Citi, Goldman, JPMorgan Urge Investors To BTFD

Is the worst behind us?

According to strategists from Goldman Sachs, Citi, JPMorgan, and BofA (selectively), it is time to buy-the-f**king-dip.

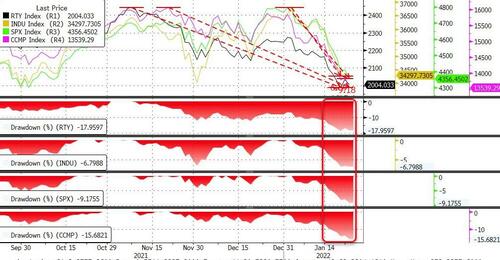

The market is experiencing a correction within an ongoing bull market cycle according to Goldman’s Peter Oppenheimer

“Any further significant weakness at the index level should be seen as a buying opportunity, in our view,”

“The key thing for equities from here is how much any of this shift upward in interest rate expectations and indeed in financial conditions will hit growth,” Goldman’s Oppenheimer said in an interview with Bloomberg Television.

“That’s going to be key to determine where equity markets stabilize.”

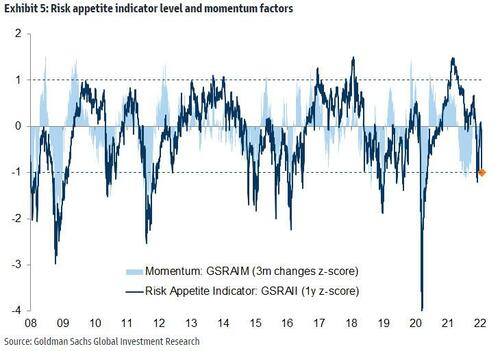

Specifically, Goldman notes that their Risk Appetite Indicator (GSRAII) has fallen back, suggesting we are getting closer to levels that have typically been a good entry point for longer-term investors.

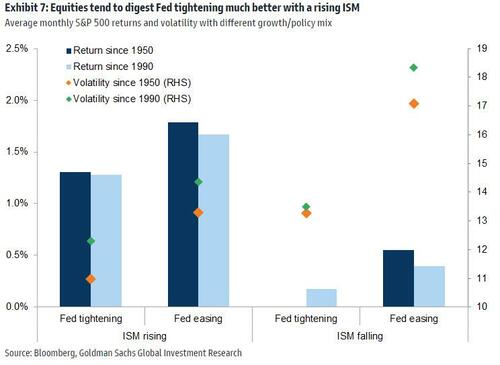

Goldman warns that the biggest risk is that high valuations will continue to unwind should real rates rise much further, but they note the crucial determinant is what is happening to growth. Historically, a Fed tightening cycle that is accompanied by accelerating growth tends to be associated with strong returns and relatively low volatility.

However, Goldman argues, this does make it more likely we are in a cycle in which aggregate returns are much lower than in past ‘secular’ bull markets in history (in particular, 1945-1968, 1982-2000 and 2009-2020).

They conclude by noting that while interest rates in the US are set to rise, they are likely to rise to relatively low levels.

While our economists forecast that terminal rates will peak at around 2.75% in the US (still around 100bp higher than market pricing), this would still be very low relative to history and unlikely to generate a recession.

In the absence of recessionary risks, equities are likely to make progress this year.

Any further significant weakness at the index level should be seen as a buying opportunity, in our view, albeit with moderate upside through the year as a whole.

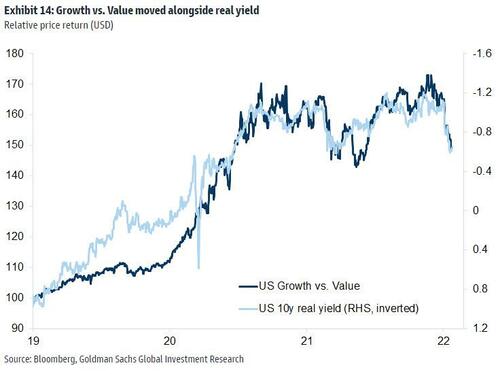

As for the rotation, Goldman says Value has further to run as tightening monetary policy and rising inflation should support a continued re-rating of pro-cyclical Value sectors.

So, in summary, ignore the historical precedent that higher rates will hurt growth – and assuming we don’t get pushed into recession by a Fed desperately trying to fight its nemesis, Stagflation – you should just buy the dip here.

Of course, Oppenheimer is merely the friendly client-focused face of Goldman’s machine, echoing Goldman’s-own flow trader’s views of the world as we outlined over the weekend.

Goldman are not alone in calling the bottom as Citi strategists including Robert Buckland, told clients that the “rapid de-rating of growth stocks may slow as real yields stabilize,” adding that their bear market checklist – which screens for various fundamental and market factors – is suggesting to buy the dip.

JPMorgan‘s Chief Equity Macro Strategist, Dubravko Lakos-Bujas, also sees this week as a strong buy-the-dip opportunity.

“We see this market sell-off as overdone, at least in the short-term, and see abullish setup (especially for small caps) going into today’s FOMC and month-end rebalance.”

Strategists at BofA wrote on Tuesday that investors should “buy some dips” in the U.S., recommending stocks with strong fundamentals and less vulnerability to macroeconomic factors.

Meanwhile, those at Wells Fargo were among the first to recommend buying, writing in a note on Tuesday that it’s “time to put new money to work.”

But not everyone’s an enthusiastic buyer here as Bloomberg notes that Barclays strategists led by Emmanuel Cau wrote in a note today that mutual funds and retail investors remain “very overweight” equities, so more de-risking is possible if fundamentals worsen.

Tyler Durden

Wed, 01/26/2022 – 12:10

via ZeroHedge News https://ift.tt/3g6aUl7 Tyler Durden