Near Record Foreign Demand For Stellar 2Y Auction Suggests Fed Tightening Panic Is Over

Today’s just concluded 2Y auction – which some feared would be a disaster as a result of zero concessions and continued fears of a tighter Fed which would promptly hammer the 2Y position – was nothing short of spectacular.

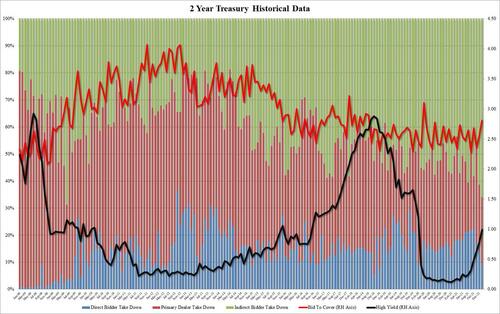

Pricing at a high yield of 0.990%, the $54BN 2Y auction stopped through the When Issued 1.002% by a massive (for the 2Y tenor) 1.2bps, the biggest stop through since April 2020 when the world was imploding in the aftermath of the covid crash.

The Bid to Cover was similarly impressive 2.811, which like above, was the highest since April 2020 (and far above the six-auction average of 2.50).

But nothing compares to the shocking stellar internals, where Indirects took down a remarkable 66.0%, which was far better than last month’s 61.39%, far better than the recent average of 54.0% and was the highest since June 2009. And since Directs took down just 9.4%, Dealers were left holding 24.6%, in line with recent auctions and just below the recent average of 26.4%

So what does this auction tell us? Well, one interpretation is that with amid the flight from risk, everyone rushed into the relative safety of 2Y paper. But this wouldn’t happen if the Fed was set to hike rates 6-7 times as Jamie Dimon predicted, so the more important implication is that the bond market has spoken and may have just called the peak in the rate hiking panic. Translation: it’s all downhill from here when it comes to the Fed’s tightening plans.

Tyler Durden

Mon, 01/24/2022 – 13:15

via ZeroHedge News https://ift.tt/3GXFrh9 Tyler Durden