Inflation Hitting Rust Belt Harder Than Rest Of US

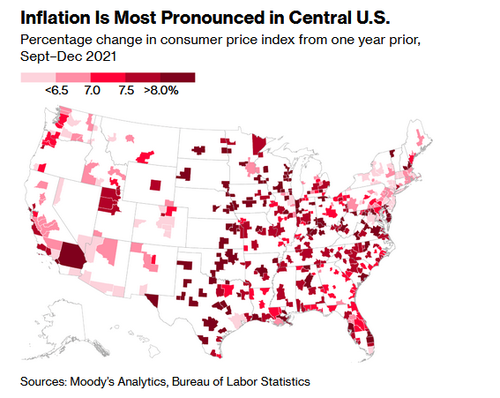

Americans in the Midwest and South – which include some of the poorest states in the nation – are suffering a greater degree of inflation than the rest of the country.

According to Bloomberg, small towns in the Midwest and South have seen consumer prices rising 9% or more – exceeding the ‘red-hot’ national average of 7%.

Wisconsin has had the most small cities registering inflation, at an average of 8% last quarter. In close second has been Texas, where ‘several oil towns experienced a surge in prices at the end of the year.’

The findings are based on data from Moody’s Analytics, which include 400 metro regions. Zooming in on cities with fewer than 200,000 people provides a more detailed account than government figures, which break down consumer prices in about two dozen large cities, obscuring the local experience of more rural and suburban Americans.

A closer look on the ground in Wisconsin highlights the reality for many counties in the middle of the country, where inflation has run higher than on the East and West coasts for months and is getting sticky. The inflation pain shows up everywhere, from a paper company facing both soaring demand and surging costs to a trucking company in Fond du Lac, population 43,000, paying double last year’s price for vans. -Bloomberg

“I don’t see these pressures ending anytime soon,” said Kurt Bauer, president of Wisconsin’s largest trade group, the Wisconsin Manufacturers & Commerce. “We’re setting new baselines with prices.”

According to University of Wisconsin economics professor, Noah Williams, the state’s high inflation likely stems from its reliance on factory jobs and its ‘small-town character,’ as the local economy is twice as concentrated in manufacturing as the rest of the nation – where people are more likely to spend on goods (which have undergone greater inflation) than services, he said.

Midwest households also spend a greater percentage of their income on gasoline and vehicles – which have experienced blistering inflation. People in the region have more vehicles per household than other areas of the country, according to Chicago Federal Reserve VP Leslie McGranahan.

Political fallout

Soaring prices across the country pose a serious problem to Democrats as midterm elections are less than 300 days away – even as the Federal Reserve prepares to hike interest rates to help cool things down.

In Madison, WI where inflation is over 9%, inflation is becoming a political issue.

“I don’t know exactly how my fellow Wisconsinites will hold the pieces together, but it’s enough that people will want to hold someone accountable,” said 53-year-old registered dietitian Tracey Elmes.

As Bloomberg notes, “The rapid price escalation in Wisconsin is also tied to the same drivers as in the rest of the country: broken international supply chains, nonstop demand for goods, as well as higher transportation costs and wages.“

It starts at the manufacturing level. In Kaukauna, a town of 16,000 people located about 20 miles southwest of Green Bay, demand is soaring at Jeff Anderson’s Precision Paper Converters, where machines convert the jumbo “parent rolls” of paper into the comfy, folded tissues we blow our noses into.

Traditionally, around one-fifth of the raw paper comes from overseas, but shipping is so expensive that manufacturers are turning to U.S. suppliers almost exclusively, boosting paper prices by about 10%, Anderson said. The cost of the boxes that hold the tissues has risen 30% in a year. -Bloomberg

Higher prices hit the road

Over the past year, Legacy Express LLC – a 60-truck delivery company with around 80 employees – has bought around 20 new delivery vans at a cost of more than $40,000 each, to shuttle everything from toilet paper to snacks to automotive parts across the region. Owner Jeff O’Brien says the prices of new vans has doubled over the past year, adding that a used trailer costs the same as a brand new one did before the pandemic hit.

Soaring prices are hurting Legacy, according to O’Brien, who is now paying employees as much as 20% more than last year – and passing the costs on to grocery stores and manufacturers.

“You have no choice but to raise prices,” he said. “The amount of stress that you already have from the coronavirus and shutdowns, and now you have the inflation issue on top of that.“

Tyler Durden

Mon, 01/24/2022 – 13:00

via ZeroHedge News https://ift.tt/3KHfULp Tyler Durden