“The Sum Of All Fed Fears” – BofA Warns FOMC Isn’t Doing Enough To Stop Inflation From Torpedoing Markets

Bank of America’s view that the Fed is way beyond the curve when it comes to suppressing inflation has led it to a ‘bear case’ outlook for stocks and bonds that’s almost apocalyptic.

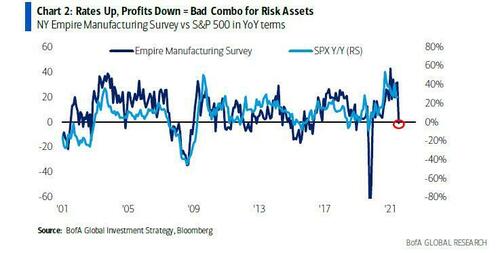

Over the weekend, we shared (with premium subs) our thoughts on the latest “Flow Show” from BofA’s Michael Hartnett, one of the gloomiest strategists on Wall Street, who has repeatedly excoriated the Fed for its unwillingness to act more boldly (“they should hike 50 basis points…but won’t”). Hartnett has warned that untrammeled inflation will eventually lead to a growth-killing “rate shock” engineered by the Fed that will torpedoe valuations for stocks and bonds. Already, his team argues, rising Treasury yields contributed to the crashing ISM, which has turned out to be a “bad combo” for risk assets.

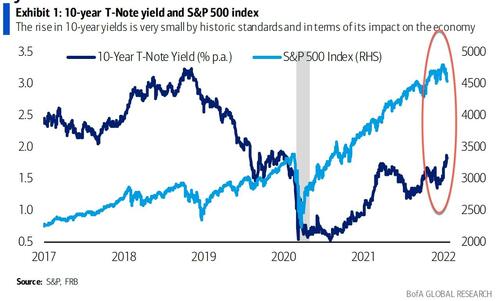

With the FOMC expected to lay the foundation for a 25 basis-point hike at its meeting this week, BofA’s economists have followed up with a series of similarly downcast FOMC previews warning that the Fed isn’t doing enough to stop inflationary pressures from unleashing stagflationary hell. Global Economist Ethan Harris noted in a note entitled “the Sum of all Fed Fears” that, even though markets have responded violently to a recent spike in Treasury yields, the rise isn’t all that much from a historical standpoint.

Harris continues: while “[t]here are plenty of risks in the global economy, including geo-political events related to Russia or China, a renewed trade war, another policy mistake by the ECB and so on. However, in our view, the biggest near-term risk is right in front of us: that the Fed is seriously behind the curve and has to get serious about fighting inflation.”

Of course, “getting serious” in BofA’s view is the last thing the Fed wants to do because it would threaten its ability to carry out that “other” Fed mandate: keeping asset prices elevated at all costs.

Harris then adds this insightful bit explaining why he feels the Fed’s outlook on rates, as expressed by its statements, minutes and forecasts, simply isn’t aggressive enough:

“It has been a long time since markets have had to deal with a serious inflation-fighting Fed. After the December FOMC meeting, the press was loaded with reference to the “Fed’s hawkish turn” and the “pivot to fighting inflation.” That tells us more about the state of thinking today, than about the reality. A central bank that signals that it will taper a bit faster and could exit zero rate six months from now is hardly fighting inflation. According to the Fed’s own forecast, inflation remains a remote problem. The median FOMC forecast assumes PCE inflation drops from 5.3% in 2021 to 2.1% by the end of 2024. Hence the Fed does not plan to return to its 2.5% estimate of the neutral rate any time in its forecast horizon.”

But what would a really aggressive inflation-fighting Fed look like, anyway? Well, Harris speculates that the first step would be for the central bank to target an end rate that truly takes the Fed funds rate “above neutral”.

What does a real inflation-fighting Fed look like? The first step is to abandon the idea of a slow motion return to neutral. As long as the funds rate is below neutral, Fed policy will only mean an even tighter labor market. The second step is to determine what degree of financial tightening is needed to slow growth below trend, pushing up the unemployment rate. It is possible that fading fiscal stimulus or some other headwind could do the trick; however, we are quite skeptical given the big tailwinds from massive accumulation of liquid savings and wealth.

As with past business cycles, they will likely need to push the funds rate above neutral. The only exception in the last cycle when inflation never showed up and COVID triggered a recession, obviating a need for a get-tough Fed.

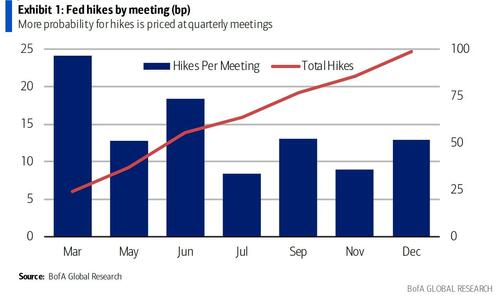

Unfortunately for consumers, the most likely “get tough” scenario envisioned by BofA is one where the Fed raises rates 6 times this year starting in March, skipping May, then hiking again in June. Six rate-hikes in 2022 and a terminal rate of 3% or greater (higher than the FOMC’s present median long-term forecast, according to the Fed’s dot plot) would just about do it:

How Likely Is Such A Scenario?

We think it is very likely that inflation settles into a higher range than the Fed is assuming. A wide range of indicators points to persistent inflation, including labor cost measures, median and trimmed mean measures, surveys of inflation expectations (from real people, not economists) and a bunch of other metrics. Hence we have them hiking faster and further than both their forecast and the consensus. In our baseline, it is an “inflation skirmishing” Fed.

However, the most likely alternative, in our view, is that inflation settles at around 3% and the Fed has to get serious. The committee is quite dovish overall, and will get more dovish if the new nominees join the board. However, even from them, 3% should be unacceptable. The most likely get tough scenario would mean an initial slow start for the Fed—perhaps hiking 25bp in March, skipping May and then hiking in June. But if they were to get more serious, six hikes this year and a terminal funds rate of 3% seems plausible.

Writing in his official FOMC Preview, Harris said he expects the Fed’s tone at this week’s meeting to be more hawkish, pushing the markets’ expectation closer to Jamie Dimon’s view of more than 4 hikes in 2022 (right now, markets are only pricing in roughly 4 hikes this year).

A hawkish FOMC should create a “curve-flattening bias (both in nominal and real rates)” while also being a “key catalyst for another leg of US dollar appreciation against lower beta FX”.

In terms of developments in the US economy, things are moving fast right now. As a result, the sluggish Fed is still “pivoting” in an effort to keep up with the market’s preferred narrative. Here are a few ways in which BofA suspects the Fed might signal a more hawkish tilt:

- The Fed has already acknowledged that it has hit its inflation goal. With the unemployment rate plunging (2% in six months) and already below 4%, it could acknowledge it has hit maximum employment.

- It could signal that omicron is at least as much of a supply shock as a demand shock, adding tom imbalances in the near term.

- It may suggest continued optimism on the growth outlook. Omicron is a temporary shock and, as COVID constraints fade, the service sector should return to recovery. Financial conditions remain very supportive of growth.

- It could note that the price pressures have.

An for anybody interested, here are BofA’s views on a number of other “topics of interest” ahead of the January FOMC:

Cold turkey taper stop: we believe it’s unlikely the Fed ends its taper cold turkey, but see some possibility it concludes purchases after the Jan/ Feb calendar. The Fed has already announced its mid-Jan to mid-Feb purchase calendar and likely has a high bar to deviate from it. However, the Fed may not taper purchases from $40bn/ month to $20bn/ month and, instead end purchases after the Jan/ Feb calendar is completed. We believe this would surprise the market and likely signal an even more hawkish turn than already expected. Announced taper conclusion at this meeting would increase the odds we assign to a 50bp hike in March and another potentially 50bp hike in May.

50bp hike in March: we believe it’s unlikely the Fed hikes by 50bp in March, but can’t rule it out given elevated inflation. We believe a 50bp hike in March would essentially acknowledge a policy mistake-keeping policy too easy for too long. If the Fed is considering a 50bp hike in March, it should indeed end purchases next week. We believe Powell may have a difficult time convincing market that a 50bp hike is off the table.

Every meeting live: Powell will likely be asked and acknowledge that “every meeting is live”. The market likely already believes every meeting could be live, but Powell’s statement of it may further increase the odds of more than 100bp of hikes delivered this year (Exhibit 1). It is worth reminding the Fed only started pressers at each meeting in January 2019, after it finished hiking in the last cycle.

QT guidance: Powell will also likely update on Fed discussions around QT. We expect Fed staff will deliver various QT options to the FOMC, including a range of redemption caps for USTs and agency MBS. We do not expect Powell to relay any decisions on redemption caps but expect more details in the January FOMC minutes. We believe the Fed could be ready to update its policy normalization plans for QT as early as the March FOMC, which would then make a May or June QT announcement likely. Our base case is for a QT announcement at the June FOMC with risks to May.

Looking ahead, BofA expects markets and inflation to “bully” the Fed into more rate hikes. Of course, what the BofA team isn’t saying (at least not yet), is that even if these hikes don’t look so substantial in the context of history, any hawkish turn will likely stoke chaos in stocks and bonds, where valuations remain inflated based on “historical” comparisons.

Tyler Durden

Tue, 01/25/2022 – 12:58

via ZeroHedge News https://ift.tt/3AxTnMj Tyler Durden