New Study Finds CFA Charterholders Are Actually Worse At Investing

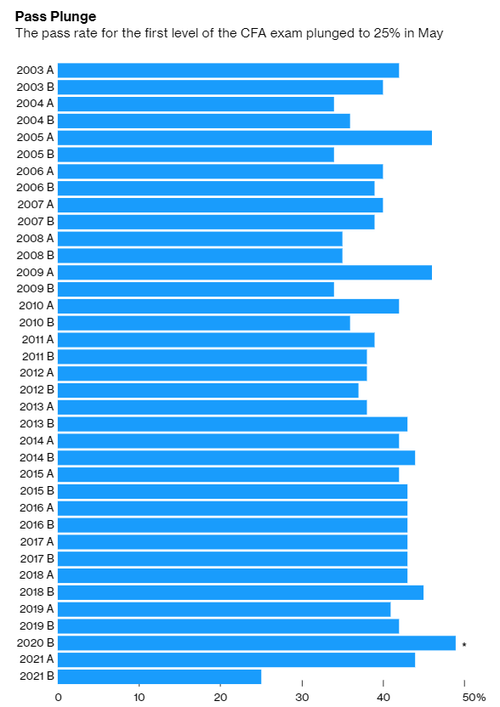

We have some good news for the thousands of candidates who failed the Level 1 CFA exam last year, when the notoriously difficult test saw a record-low pass rate of just 25%: turns out, the credential doesn’t really have any bearing on an individual’s competence as an investor.

On Monday, Bloomberg reported on a new study from researchers with two British business schools which purported to show that, contrary to popular belief, the CFA credential – once seen as a reliable path toward advancement on Wall Street – is actually correlated with worse performance. The researchers arrived at this conclusion after examining the careers of more than 6,000 fund managers.

Researchers from Bayes and Cork University Business School examined 6,291 US equity mutual fund managers’ careers, tracking their performance across various funds and companies as well as examining factors such as gender, qualifications and whether the manager was invested in the fund. Previous similar studies have looked mostly at managers’ performance while working for particular funds.

The research found that experience in the market was more closely correlated with investing success; on the whole, managers who had a CFA actually underperformed their non-charterholder peers. Although, as the researchers acknowledged, correlation doesn’t necessarily mean causation.

“Some of the more experienced guys probably don’t have the CFA designation because they’re older,” Andrew Clare, a professor at Bayes Business School, City University of London, said in an interview. “So you could imagine that CFA designation is kind of a proxy for, not inexperienced, but less experienced managers.”

The research offered little to recommend the CFA, although the study ultimately found more persistent outperformance among managers who came from universities with more stringent entry requirements, as well as among those who studied more technical fields like physics and math.

In a sign of the CFA Institute’s injured pride, a spokesman for the institute insisted that other research arrived at the opposite conclusion.

“The CFA Program represents a demonstrated and proven pathway to a successful career in investment management,” a spokesperson for the institute that oversees the qualification said. “Other pieces of academic research have arrived at the opposite conclusion to this study.”

It’s been said that the average student studies for 300 hours before taking each of the three CFA exams, often taking about 4 years to complete the process. And if pass rates continue to plunge, more people might start to question whether the whole ordeal is truly worthwhile.

Especially when traders who YOLO’d Gamestop calls and sh*tcoin crypto plays still outperformed many of the market’s most esteemed investors last year.

Tyler Durden

Mon, 01/24/2022 – 21:30

via ZeroHedge News https://ift.tt/3fQAbzX Tyler Durden