Wage Increase – The Good, Bad, & Ugly

Authored by Lance Roberts via RealInvestmentAdvice.com,

Wage increases are undoubtedly good for workers. However, as we will explore, wage increases are a double-edged sword that often has more negative economic consequences.

Importantly, wage increases are undoubtedly good for consumers. There is no arguing that point. After all, who doesn’t want to make more money for doing their job? However, as we discussed in “$15/Hour Cost & Consequences,” wage increases are not a “free lunch.” To wit:

“Labor costs are the highest expense to any business. It’s not just the actual wages, but also payroll taxes, benefits, paid vacation, healthcare, etc. Employees are not cheap, and that cost must be covered by the goods or services sold. Therefore, if the consumer refuses to pay more, the costs have to be offset elsewhere.

For example, after Walmart and Target announced higher minimum wages, layoffs occurred and cashiers were replaced with self-checkout counters. Restaurants added surcharges to help cover the costs of higher wages, a “tax” on consumers, and chains like McDonald’s, and Panera Bread, replaced cashiers with apps and ordering kiosks.”

The CBO also reported similarly:

-

By increasing the cost of employing low-wage workers, a higher minimum wage generally leads employers to reduce the size of their workforce.

-

The effects on employment would also cause changes in prices and in the use of different types of labor and capital.

-

By boosting the income of low-wage workers who keep their jobs, a higher minimum wage raises their families’ real income, lifting some of those families out of poverty. However, real income falls for some families because other workers lose their jobs, business owners lose income, and prices increase for consumers. For those reasons, the net effect of a minimum-wage increase is to reduce average real family income.

Read that last sentence again.

Wage Increase – Good Until You Get Inflation

As noted, “the net effect of increasing wages,” if not broad-based, “reduces average real family income.” The reason is “inflation.”

The current wage increase focuses primarily on lower-tier jobs such as health care, leisure and hospitality, and restaurants. Labor turnover is exceptionally high as employees jump jobs for higher pay. As labor costs rise, so do prices, as businesses pass along higher costs to consumers.

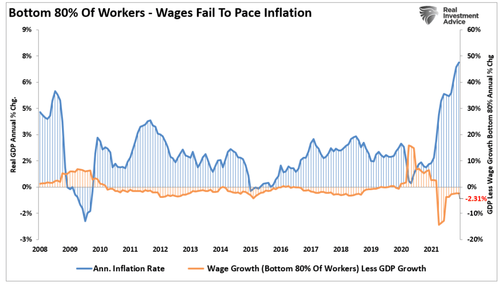

The surge in wages is certainly notable until you factor in inflation. However, as shown below, real wages for the bottom 80% of income earners are negative.

In other words, the increases in their cost of living are outpacing their incomes. As such, they have to turn to credit to fill the gap. (Such is why we have seen a surge in credit usage in recent months as liquidity drains from the system.)

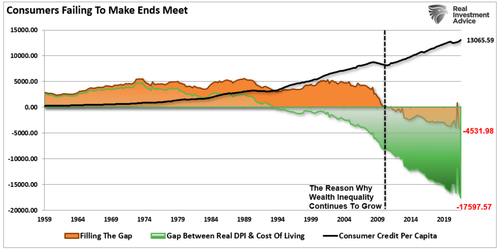

(The chart below shows the gap between real incomes plus savings and the cost of living. It currently requires $4531 annually in debt to fill the cost of living gap.)

When real wages fall short, it ultimately weighs on consumption.

Wage Increase – The Bad Of Shrinking Margins

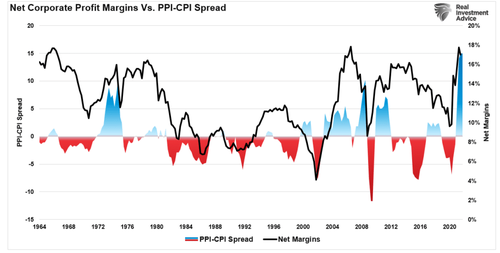

Employers are in a tough spot when it comes to protecting profit margins. As noted in “Inflation Surge,” the massive spread between input and consumer prices suggests corporations cannot pass along inflation entirely. Such means there is considerable pressure on profit margins in the quarters ahead.

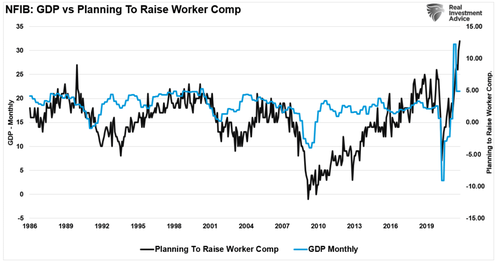

While input costs are on the rise, the single most significant cost to businesses, as noted above, is labor. The NFIB monthly survey shows labor costs are one of the biggest concerns of small businesses. Importantly, note that while they understand they will pay more for labor, increasing wages will mark the peak of economic growth.

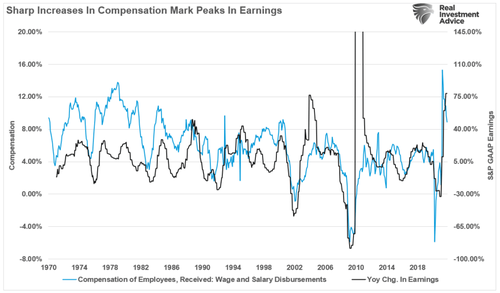

However, higher costs (input prices, labor, benefits, etc.) also directly affect profits and earnings.

As the CBO study noted, employers will respond to higher labor costs.

-

Higher wages increase the cost to employers of producing goods and services. The employers pass some of those increased costs on to consumers in the form of higher prices, and those higher prices, in turn, lead consumers to purchase fewer goods and services.

-

The employers consequently produce fewer goods and services, so they reduce their employment of both low-wage workers and higher-wage workers.

-

Lastly, when the cost of employing low-wage workers goes up, the relative cost of employing higher-wage workers or investing in machines and technology goes down.

Read that last sentence again.

The Ugly Leading Indicator Of Recessions

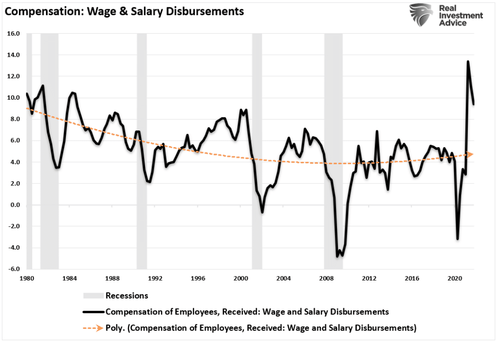

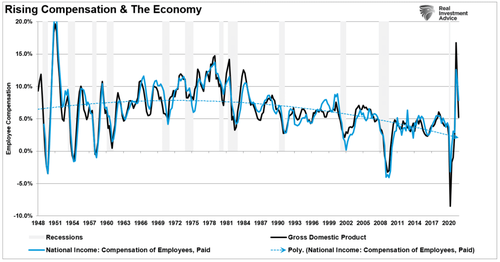

What economists tend to forget about rising wages is that businesses will respond to protect profit margins. Wages and costs rise, companies lay off workers, consumption decreases, and the economy slips into recession. There is a very high correlation between rising compensation and economic growth.

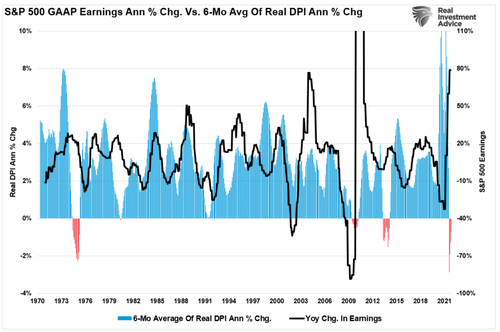

Such is because earnings are a function of economic growth, which is 70% comprised of consumer spending. Therefore, as higher costs get passed onto consumers in the form of inflation, their disposable income shrinks. In turn, they spend less, which leads to economic and earnings contraction.

To explain this, let’s revisit what the CBO said about the macroeconomic effects of higher wages.

-

Reductions in employment would initially be concentrated at firms where higher prices quickly reduce sales.

-

Over a longer period, however, more firms would replace low-wage workers with higher-wage workers, machines, and other substitutes.

-

A higher minimum wage shifts income from higher-wage consumers and business owners to low-wage workers. Because low-wage workers tend to spend a larger fraction of their earnings, some firms see increased demand for their goods and services, which boosts the employment of low-wage workers and higher-wage workers alike.

-

A decrease in the number of low-wage workers reduces the productivity of machines, buildings, and other capital goods. Although some businesses use more capital goods if labor is more expensive, that reduced productivity discourages other businesses from constructing new buildings and buying new machines. That reduction in capital reduces low-wage workers’ productivity, which leads to further reductions in their employment.

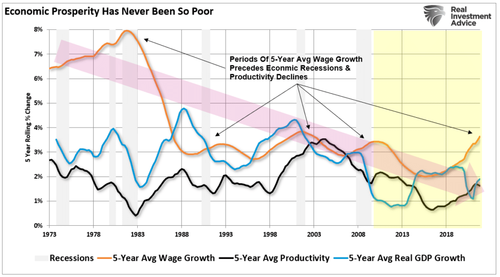

Our last chart confirms the CBO analysis.

Conclusion

The surge in wages resulted from the confluence of $5 trillion in liquidity, creating a massive level of artificial demand with production shut down. With that liquidity reversing, demand will fall as higher costs impact corporate profitability who, in turn, react by curtailing employment. Such will lead to an eventual recession.

As shown in the chart above, rising wage growth has also preceded recessions in the economy. This time will likely be no different.

The unintended consequences of an artificial surge in demand in a weak economic environment are not inconsequential. For investors, 2022 will likely be a year of disappointment in earnings and economic growth expectations. Those disappointments will likely become magnified by theFed’s coming policy mistake.

Tyler Durden

Mon, 01/24/2022 – 14:25

via ZeroHedge News https://ift.tt/3GX9NjC Tyler Durden