Ford Stops Orders For $20,000 Pickup Until Summer 2023 Due To Overwhelming Demand

When demand is so overwhelming that you have to stop taking pre-orders, that’s usually a good sign – even when you’re battling a supply chain crisis.

This was the case with Ford’s new Maverick pickup truck which, priced at $20,000, has attracted so much demand that the automaker has been forced to stop taking orders until 2023.

With auto prices skyrocketing over the last 18 months, the Wall Street Journal reports that the demand is a surefire sign that customers are “hungry for more-affordable options” in the auto market.

On Monday of this week, dealers were told that Ford is “suspending customer orders” because it is “already straining to fill a backlog”. The company will resume taking orders this summer.

Dean Stoneley, general manager of Ford trucks told the WSJ: “We didn’t want to take more orders than we could build. We’re getting customers who would have perhaps bought a used car and are now buying the Maverick because it is so affordable.”

Chris Lemley, president of Sentry Auto Group in Boston called the move “unusual”, but also said that it’s “appropriate under the circumstances to avoid customer disappointment.”

“We desperately needed something in that price range,” he said of the Maverick’s $20,000 tag.

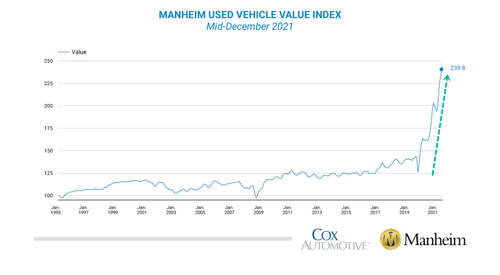

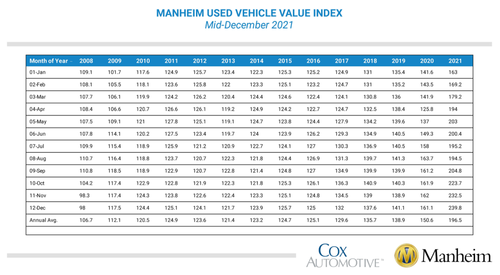

Recall, in late December we noted that used car prices had smashed through yet another record high. The Manheim Index, the most recognized wholesale used-vehicle price index by financial and economic analysts, reported that the wholesale used car index rose 3.1% in the first 15 days of December compared to November. The overall index has jumped a mindboggling 48.9% from December 2020.

“On a year-over-year basis, all major market segments saw seasonally adjusted price gains through the first 15 days of December. Pickups had the smallest year-over-year gains, vans had the largest at 63.3%, and both non-luxury car segments outpaced the overall industry in seasonally adjusted price growth. Compared to November, SUVs and vans had the smallest growth in the first half of December, while compact cars had the largest gain,” the report said.

Heading into the new year, Goldman Sachs chief economist Jan Hatzius provided clients with an outlook on the automobile market. He expects “further increases in new and used car prices during the first quarter of 2022, but outlines “new car prices peak in Q2 (vs. Q1 previously) and used car prices peak in Q1 (vs. December 2021 previously).”

Hopefully, for those looking to get their hands on a Ford Maverick this summer, price rises offer a slight respite.

Tyler Durden

Wed, 01/26/2022 – 07:00

via ZeroHedge News https://ift.tt/32z74Oz Tyler Durden