Buzzfeed Shares Crater: Down 60% As SPAC Bloodbath Worsens

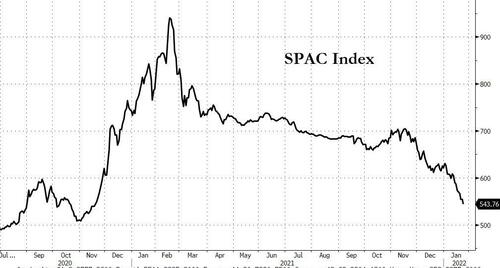

As shares of “pre-revenue” companies have been absolutely clobbered during the selloff that has afflicted US stocks since the start of the year, shares of the recently de-SPAC’d Buzzfeed are down 60% from their offering price – the $10/share that’s typical of pre-deal SPACs.

Shares of the firm, which now trades on the Nasdaq under the ticker “BZFD”, have sunk to a new low below $4 a share during Tuesday’s market ructions.

We have noted many times that BuzzFeed, a languishing darling of the mid-2010s VC love affair with “hip” “progressive” digital-media companies, has never been profitable, and while it’s revenues have climbed somewhat in recent years, it remains modestly unprofitable.

Still, with a pesky new union dedicated towards battling with management for higher wages (even while wages at the company remain very attractive compared with the rest of the digital media space), CEO Jonah Peretti has his work cut out for him.

The company’s market value has fallen without stopping since its December debut trading under the “BZFD” ticker.

The company’s best-known bull, Bustle Digital Group CEO Bryan Goldberg, has said that he bought a “f*** ton” of the company’s shares at roughly $6/share – substantially higher than where its shares are trading today. Goldberg told CNBC that $15/share would be a “key level” for the firm, because it would show potential acquisition targets that Buzzfeed has credibility (while also providing it with the currency necessary to buy):

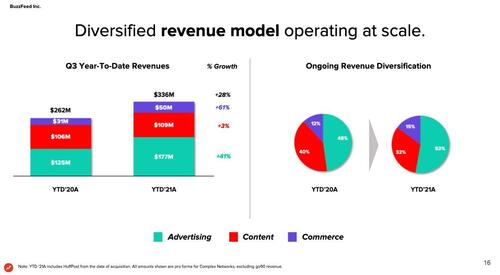

The key level for BuzzFeed will be $15 per share, said Bustle Digital Group CEO Bryan Goldberg. At $15 per share, BuzzFeed’s market capitalization would be about $2.25 billion. That approaches a trading multiple of four times revenue. BuzzFeed generated $161 million in revenue in the first half of 2021 and acquired Complex Media earlier this year, which brought in $53 million in the first six months.

Confidence in BuzzFeed’s future prospects may grease the wheels for consolidation. BuzzFeed will need outsider faith in its equity to use it as viable currency for acquisitions. If BuzzFeed can hold steady at a 4x revenue multiple, sellers will feel they’re getting a just price, Goldberg said.

“4x revenue should be the default,” Goldberg said. “But it may take six to eight months to get there.”

The firm recently bough out Complex and the Huffington Post, two deals that have yet to pay off in terms of revenue.

And as management claimed in a presentation to investors given around the time of the company’s Nasdaq debut, Buzzfeed has grandiose ambitions of expanding its commerce business, in addition to its advertising and content businesses.

But whether it executes on this plan or not remains to be seen.

More broadly, shares of “de-SPAC”-ed companies have been struggling over the past year as they substantially underperform the broader market.

That’s quite a roundtrip!

Tyler Durden

Tue, 01/25/2022 – 15:29

via ZeroHedge News https://ift.tt/3tX03SX Tyler Durden