Joe Biden’s Gasoline Problem Is Back

By Bloomberg Markets Live commentator Jake Lloyd-Smith

Costly crude oil means runaway gasoline. With Brent now threatening to hit $90/bbl, pressure on the vital motor fuel remains to the upside. In this environment, look for governments trying to protect hard-pressed consumers — aka voters — from pain at the pump.

The latest salvo came in Asia this morning. Japan said it will give oil refiners subsidies that are designed to help processors maintain margins without passing on the rising costs to customers. The strategy also applies to diesel and kerosene oil, and may be followed by other measures.

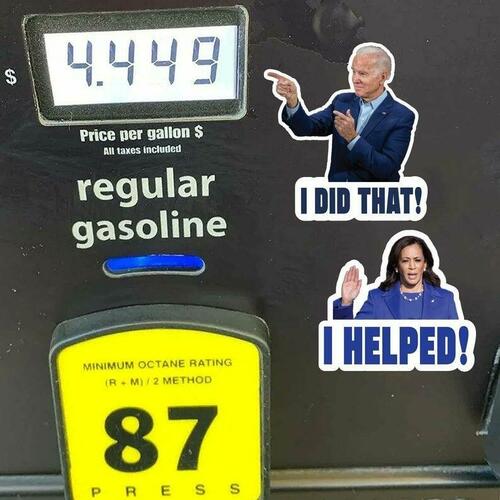

The same dynamic is at play in the U.S., where gasoline futures have surged more than 50% over the past 12 months. A worried Joe Biden has already orchestrated a crude release from strategic reserves, an initiative joined by Japan among others. That bought some time, but didn’t turn the tide. Average retail prices are a few cents below the seven-year high hit in November.

The next focus will be the Feb. 2 OPEC+ meeting, when producers will review the market and decide on supply policy. The Biden administration will likely step up diplomatic efforts to get members that still have spare capacity to deliver more crude.

Whether they’ll listen is quite another matter.

Tyler Durden

Tue, 01/25/2022 – 13:11

via ZeroHedge News https://ift.tt/3H3M9lt Tyler Durden