Can You Sidestep The U.S. Stock Collapse By Abandoning The Dollar And Looking Overseas

Submitted by QTR’s Fringe Finance

I’ve been guiding my personal investing over the last few months by whether or not I think the U.S. is entering a longer term market wreck or another 3 month bump in the road like we saw in early 2020.

After all, if we are at a spot where we can shake it off and “buy the dip” were to work again, why wouldn’t you be keen to adopt the strategy of “if you can’t beat the lobotomized automaton active manager buying the dip, join ‘em.”

But my readers already know that I don’t feel this way. In fact, I believe the Fed to be in a true catch 22 – stuck between not being able to raise rates, which would very likely crash markets further, and the inability to maintain accommodative monetary policy, which could fan the flames of inflation (or at least appear to fan the flames of inflation from a psychological and political spin perspective).

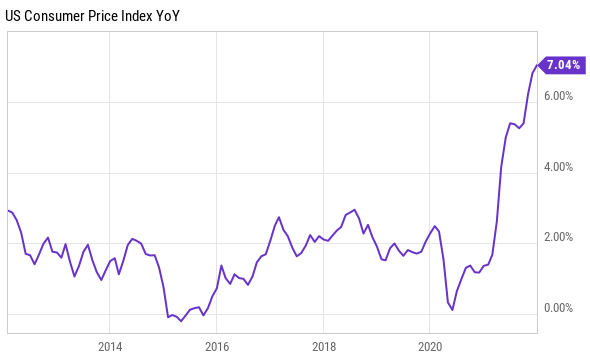

You see, the inflation is the key here. In years past, the Fed never had to face the consequences of its QE. In fact, it was able to parade around suggesting QE was this perfect mechanism for getting the markets to do whatever the Central Banks wanted specifically because it didn’t cause any inflation.

Well now, the inflation has showed up and the Fed’s gravy train is officially over.

As a result, while U.S. markets continue to be brutally volatile, swinging from getting absolutely spanked to ripping 5% higher for no reason, I have dabbled in a couple U.S. names – namely value stocks and a couple of tech stocks that I think have gotten far too cheap.

But I’m also starting to look outside the U.S. – and why wouldn’t you? Overseas and emerging markets are worlds cheaper than U.S. markets and, if you think the dollar’s dominance is at risk, foreign currencies (and the businesses who transact in foreign currencies) are where you want to be. How am I doing this?

I’ve recently been starting to accumulate exposure to the the iShares MSCI Hong Kong ETF (EWH) and the iShares MSCI Japan ETF (EWJ). I had already owned the iShares MSCI Emerging Markets ETF (EEM) and will likely continue to add.

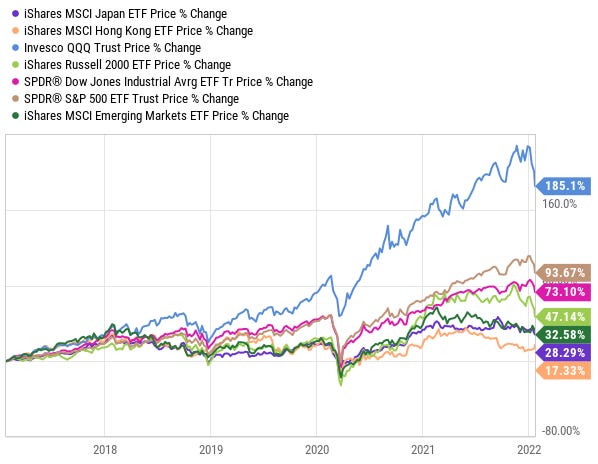

All three have underperformed U.S. index ETFs wildly over the last 5 years. While the NASDAQ ETF is up 185.1%, the S&P ETF is up 93.7% and the Dow Jones ETF is up 73.1%, emerging markets have only risen 32.6%, while the Hong Kong and Japan ETFs have only risen 17.3% and 28.3%, respectively.

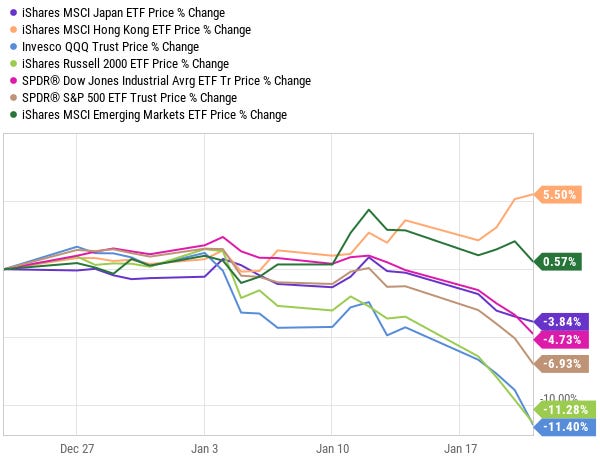

But…all three have also sidestepped the carnage in the U.S. to a degree over the last month, as one-time growth investors start to look for exactly the type of value and dollar safe haven these ETFs provide.

While the same U.S. ETFs crashed as much as 11% over the last month, geographical ETFs like the EWH were up 5.5%. The EEM returned 0.57% in the last month, outperforming the NASDAQ ETF by almost 12%.

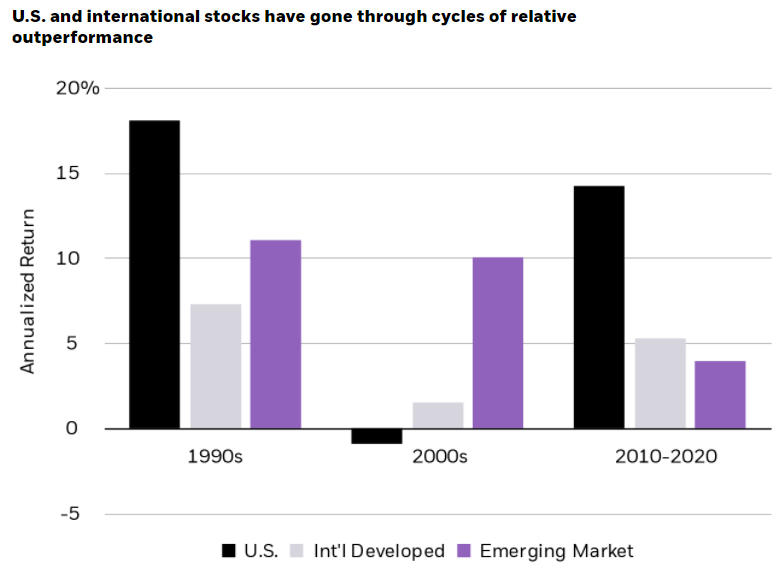

Emerging markets have already underperformed relative to U.S. stocks and other developed countries over the last decade. As market volatility makes it an easy decision to sidestep the U.S., I’m expecting reversion to the mean, which has happened in the past (i.e. emerging markets move higher, U.S. stocks move lower).

The iShares MSCI Emerging Markets ETF (EEM) gets me immediate exposure to a basket of emerging market names, including Taiwan, South Korea, India, Brazil, China, Saudi Arabia and South Africa.

This is a decent enough basket of geographies, while excluding heavy weightings to inordinately risky ones (like Argentina, in my opinion), to gain exposure to the next rotation, hopefully.

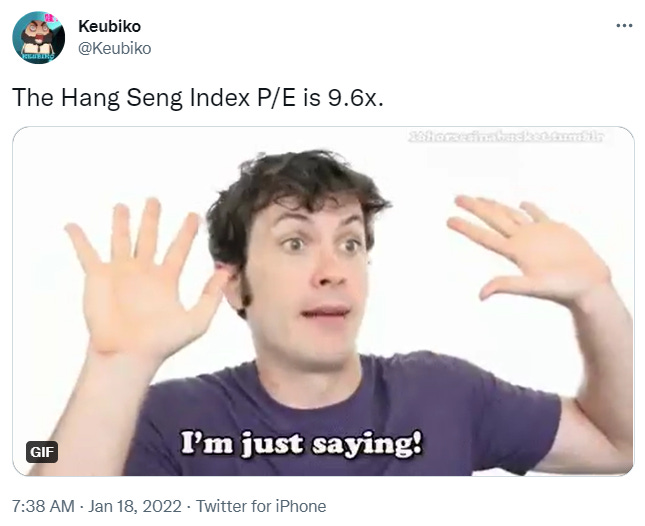

Markets like Hong Kong’s Hang Seng are just outright cheap when compared to U.S. markets, as my friend @Keubiko pointed out the other day on his Twitter.

Here’s a chart of the Hang Seng Index’s ttm P/E dating back to 2015. Since then, it has expanded to as high as 16x earnings and has fallen to as low as 8.97x earnings.

At today’s 9.6x P/E, it is nearly the cheapest it has been over the last 6 years. And it doesn’t have to get to extremely expensive like U.S. exchanges. If you buy the exchange at a 10x multiple and sell it at a 15x multiple, that’s a 50% ride up.

To quote @Keubiko:

“Buy them really cheap, sell them when just cheap.”

The main risk to owning stocks in Hong Kong is that they could very easily get caught in the middle of any escalating U.S./China tensions. Additional risks, pointed out by Global Edge, include:

-

Lack of innovation and diversification of the economy

-

Exposure to slowdown in mainland China

-

Mismatch between business cycles in the United States and China, as the HKD is pegged to the USD

-

Real estate sector risks and housing affordability

-

Rising income inequality and social discontent

-

Industry has fully relocated to mainland China

You can view the full EWH fact sheet, which includes the fund’s components and historical performance here.

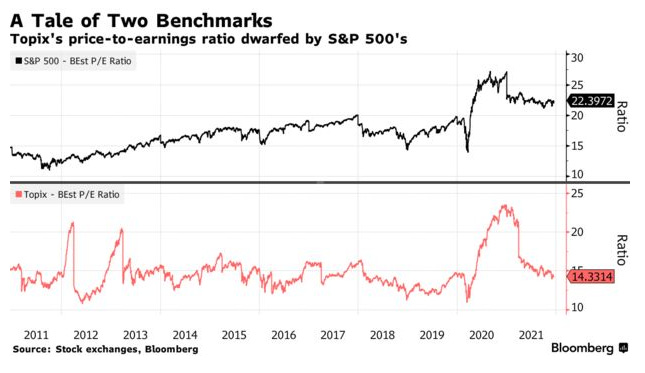

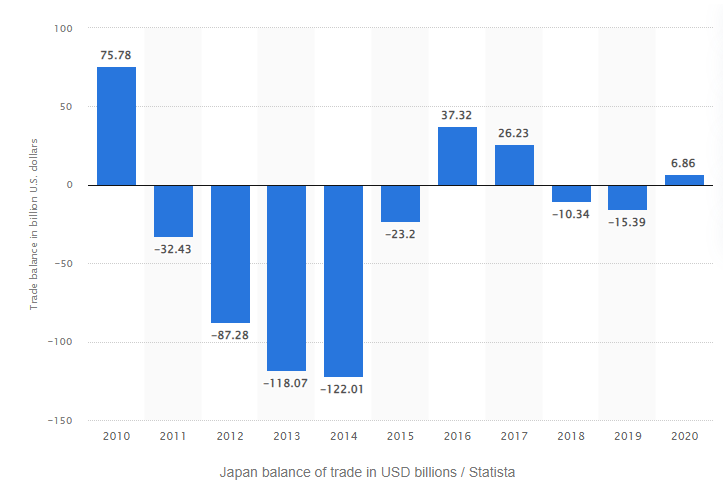

Japanese stocks are also cheap when compared to the U.S., and Japan is a developed country with far healthier trade balance than the U.S.

The Japanese Topix trades at about 14x earnings while the S&P 500 currently sits well over 20x.

Bloomberg notes that Goldman Sachs and Morgan Stanley were out last December advocating for a move into Japanese stocks. Both banks are expecting about 12% gains for the Topix index from December 2021 to December 2022. If U.S. markets continue to sputter, that should be a major outperformance.

For comparison, the NASDAQ has started 2022 off down -11.4% and the Dow has started 2022 off down -5.62%. The EWJ is lower, but only by -3.63% so far this year.

“Japanese equities are primed to close the gap to global peers in 2022,” Bloomberg wrote last month.

Goldman strategist Kazunori Tatebe added: “Cheap valuations and foreigners’ low exposure will all work to the benefit of Japanese stocks.”

Additionally, exports should get a boost as the yen weakens slightly against the U.S. dollar in the short term, as FX markets continue to price a taper and rate hikes in to U.S. monetary policy. This is all, of course, pending short term swings that will occur due to FOMC disclosures set for Wednesday of this week.

Finally, the Nikkei is on the verge of what could be a massive breakout, once it reaches all time highs that it hasn’t come near since the late 1980s! (Yes, as in more than 40 years ago).

The EWJ gives you access to well known worldwide Japanese names like Toyota, Sony and Nintendo.

Jeremy Grantham also added to the chorus of investors recommending Japan last week, Yahoo! Finance reported:

Under these conditions, the traditional 60/40 portfolio of stocks offset by bonds offers so little protection it’s “absolutely useless,” Grantham said. He advises selling U.S. equities in favor of stocks trading at cheaper valuations in Japan and emerging markets, owning resources for inflation protection, holding some gold and silver, and raising cash to deploy when prices are once again attractive.

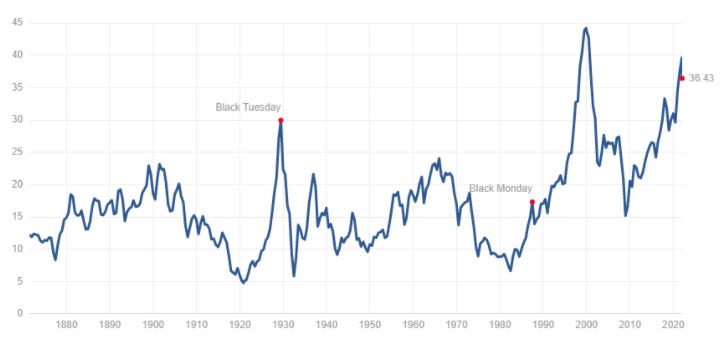

The fact is that even though valuations have come down in the US slightly due to the ugly nature of the last 2 months, the current Shiller PE (as of morning, 1/25/2022), still stands at an astronomical 36.43x.

If we really are headed for a tough year and a broad re-valuation of stocks, things look as though they can sure get a lot worse.

A lot is going to depend on whether or not the Fed pivots or postures heading into the end of January. If the market catches wind that Powell could lay off the gas, stocks will rip. If the Fed holds its hawkish stance, it’s look out below.

But either way – even if U.S. stocks rally, they should take global markets with them and these ETFs may also appreciate in such a case. On the downside, they may couch the blow a little if U.S. stocks continue to plunge.

—

Now read:

-

When The Global Monetary Reset Happens, Don’t You Dare Forget Why

-

The Fed Is Fucked And So Are The Lobotomized “Genius” Fund Managers It Has Created

-

Inflation Is The Kryptonite That Will End The Fed’s Ponzi Scheme

If you don’t already subscribe to Fringe Finance and would like access, I’d be happy to offer you 20% off. This coupon expires in 48 hours: Get 20% off forever

—

Disclaimer: I own and have owned and will continue to own EWJ, EWH and EEM. This is not a recommendation to buy or sell any securities, it is merely a look into my own personal portfolio. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. Consult your financial adviser before making any investing decisions, always. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Thu, 01/27/2022 – 06:30

via ZeroHedge News https://ift.tt/3ILQPNB Tyler Durden