Fed Warns “Soon To Be Appropriate” To Raise Rates, QE Ends In March

Since the last FOMC meeting, on December 15th, Gold is the lone asset-class that is higher while bonds and stocks have been monkey-hammered and the dollar is weaker…

Source: Bloomberg

All US equity markets are lower since the last Fed meeting with Tech/hyper-growth hammered and all the bubble-markets blowing up.

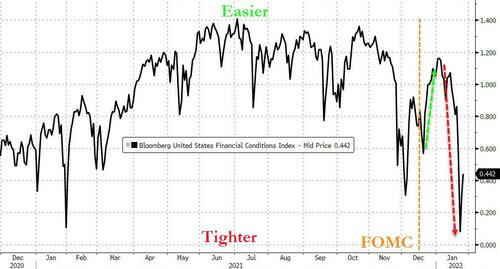

Financial Conditions have tightened significantly since the last Fed meeting (after easing dramatically into the Santa Claus rally)…

Source: Bloomberg

Rate-hike expectations have soared since the last Fed meeting too with March now fully priced-in and more than 4 hikes priced in by year-end. The last few days of market weakness prompted a dovish drop in rate-hike odds, but the last two days have seen it shift hawkishly once again…

Source: Bloomberg

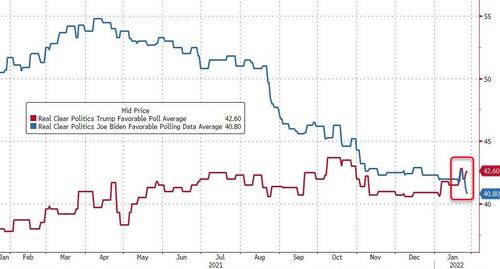

And before we get to The Fed’s decision, there is also this chart to consider… President Biden’s approval rating has crashed below that of Trump’s…

Source: Bloomberg

We suspect the politicians will learn that lack of jobs is way worse for being reelected than inflation… and indirectly pressure The Fed (if they haven’t already) to walk-back the QT and rate-hike trajectory plans… at least until after November maybe.

So what did The Fed say/do…

The market is pricing-in liftoff in March (followed immediately by QT) and four rate-hikes by year-end (just like The Fed’s “Dots”) – did Powell and his pals jawbone any of that hawkishly or dovishly today?

In a word: NO.

-

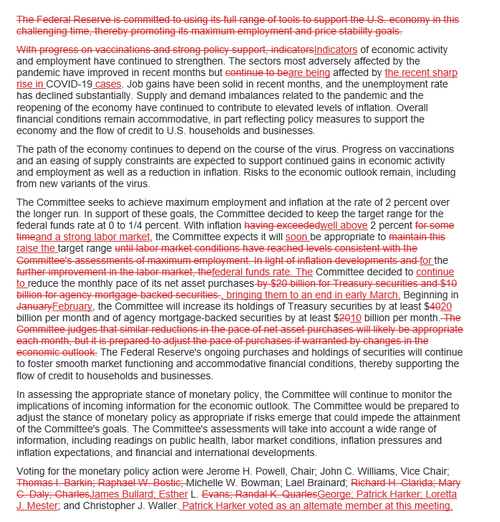

The Fed says it “will soon be appropriate” to raise funds rate.

-

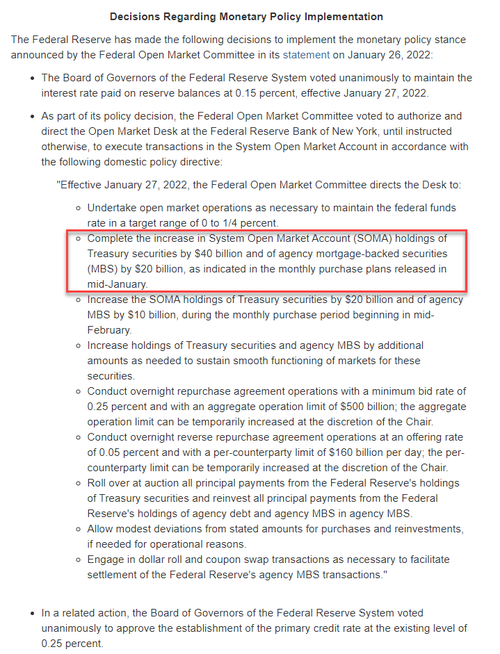

The Fed says asset-purchases will end in March…

-

And The Fed says that balance-sheet-shrinking (QT) will start after rate-hikes commence.

Arguably the Fed was ‘dovish’ because it did not bring forward the end of QE or explicitly name a time for QT.

* * *

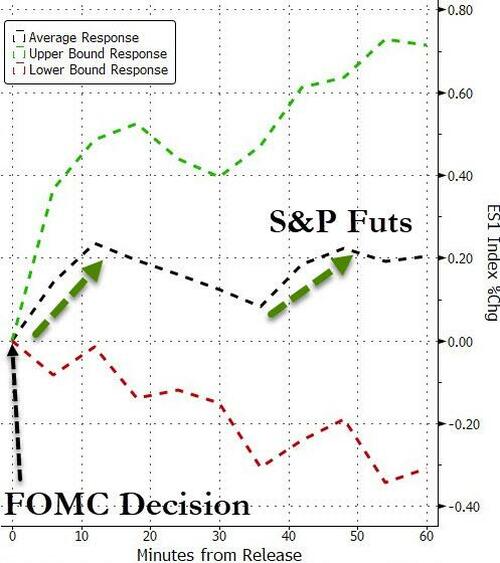

Of course, we know what the stock market will do… at least to start with anyway…

* * *

Read the full redline below:

Tyler Durden

Wed, 01/26/2022 – 14:05

via ZeroHedge News https://ift.tt/3AC8eFj Tyler Durden