US GDP Soared In Q4 To 6.9% Despite Omicron, Driven By Huge Inventory Accumulation

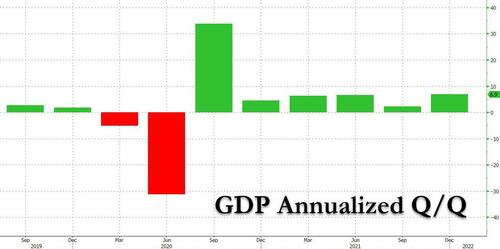

With attention increasingly turning to how fast the economic slowdown will hit the US economy in 2022, growth cheerleaders will have a favorable, if brief, diversion today courtesy of the Bureau of Economic Analysis which moments ago revealed that in Q4, US GDP grew at a remarkable 6.9% annualized Q/Q clip, nearly three times faster than the 2.3% growth recorded in Q3 and well above the 5.5% expectation, even if the components of GDP are an ominous confirmation that the US is engaging in aggressive restocking which could soon lead to a deflationary liquidation wave.

According to the BEA, the acceleration in the fourth quarter was led by an upturn in exports as well as accelerations in inventory investment and consumer spending. In the fourth quarter, COVID-19 cases resulted in continued restrictions and disruptions in the operations of establishments in some parts of the country. Government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased as provisions of several federal programs expired or tapered off.

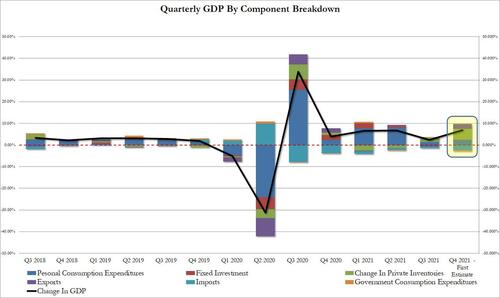

As shown in the chart below, the fourth quarter increase in real GDP primarily reflected increases in inventory investment, exports, consumer spending, and business investment that were partly offset by decreases inboth federal and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

A detailed breakdown reveals the following:

- Personal consumption rose 2.25% in Q4, up from 1.35% in Q3. The increase in consumer spending primarily reflected an increase in services (led by health care, recreation, and transportation). Consumer spending for goods also increased (led by recreational goods and vehicles).

- Change in private inventories added a whopping 4.90% to GDP, up from 2.2% in Q3, a huge increase which accounted for over 70% of the bottom line 6.9% GDP print. The increase in inventory investment primarily reflected increases in retail (led by motor vehicle and parts dealers) and wholesale (led by durable goods industries).

- Fixed Investment contributed 0.25% to the bottom line, also an improvement from the -0.16% detraction in Q3. The increase in business investment primarily reflected an increase in intellectual property products (led by software as well as research and development) that was partly offset by a decrease in structures (led by commercial and health care).

- Net Exports were a wash, with exports adding 2.43% to GDP while imports subtracting -2.43%, perfectly offsetting each other for a net contribution of 0%. The increase in exports reflected increases in both goods (led by nondurable goods) and services (led by travel).

- Government spending declined, leading to a -0.51% subtraction from the bottom line GDP. The decrease in federal government spending primarily reflected a decrease in defense spending on intermediate goods and services (led by services). The decrease in state and local government spending reflected decreasesin consumption expenditures (led by compensation of state and local government employees, notably education) and in gross investment (led by new educational structures).

In other words, the inventory restocking process is now running red hot – even if many won’t notice it on the shelves of their favorite retailer – and in future quarters will likely lead to further declines in GDP, which is a problem for a Fed preparing to hike “5 or 6” times in 2022.

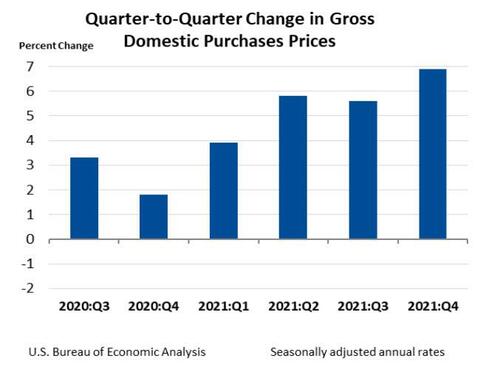

Elsewhere, the GDP price index rose 6.9% in 4Q after rising 6.0% prior quarter, and higher than the 6.0% expected, while the Fed’s favorite inflation metric, Core PCE q/q rose 4.9% in 4Q in line with expectations, after rising 4.6% in the prior quarter, as inflation keeps rising. Energy prices increased 40.7 percent in the fourth quarter while food prices increased 9.2 percent. Excluding food and energy, prices increased 5.9 percent in the fourth quarter after increasing 5.1 percent in the third quarter.

Finally, on a full year basis, real GDP increased 5.7% (from the 2020 annual level to the 2021 annual level), in contrast to a decrease of 3.4% in 2020. The increase reflected increases in all major subcomponents: consumer spending, business investment, exports, housing investment, and inventory investment. Imports increased.

Bottom line: this was a strong number, but peeking between the lines reveals that it was a very low quality print, one driven almost entirely by a surge in inventories. If and when this restocking reverses, not only will it subtract from GDP but will have a sharply deflationary effect as liquidations kick in.

And while the US economy closed on a high note, it’s all downhill from here, with sellside expectations for Q1 2022 looking much more ominous, somewhere in the 2% range, a number which we expect will continue sliding over the next 2 months potentially turning negative some time around the March FOMC.

Tyler Durden

Thu, 01/27/2022 – 08:53

via ZeroHedge News https://ift.tt/34aTKAg Tyler Durden