Even One Of The Biggest Bears Expects A Post-Fed Rally

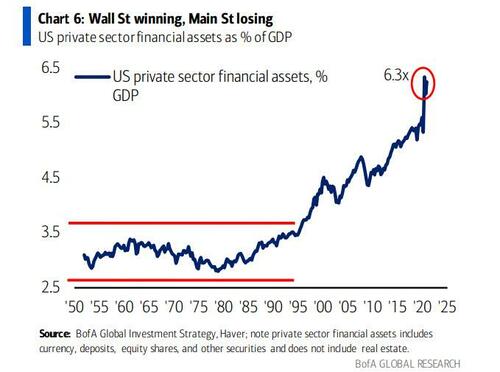

Larry McDonald, author of the Bear Traps report has, for much of the past year been, as his publication’s name implies, one of the bigger market bears-cum-commodity bulls, correctly expecting and predicting the violent reversal in growth and value names we are currently observing. But not even Larry believes that today’s Fed announcement will precipitate a crash: after all, for all the “inflation fighting credibility posturing” the last thing the Fed will ever risk is a full market crash and as recent market events have clearly warned Powell, it will take just one word out of place for the world’s most hyperfinancialized economy to collapse… right after its market.

Below we excerpt from McDonald’s latest Bear Traps Report in which he lays out his short-term and longer-term trading strategy following today’s 2pm main event, with the following punchline: “The slightest backtrack is all that is needed to trigger a large counter trend rally – gold and silver miners will be 15-25% higher on any softening of the language. “

The beast inside the market is NOT happy – it all started the Wednesday before Thanksgiving.

The Fed has been using their Street pawns – namely Goldman Sachs – to rachet up rate hike and quantitative tightening (QT) expectations.

All this noise out of the Powell trombone has come with tightening FCIs. As we learned in Q4 2018, when front rates (2s from 20bps to 100bos since September) scream higher – financial conditions behind the scenes tighten FAR faster than clueless academics can measure on the fly. They NEVER have been proper risk managers, have they?

The serpent will keep pushing the central bankers early this coming week – but Powell has enough of a recent economic soft patch in the data to walk-back his insane declarations (4 hikes in 2022 and QT, for six-seven total).

The slightest backtrack is all that is needed to trigger a large counter trend rally – gold and silver miners will be 15-25% higher on any softening of the language. Powell won ́t be doing high-speed “Michael Jackson moonwalk” in the opposite direction, but he will be moving gently that way.

That should be enough of a fire hose to calm things down – for now. Look for a large rally in risk assets by the end of the week.

We look to lighten hedges – long volatility VXX exposure early – into the Fed meeting. The VIX is up 70% year to date, close to a 30 handle on Friday – that is the highest reading to start the year since the 2008-2009 Lehman era.

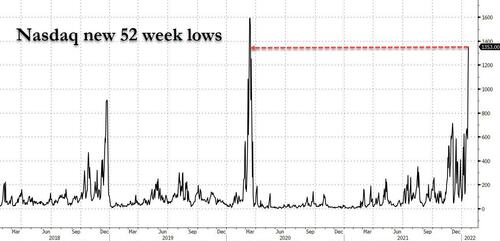

As we stressed in November and December, Nasdaq new lows rarely ever crossed 600 without touching 800 within three months, Monday we kissed 1353

These are classic buys signals – we love the XBI Biotech ETF for a counter-trend rally – looking out 30 days.

“The Fed is up against a classic Keynesian dilemma. The U.S. economy is slowing – yet inflation is still rising. Should tapering QE and raising rates be priority over stimulating growth? We suspect the FOMC shifts into walk-back mode very soon.” CIO, Macro Fund in our Live Bloomberg Chat, we agree.

Above all, we are entering a new bear market, enjoy the rallies – but they must be faded. Exit growth stocks on the bounce, we continue to favor hard assets over financial assets in 2022.

Tyler Durden

Wed, 01/26/2022 – 13:25

via ZeroHedge News https://ift.tt/3onehJl Tyler Durden