US Services PMI Crashes To 18-Month Lows As Omicron Strikes

With US macro data serially disappointing in recent weeks, it should come as no surprise that analysts expected both Services and Manufacturing surveys from Markit to slide further in preliminary January data. The analysts were right in direction but the magnitude was dramatically worse with Manufacturing dropping from 57.7 to 55.0 (worse than the 56.8 expected) while Services collapsed from 57.6 to 50.9 (hugely worse than the 55.0 expected)…

Source: Bloomberg

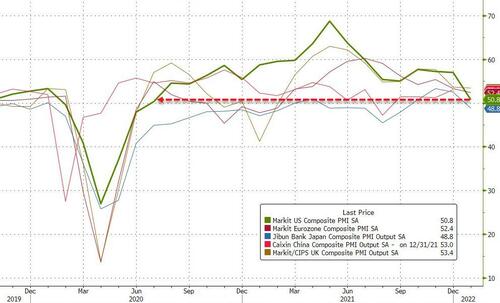

That is the lowest Services print since July 2020 and lowest Manufacturing since October 2020, which combined dragged the US Composite PMI down to July 2020 lows – now second only to Japan for the weakest economy in the developed world.

Source: Bloomberg

Commenting on the PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

“Soaring virus cases have brought the US economy to a near standstill at the start of the year, with businesses disrupted by worsening supply chain delays and staff shortages, with new restrictions to control the spread of Omicron adding to firms’ headwinds.

“However, output has been affected by Omicron much more than demand, with robust growth of new business inflows hinting that growth will pick up again once restrictions are relaxed. Furthermore, although supply chain delays continued to prove a persistent drag on the pace of economic growth, linked to port congestion and shipping shortages, the overall rate of supply chain deterioration has eased compared to that seen throughout much of the second half of last year. This has in turn helped lift manufacturing optimism about the year ahead to the highest for over a year, and has also helped bring the rate of raw material price inflation down sharply. Thus, despite the survey signalling a disappointing start to the year, there are some encouraging signals for the near-term outlook ”

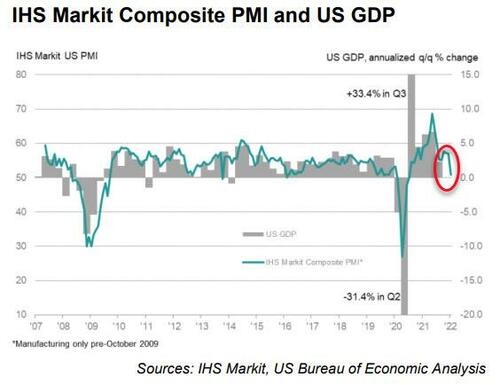

Nevertheless, Q1 GDP looks like it’s going to be a big disappointment…

Will The Fed be hiking rates in a recession?

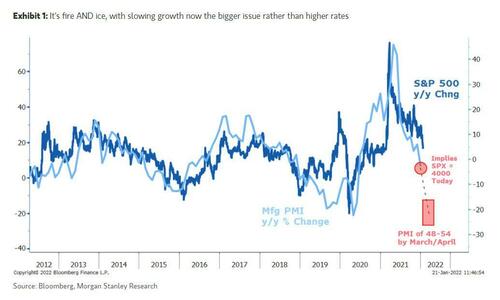

Finally, we note that this trend in PMIs is not a good sign for US equity markets…

In fact, perhaps it is the market that is leading Markit lower.

Tyler Durden

Mon, 01/24/2022 – 09:54

via ZeroHedge News https://ift.tt/35nLDkF Tyler Durden