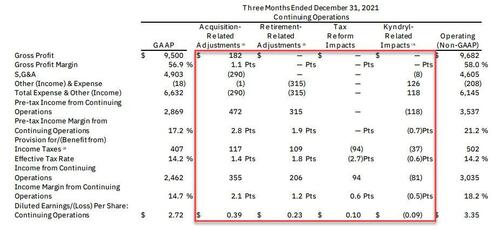

There was some genuinely good news: adjusted gross margin 56.9% just barely beat expectations of 56.1% but was down from 58.9% last year.

Going back to IBM’s bottom line, there was as usual much more, because the GAAP to non-GAAP bridge was, as usual, ridiculous and a continuation of an “one-time, non-recurring” addback trend that started so many years ago we can’t even remember when, but one thing is certain: none of IBM’s multiple-time, recurring charges are either one-time, or non-recurring.

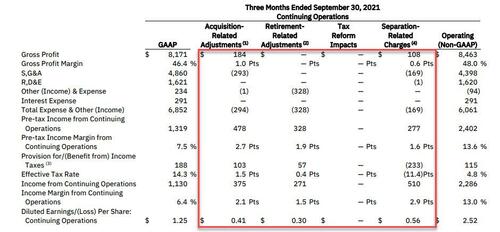

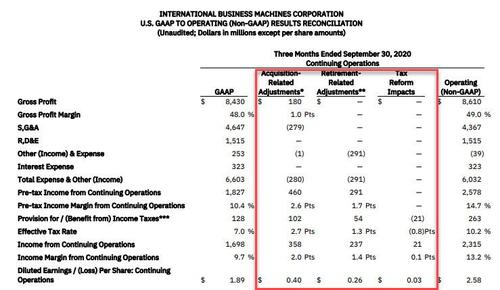

We have said it before, but we’ll say it again: here is IBM’s “one-time, non-recurring” items In Q3 2021…

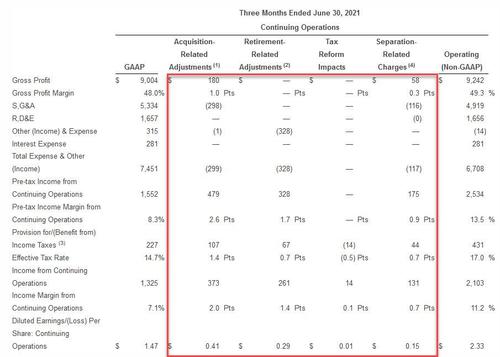

… and Q2 2020…

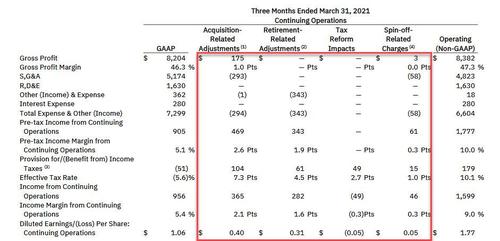

In Q1 2021…

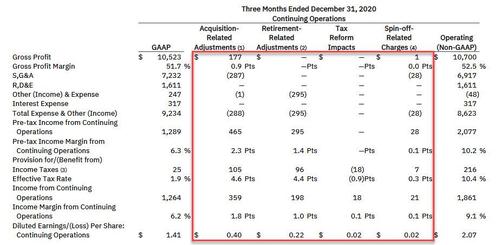

… and Q4 2020…

… and Q3 2020…

And so on.

Commenting on the quarter, Chairman and CEO Arvind Krishna said that “we increased revenue in the fourth quarter with hybrid cloud adoption driving growth in software and consulting. Our fourth quarter results give us confidence in our ability to deliver our objectives of sustained mid-single digit revenue growth and strong free cash flow in 2022.”

Maybe: we’ll wait until the conference call when IBM is expected to share its first guidance and expectations in almost two years.

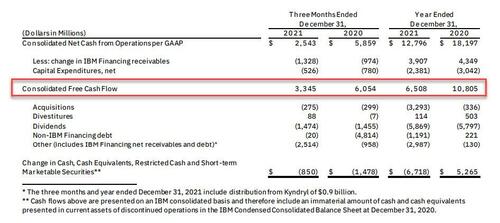

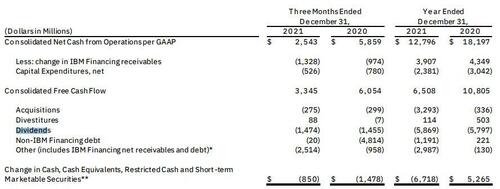

And speaking of IBM’s cash flow target which the company disclosed previously as $11-$12BN, we assume that number is no longer meaningful after the Kyndryl separation, simply because the actual number was almost 50% lower!

As the company reveals, on a consolidated basis, full-year cash from operating activities was $12.8 billion and free cash flow was just $6.5 billion. These consolidated results include ten months of Kyndryl results, and reflect cash paid in 2021 for separation charges and fourth-quarter 2020 structural actions.

So to guide going forward, IBM’s post-separation baseline free cash flow for the year was $7.9 billion excluding Kyndryl charges and pre-separation activity, a view which is aligned to the company’s go-forward business. Payments for IBM-related structural actions and deferred cash taxes paid in 2021 contributed to the year-to-year decline in the post-separation baseline free cash flow.

IBM ended the year with $7.6 billion of cash on hand, down $6.7 billion from year-end 2020, reflecting acquisitions of $3.3 billion and debt reduction payments consistent with the company’s previously-stated intention to deleverage. We have said previously, that IBM’s decision to pay down debt will be ruinous for its stock as it means the company has no better use of cash (like investing, growing or M&A for example) than paying down debt at record low rates.

Debt, including Financing debt of $13.9 billion, totaled $51.7 billion, down $9.6 billion since the end of 2020, and down more than $21 billion since closing the Red Hat acquisition. The company returned $5.9 billion to shareholders in dividends.

But while there was more in the press release, including other red flags, the company’s ability to confise markets and give the impression that its revenues grew substantially was enough to send its stock higher after the close.

Tyler Durden

Mon, 01/24/2022 – 17:05

via ZeroHedge News https://ift.tt/3GU5k18 Tyler Durden