Goldman Sachs Warns Ukraine Conflict Risk Could Spark Doubling In EU NatGas Prices

Geopolitical tensions are soaring over Ukraine between Russia and the U.S. and its European allies. On Sunday, the U.S. ordered family members of the Kyiv embassy to evacuate after President Biden may deploy thousands of troops to Eastern Europe. NATO said on Monday it was putting forces on standby.

The impending threat of World War III has quashed demand for riskier assets such as bitcoin and technology stocks and supported demand for energy.

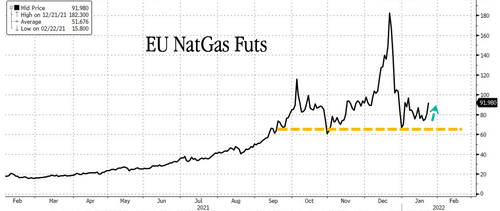

In particular, European natural gas soared 20% Monday as the increasing risk of conflict threatens fuel-starved Europe with supplies from Russia.

Goldman Sachs commodity analyst Samantha Dart expanded more on the supply side story and told clients Sunday, “should further tensions between Russia and Ukraine escalate, the initial uncertainty around its impact on gas flows would likely lead the market to once again add a significant risk premium to European gas prices.”

Dart explained if “current tightness in European gas balances” persisted and “existing gas flows from Russia” were blocked, “we wouldn’t rule out in this scenario the market briefly revisiting the 180 EUR/MWh high observed in mid-December – or even higher levels – while flow impacts are assessed.”

She also outlined a “potential risk” if escalating tensions over Ukraine result in sanctions against Russia’s Nord Stream 2 pipeline to Germany, which would delay the certification of the pipeline even more and cause continued tightness in European markets.

There’s also a risk, “tightness in European gas markets to linger for another three years,” Dart warned (The full report is available to pro subs in the usual place).

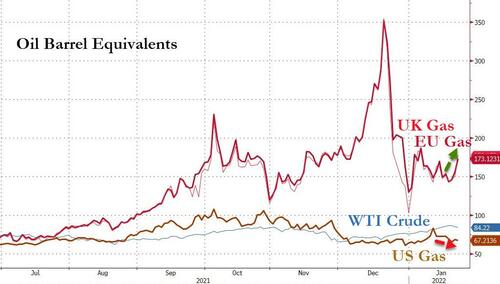

Rising geopolitical uncertainties and adverse weather conditions have made Europen gas a massive arbitrage opportunity for traders. As shown below, the premium for European gas is much higher than in the US.

While the premium for EU gas over US gas is rising once again, after hitting a record high at the end of 2021, this is equivalent to a $173 price for a barrel of crude oil…

The latest escalations could mean sanctions on Russia would undoubtedly result in massive consequences for Europe of declining gas flows that would send energy prices through the roof and crush consumers who can barely afford to pay their energy bills already.

Tyler Durden

Tue, 01/25/2022 – 05:45

via ZeroHedge News https://ift.tt/3IyLjNX Tyler Durden