JPMorgan Prime Asks “Are We There Yet” And Answers…

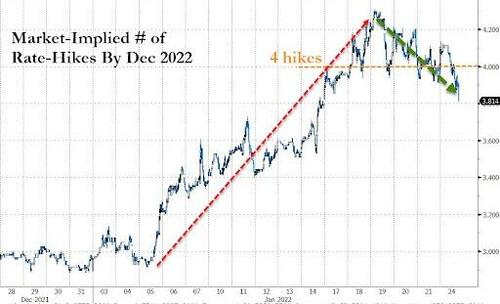

With markets in freefall (at least until the furious reversal midday when as we noted earlier, bitcoin soared higher as rate hike odds tumbled)…

… the only question panicked traders are asking is “is this finally the bottom.”

One place we look for an answer is in the latest note from JPMorgan’s Prime Brokers titled aptly “are we there yet”, in which the bank admits that – contrary to the conviction of JPM’s pernabullish preacher Marko Kolanovic, “the signs are not that clear.”

We excerpt from the note below:

Given how much equity markets in the US have sold off MTD, are we seeing signs of risk-off behavior, i.e. capitulation, which might suggest we’re due for a bounce? In short, the answer is “not really”, at least across HF data we track. This leaves us with a different set-up than we were pointing out in early and mid-Dec when there were clearer risk-off signs

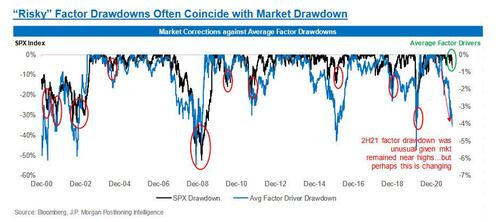

However, before summarizing the key points on flows and positioning, to some extent the recent sell-off in broad indices might not be too surprising, given how challenging things have been for many stocks over the past few months. As we pointed out about a month ago, “risky” factors had been selling off sharply in 2H21 and the fact that the S&P 500 had not seen a larger drawdown made the recent episode quite anomalous from other drawdowns over the prior 20 years.

Thus, we suggested that we might need to see a bigger S&P drawdown before some of the riskier stocks in the market have a more substantial rally…perhaps we’re seeing this setup start to build.

Getting back to recent flows and positioning changes, here are a few things we’d highlight based on HF data we track:

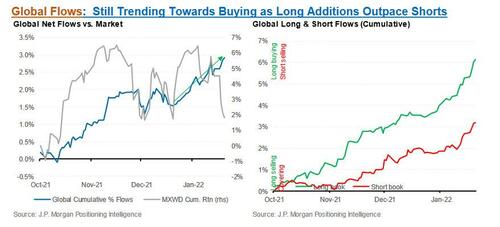

- Flows: we’ve mostly seen net buying over the past 4 weeks as longs additions have outpaced shorts.

4-week global net flows are actually quite positive (given some increased buying in EMEA and APAC lately), which is somewhat unusual.

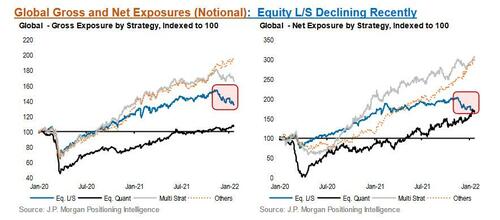

Furthermore, 1-week net flows in N. America have chopped around neutral levels and have yet to get very negative (i.e. -2z), which is something we saw a number of times around lows in 2021. - Exposure changes (i.e. notional exposures, rather than leverage): Globally, there’s been little decline in gross or net exposure for most strategies.

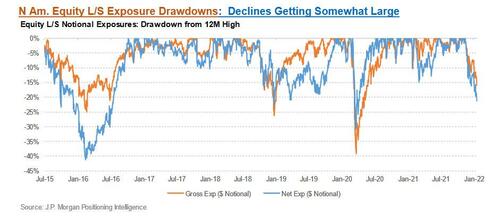

However, Equity L/S gross and net exposures in N. America are an exception as gross exposure is down 16% from mid-Nov highs, while net exposure is down 21% from mid-Nov highs.

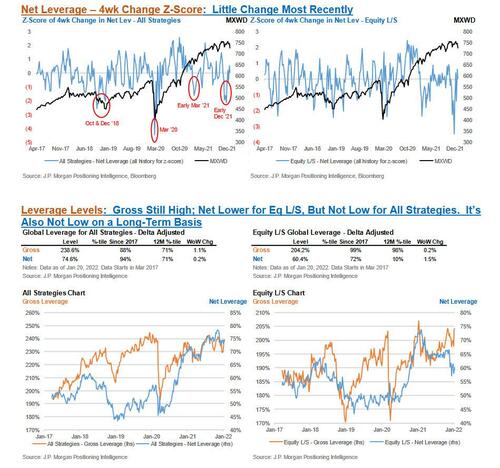

While not the same magnitude that we saw in 1Q20 or into 1Q16, the recent decline in notional exposures is relatively similar to what we saw in 4Q18. However, given the performance of Eq L/S longs and shorts in N. America is -14% to -15% since mid-Nov, most of the reduction in gross could reflect mark-to- market declines, while the larger decrease in net is suggestive of net selling (something we saw among these funds from mid-Nov to mid-Dec, but less so recently). - Leverage: Unlike in early Dec, we have not seen a significant decline in net leverage most recently, which has historically been a good tactical indicator. Global Equity L/S net leverage is relatively low vs. the past 12 months (10th %-tile), but arguably still around the middle of its range since Jan 2020 and the 72nd %-tile since 2017.

When we look at gross leverage, it’s still relatively high and has increased a bit in recent weeks

Performance among HFs continues to tell a familiar story: Equity L/S funds have struggled as longs are down significantly (Tech and HC longs are down ~15% since the start of Nov), but long-short spreads have been more sideways. Among Multi-Strats and Quants, however, overall performance has fared better as shorts provide a buffer; most sectors have had positive long-short spreads in recent months among Equity Quants and Multi-Strats.

There is much more in the full report available to professional subs.

Tyler Durden

Mon, 01/24/2022 – 15:41

via ZeroHedge News https://ift.tt/33NoIyz Tyler Durden