The Fed Is About To Drain Trillions In Cash: Here’s How It Will Do It

While traders are mostly focused on what the Fed will say about the coming rate liftoff, with markets today expecting just over 4 rate hikes by the end of 2022…

… a much more relevant question is what the Fed’s balance sheet runoff – i.e., Quantitative Tightening (QT) – will look like both strategically and tactically.

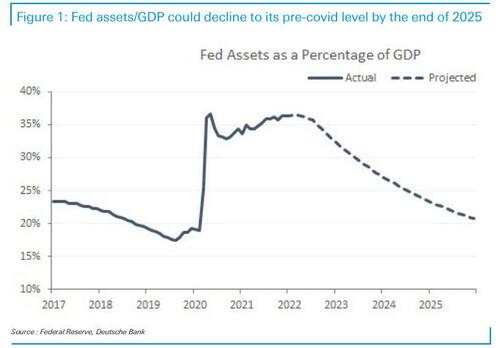

As a reminder, two weeks ago Deutsche Bank predicted some $3 trillion in balance sheet normalization as the Fed undoes the emergency actions from the covid crisis which doubled the Fed’s asset holdings from 20% to almost 40% of GDP.

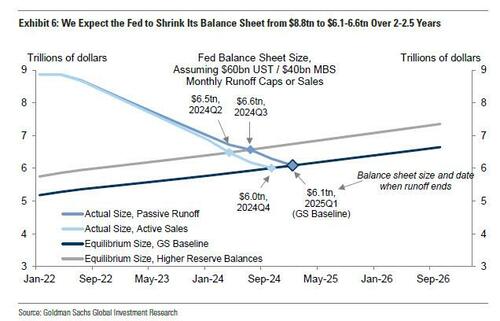

Meanwhile, in its forecast of QT, Goldman forecast peak balance sheet runoff caps of $60bn per month for Treasury securities and $40bn per month for mortgage-backed securities, or $100bn total, with at most a brief ramp-up period. This pace of runoff would shrink the balance sheet from $8.8tn today to $6.1-6.6tn over 2-2.5 years, or a whopping $2.5 trillion in 2 years (by which point the US will be in a deep recession so the entire forecast falls apart but whatever).

And while most other Wall Street banks vary in their forecasts modestly, they all agree on one thing: trillions in liquidity is about to be drained from the market.

But how? And which parts of the financial system will the Fed suck the most liquidity from?

That, as Bloomberg writes today, matters because it could determine how disruptive the so-called quantitative tightening process is to financial markets as well as how long it might go on for. If and when the Fed starts to shrink its balance sheet, whether by simply not replacing maturing securities or outright asset sales, there will be an increase in the amount of Treasuries in search of a home. Most of these are likely to be hoovered up by banks or money-market funds, which in turn will need to reduce the amount of cash they have parked in different ways at the Fed in order to purchase them.

If the buyers are mainly the banks, that will result in a significant drawdown in the amount of reserves that lenders hold with the U.S. monetary authority (as a reminder, it was the “plunge” in bank reserves in 2019 that sparked the repo crisis and launched “NOT QE” days later). Conversely, if it’s money funds, then there will likely be a drop in how much is stashed away with the Fed’s overnight repo facility. Most likely it will likely be a combination of the two, but whether one or the other takes the brunt will be important and is currently being debated by analysts.

And, as Bloomberg notes, it’s also a question that Fed officials, who are meeting this week to decide on their next moves, may struggle to answer, as it depends on how various market players react to the central bank’s policy steps. A big shift in bank reserves is the more problematic outcome and could curtail how long QT lasts — and how small the Fed balance sheet ultimately gets. If the biggest impact is on the banks, then there is a risk of repeating some of the reserve issues that took place in late 2019 following the last round of quantitative tightening, according to Priya Misra, global head of rates strategy at TD Securities in New York.

As noted above, back then, a drop in reserves below the system’s comfortable level helped fuel a disruptive spike in rates on repurchase agreements, a keystone of short-term funding markets. The Federal Reserve has since then implemented additional tools to help reduce potential problems in this area, but a decline in reserves could nevertheless create risks and forestall how much the central bank chooses to shrink its balance sheet.

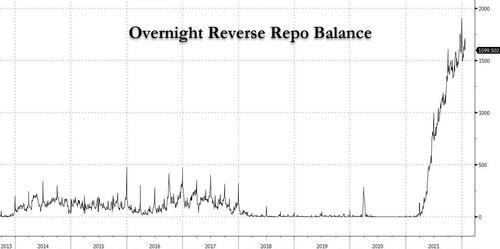

On the other hand, if bank deposits decline faster than expected, there could also be a mismatch in lenders’ securities portfolios, which might spark more widespread de-risking and result in institutions selling securities at a time when the Fed is also stepping away from the markets. That said, a reduction in the Fed;s reverse repo facility, which currently stands near $1.6 trillion and is full of largely inert liquidity, would likely be more benign, and the unwinding process could continue for a while, according to Misra.

Below, courtesy of Bloomberg, are the views of several prominent rates strategists opining on how the Fed’s balance sheet will shrink:

- Bank of America strategist Mark Cabana, a former NY Fed staffer, believes that deposits will lead the drop, citing evidence from what happened after the Treasury Department rebuilt its cash balance in the wake of the most recent federal debt-ceiling imbroglio. While the Treasury amped up bill issuance following the latest Congressional fix, usage of the RRP also increased, climbing to new record highs. Cabana also suggested that when the Fed starts raising rates, banks may be slower to reprice their deposits with so much excess cash, while money-market yields are expected to more rapidly reflect central bank hikes. That said, he believes that a larger Fed QT reserve drain won’t meaningfully drive signs of reserve scarcity until the reduction approaches $2 trillion or $3 trillion, or roughly in line with the forecasts from Goldman and DB.

- Credit Suisse strategist Zoltan Pozsar, also a former NY Fed staffer and repo market stalwart, has also explored the potential ways that QT could play out, and concluded that drawdowns of reserves and the RRP are both equally likely. He also underscored how different this upcoming round of QT might be from the last and said that, unlike last time, the Fed could choose to go beyond simply allowing bonds to roll off to engage in actual outright asset sales (his full note is available to professional subs).

- Citigroup strategist Jason Williams, on the other hand, reckons RRP usage will drop faster, referring to the recent disconnect between the Treasury General Account and reverse repo facility as an “isolated incident.” He also said, however, that if reserves were to fall materially this year and next, there’s an increasing risk that the Fed would have to slow its balance sheet unwind.

- BNP Paribas strategists led by Shahid Ladha wrote in a note Tuesday that the RRP facility offers a large buffer against liquidity tightening, and we agree. They do not expect reserves scarcity in 2022 or 2023 and that QT should end before scarcity hits. The strategists also noted that the standing repo facility can be modified and other liquidity easing tools enacted as needed.

Of the above, we agree with the last: with $1.6 trillion in inert liquidity currently parked at the RRP, the Fed can withdraw almost $2 trillion from the facility without anyone in the market noticing.

Tyler Durden

Wed, 01/26/2022 – 12:48

via ZeroHedge News https://ift.tt/34fP3p2 Tyler Durden