Here Comes The Fund Rebalancing: $65 Billion In Month-End Buying

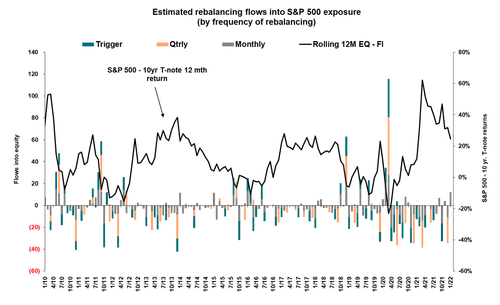

It’s not just buybacks that emerge seemingly out of nowhere (technically, the tend to emerge out of select VWAP desks) to help lift stocks higher: month end is notorious for pension and mutual fund rebalancing flows, and in a month when stocks tumbled far more than bonds, funds are now catching up as they are mandated to buy a certain amount of stocks to balance their portfolios.

So how much in buying is there? Well, according to JPMorgan’s Nick Panigirtzoglou, “In the very near term, one flow that could support the equity market is potential month-end rebalancing by balanced mutual funds for which we estimate $65bn of equity buying by the end of this month.”

Goldman’s own estimate is for a net $12 billion of US equities to buy from US pensions given the moves in equities and bonds over the month. While this ranks in the 31st percentile amongst all buy and sell estimates in absolute dollar value over the past three years, Goldman notes that it is the biggest month-end estimate since the March 2020 collapse.

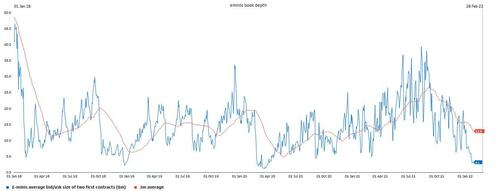

Here, JPM’s resident permabull Marko Kolanovic also chimes in, nothing that he has been getting questions about month end buying – which he believes translated into 5% upside pressure on broad indices. The reason cited by Marko is “very low liquidity (1/5th of average liquidity)” something we have been noting every single day this week, pointing out that liquidity now is as bad as it was in March 2020 when the Fed had to inject trillions to kickstart the market.

As Kolanovic continues, “stocks are underperforming bonds by ~8% (some indices more), and usually beta is about 20-25%, so say 2% in normal market conditions, but there is a significant liquidity multiplier to amplify the move. Also, historically – month end flow start ~3 days before month end, and trend was that on 31st flows were completed.” That leaves Thursday and Friday (and judging by yesterday’s action, there wasn’t a lot of forced buying).

So focusing on the market’s scant liquidity, which Kolanovic compares to December 2018, he notes that “in those situations, these flows can almost entirely reverse the month to date bond-equity performance. Also note short gamma that would be amplifying any equity buying. Also CTA levels are in the range so that is another amplifier.”

And speaking of gamma, GS estimates that dealers are the shortest gamma they have been since Jul’20. Interestingly, the bank sees this short gamma positioning spread across several expiries and strikes to the downside as opposed to concentrated on one or a few particular option lines, as is often the case. “This gamma dynamic coupled with the current liquidity environment sets up for exacerbated moves at the index level.”

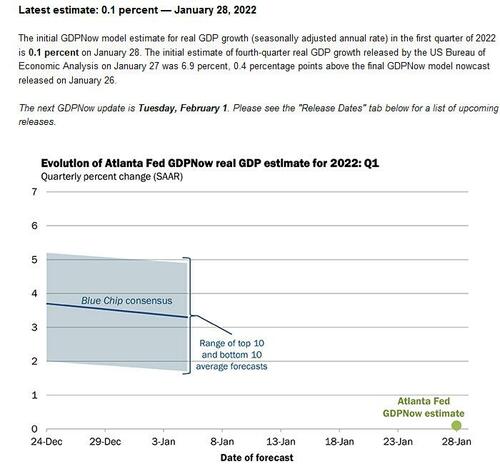

Translation: even a modest upward spark could send the market exploding higher, and that particular spark was just provided by the Atlanta Fed, which just came out with a 0.1% estimate for Q1 GDP.

Translation: the rate hike panic is over and with now that bad news are good again, risk is about to go vertical…

Tyler Durden

Fri, 01/28/2022 – 12:05

via ZeroHedge News https://ift.tt/3u7g34N Tyler Durden