“Fed Club Was The Beginning. Now It’s Moved Out Of The Basement, It’s Called Project Mayhem”

By Mike Every of Rabobank

“Welcome to Fed Club. The first rule of Fed Club is: you do not talk about Fed Club. The second rule of Fed Club is: you DO NOT talk about Fed Club! Third rule of Fed Club: if someone yells “stop!”, goes limp, or taps out, the Fed is over.”

Well, that was a day in markets! After an initial collapse in just about everything that threatened to not just take the S&P into correction territory, joining the Nasdaq, but to the worst start to a year since 1920, intraday saw a sudden, magical reversal. Rate hike bets tumbled out of the blue – just before the Fed meeting, even though US 10-year yields traded a narrower (bp) intraday range than in some of the other crazy swings we have seen of late. Equities soared to close slightly up, having been down over 4% – the best bounce seen since the last two occasions we got *major* central-bank bail-out actions, both back in October 2008.

I do not believe in conspiracy theories. Almost all of the time what you are seeing is coincidence at best, and prejudice at worst. Moreover, markets are fantastically dumb if you speak to the average multi-billion dollar buy-side fund, and presumably at the peak of the panic yesterday everyone was short and so easy to squeeze. However, was it totally random that markets rebounded so spectacularly, on nothing,… or was it Fed Club?

The optimism implies that just before the hawkish Fed meets –with inflation high enough to get political (i.e., prompting a very unpresidential comment)– it is already reassessing because stocks and crypto are down year-to-date. That’s the assumed rule of Fed Club: you do not talk about it; you do not talk about it; but as soon as markets yell “stop!”, or go limp, or tap out, the Fed is over.

Well, the Fed is up shortly and so we will soon find out. If Fed Club is just the product of paranoid minds then things are about to get uglier. There will be no ability to tap out until something gets bloodied, bruised, broken, or dislocated.

If there is a Fed Club, then said Fed are in as much trouble as Tyler Durden was at the end of the movie Fight Club. If they act, things crash around them by their hand. If they don’t, they watch impotently as things crash around them anyway. Supply-side inflation will become entrenched in the economy and then spreads to wages, and stagflation looms. Even if you view rate hikes as the wrong response to supply-side inflation, one has to see that blowing asset bubbles is not either, as the public opens unofficial chapters of Fed Club across the country, all speculating away in basements. Ironically, the recent collapse in crypto is likely to have forced many Americans to think about the need to re-join the labour force again, so capping wage pressures: if you cannot mint millions from flipping digital flatulence, it might be time to flip burgers again instead.

In short, for markets, the fight isn’t over; and that is even more the case for them via geopolitics.

The US is withdrawing its embassy staff from Kyiv, which the EU (and Ukraine) says is being dramatic. Well, so have the Russians – what do they know? The UK is insisting it has intelligence that Moscow plans to attack Kyiv and install a puppet government: then again, PM BYO now allegedly cannot just fail differentiate between a party and a work meeting, but also cannot recognize when he is attending his own birthday party! The US may send 8,500 troops to eastern EU members – enough to enrage Russia and escalate the crisis, but not to win any war; and the EU is lending Ukraine EUR1.2bn for economic development – enough to enrage Russia and escalate the crisis, but not to prevent any war. (The two actions also show how the two different powers react in a crisis, and why many EU members still look to Washington and not Brussels when push comes to shove.) Russia is meanwhile suggesting it could literally replay the 1962 Cuban Missile Crisis by reaching out publicly to Havana about “strategic partnership coordination”.

Put that together with another two missiles fired at Abu Dhabi by Houthis, but luckily intercepted; China flying 39 jets near Taiwan, the most in months; and Russian jets suddenly appearing unannounced in the skies over Syria, restricting the Israeli airforce’s ability to strike Hezbollah and Iranian targets there, and it really looks like a global Fight Club that even markets –who understand NOTHING about these kind of things– can grasp; at least enough to unironically echo Dr. Strangelove in shouting “Gentlemen! You can’t fight in here! This is the War Room!”

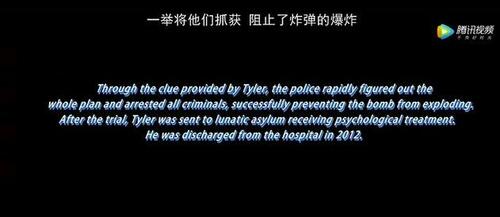

Meanwhile, in a sign of the times markets should also notice, but won’t, China has decided to change the ending of Fight Club. In the original, Tyler Durden blows a hole in his own face to snap out of his anti-establishment paranoid schizophrenia, and then watches the bourgeois capitalist skyscrapers around him collapse. In the new Chinese version the ending sees a flashcard that says “Through the clue provided by Tyler, the police rapidly figured out the whole plan and arrested all criminals, successfully preventing the bomb from exploding. After the trial, Tyler was sent to lunatic asylum receiving psychological treatment. He was discharged from the hospital in 2012.” So they all lived happily ever after: now go buy expensive (not imported) soap.

“Fed Club/Fight Club/‘Fight Club’ was the beginning. Now it’s moved out of the basement, it’s called Project Mayhem.”

Tyler Durden

Tue, 01/25/2022 – 11:50

via ZeroHedge News https://ift.tt/3FTPJgQ Tyler Durden