How Yesterday’s Miraculous Market Rebound Prevented A Massive Crash

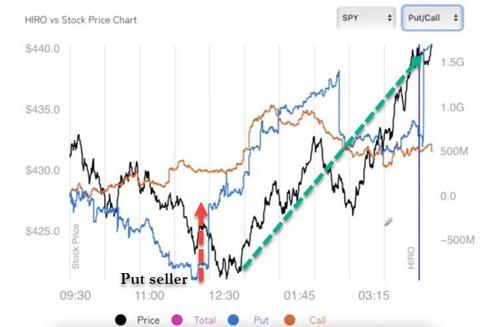

We previously discussed how a mystery put-selling whale emerged just around noon on Monday…

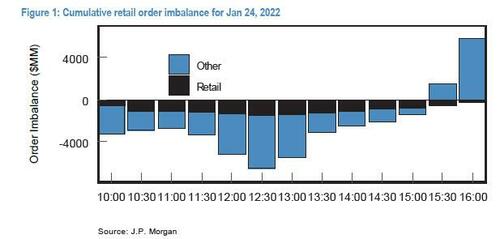

… and helped reverse a historic rout of nearly 5% in the Nasdaq, which then attracted a frenzy of retail dip-buying momentum chasers, who reversed near-record selling in the first half of the day to near-record buying in the second half.

But while there is still some speculation as to who or what may have been behind yesterday’s historic reversal, what is beyond dispute is what a massive difference the reversal meant for the market’s future demeanor, in other words the difference between the market closing down -4% on Monday and just slightly green.

Conveniently, Morgan Stanley has done the analysis and has a stunning result.

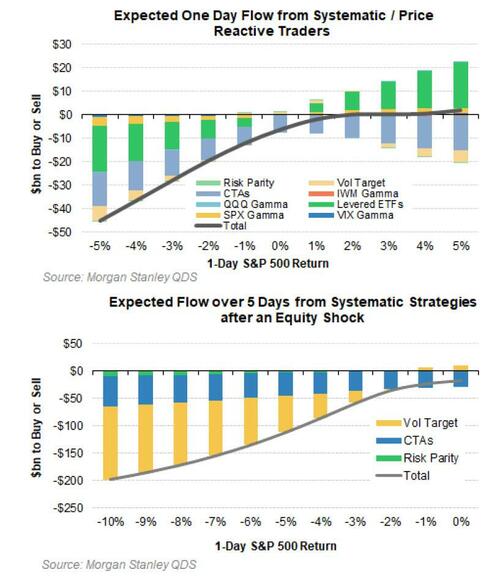

As we noted earlier, the bank’s Quantiative and Derivatives Strategies desk estimates that systematic macro strategies (Vol Target Funds, Risk Parity Funds, and Trend Following CTAs) as of this moment, have equity supply of $15-20BN over the next week, or about $3-4bn / day, which is hardly catastrophic: according to Goldman this is less than the daily Buyback bid of about $5bn/day.

But had the S&P closed on its Monday lows, down 4%, QDS estimates the group would have had at least ~$90bn of equity supply over the coming week…

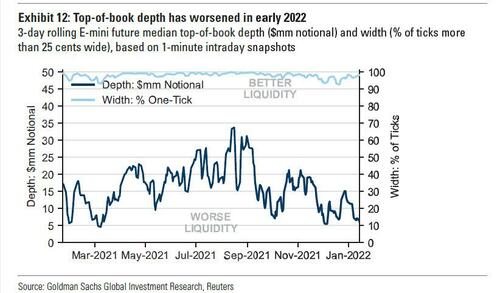

… or more than 4x than the current supply and enough to crush the current extremely illiquid market where top of book liquidity is now down to just $5 million (meaning it takes just $5 million in emini orders to move the ES one tick).

As Morgan Stanley elaborates “most of the forecast supply comes from CTAs as many short momentum triggers are now being hit, with ~50% of QDS’s CTA models are still long SPX and NDX futures as longer-term trend signals are still positive. But vol target funds have not delevered much yet, meaning they remain a future risk.”

Translation: whather or not the PPT/i.e., Fed Club, rescued markets or not, or it was a purely coincidental – if highly improbable – rescue, the reversal yesterday surely prevented what would have been a major crash in the market today as 4 times as much selling flows would have hit, flushing away all bids and promptly sending the market well below 4,000.

Tyler Durden

Tue, 01/25/2022 – 15:15

via ZeroHedge News https://ift.tt/3KLXhFS Tyler Durden