Recession On Deck? BofA Slashes GDP Forecast, Sees “Significant Risk Of Negative Growth Quarter”

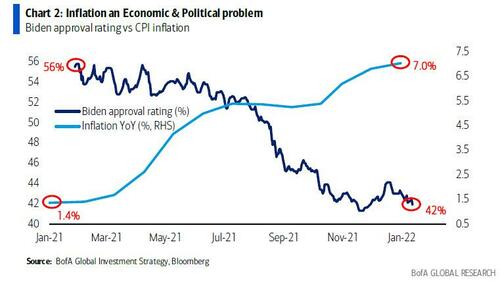

With a panicking Biden likely to continue freaking out over soaring inflation, and calling Powell every day ordering the Fed chair to do something about those approval rate-crushing surging prices…

… which in turn has cornered Powell to keep jawboning markets lower, with threats of even more rate hikes and even more price drops until inflation somehow cracks (how that happens when it is the supply-driven inflation that remains sticky, and which the Fed has no control over, nobody knows yet) we recently joked that the market crash will continue until Biden’s approval rating raises.

Stocks will keep crashing until Biden’s approval rating rises

— zerohedge (@zerohedge) January 26, 2022

Sarcasm aside, we are dead serious that at this point only the risk – or reality – of a recession can offset the fear of even higher prices. After all, no matter how many death threats Powell gets from the White House, he will not hike into a recession just because Biden’s approval rating has hit rock bottom. It’s also why we said, far less joingkly, that “every market bull is praying for a recession: Biden can’t crash markets fast enough”

every market bull is praying for a recession: Biden can’t crash markets fast enough

— zerohedge (@zerohedge) January 27, 2022

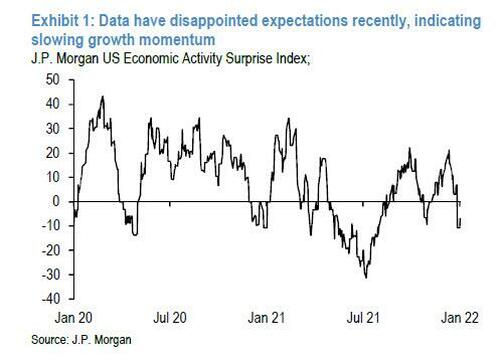

Which brings us to the current Wall Street landscape where some banks, most notably the likes of Goldman, continue to predict even more rate hikes while ignoring the risk of a slowdown, it’s entire bullish economic outlook for 2022 predicated on households spending “excess savings” which they have spent a long time ago (expect a huge downgrade to GDP in 2022 from Goldman in the next few weeks as the bank realizes this), while on the other hand we have banks like JPMorgan, which recently pivoted to the new narrative, and as we reported last weekend, now sees a sharp slowdown in the US economy following a series of disappointing data recently…

… and as a result, JPM now “forecast growth decelerated from a 7.0% q/q saar in 4Q21 to a trend like 1.5% in 1Q22.“

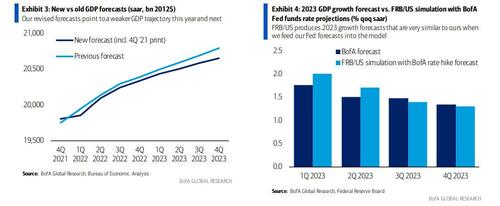

And while not yet a recession, today Bank of America stunned market when it chief economist joined JPM in slashing his GDP for 2022, and especially for Q1 where his forecast has collapsed from 4.0% previously to just 1.0%, a number which we are confident will drop to zero and soon negative if the slide in stocks accelerates due to the impact financial conditions and the (lack of) wealth effect have on the broader economy.

Harris lists 4 reasons for his gloomy revision, which are all in line with what we have been warning for quite some time now, to wit:

1. Omicron: The Omicron wave has exacerbated labor-supply constraints and slowed services consumption. All else equal, we estimate that services spending could slice 0.6pp off January real consumer spending, although a pickup in stay-at-home durable goods demand could offset some of the shock. This is consistent with the aggregated BAC card data: Anna Zhou has flagged a significant slowdown in spending on leisure services, and a pickup in durables spending. Meanwhile Jeseo Park finds that our BofA US Consumer Confidence Indicator has slipped further from already weak levels. All of this points to a slowdown in economic activity in January. With cases already down around 25% from their mid-January peak, however, we expect the Omicron shock to be short-lived. The data should improve meaningfully starting in February. This creates downside to 1Q GDP growth and upside to 2Q, given favorable base effects.

2. Inventories. Earlier this week we learned that inventories surged in December and contributed 4.9pp to 4Q GDP growth. Inventories remain depressed relative to pre-pandemic levels because of continued supply bottlenecks. And with demand surging, there is room for even more of an increase. However, it is important to remember that GDP depends on the change in inventories (not the level), and GDP growth depends on the change in the change in inventories. Therefore the $173.5bn increase in inventories in 4Q limits the scope for inventories to drive growth again in 1Q. So inventories create more downside for 1Q growth.

3. Less fiscal easing. We now expect a fiscal package about half the size of the Build Back Better Act, with less front-loaded fiscal stimulus. We think it will boost 2022 growth by just 15-20bp, compared to our earlier estimate of 50bp. Our base case is that outlays will start in April: the delay in passage means that the growth impact relative to our earlier forecast will again be largest in 1Q. Given the deadlock between moderate and progressive Democrats, the risk is that nothing gets passed. We think that the retirement of Justice Breyer increases this risk because appointing his replacement will be a policy priority for Democrats, eating into the limited time they have before the midterm elections. If there is no further fiscal stimulus, we would expect modest downside to 2Q-4Q growth.

Putting together the Omicron shock, the expected path of inventories and our base case fiscal outlook, BofA has cut its 1Q growth forecast to 1.0% from 4.0% and ominously adds that “risks of a negative growth quarter are significant, in our view.” To offset the risk of a full-blown technical recession (where we get 2 quarters of negative GDP prints) however, BofA has increased 2Q slightly to 5.0% from 4.0%: this would amount to only partial payback for various 1Q shocks. Growth remains unchanged for 2H 2022, but it would now be coming off a lower base. As a result, BofA’s annual growth forecast for 2022 drops to 3.6% from 4.0%. But what about 2023?

The wildcard of course, is monetary tightening. As a reminder, with Dems guaranteed to lose control of Congress, any further fiscal stimulus becomes a non-factor until at least the Nov 2024 presidential elections, meaning the fate of the US economy is now entirely in the hands of the Fed, especially if Biden’s BBB fails to pass, even in truncated form.

Here the core tension emerges: while the US economy is slowing, BofA still sees inflation remaining quite sticky for a long, long time.

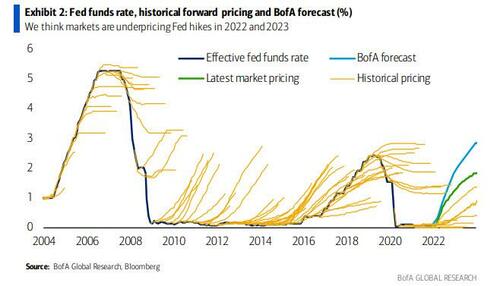

As such, and following the continued hawkish pivot at the January FOMC meeting, BofA now expects the Fed to start tightening at the March 2022 meeting, raising rates by 25bp at every remaining meeting this year for a total of seven hikes, and in every quarter of 2023 for a total of four hikes. This means that BofA’s target for a terminal rate of 2.75-3.00% will be reached in December 2023. Harris explains the logic behind this upward revision to the bank’s tightening forecast:

… the Fed is behind the curve and will be playing catch-up this year and next. We think the economy will have to pay some price for 175bp of rate hikes in 2022, 100bp in 2023, and quantitative tightening. Given the lags with which monetary policy affects the real economy, we think growth will slow to around trend in 1Q 2023, before falling below trend in 2Q-4Q. This compares to our previous forecast of slightly

above-trend growth throughout 2023.

As the chief economist also notes, at of this moment, the markets are now pricing in 30bp of hikes at the March meeting, 118bp for the year and a terminal rate of around 1.75%. In his view, “that is not enough. Markets underpriced Fed hikes at the start of the last two hiking cycles and we think that will be the case again (Exhibit 2). We now expect the Fed to hike rates by 25bp at all seven remaining meetings this year, and also announce QT (i.e., balance sheet shrinkage) in May. When you are behind in a race you don’t take water breaks.”

But how does the Fed hike up a storm at a time when BofA admits the risks are growing for a negative GDP quarter in Q1? Well, as Harris admits, “the new call raises a number of questions.”

- Will the Fed hike by 50bp in March? We think this is unlikely. If the Fed wanted to get going quickly they would have hiked this week and ended QE. Moreover, we see the Fed continuing to gradually concede ground rather than suddenly lurching in a hawkish direction. Hence we think it is more likely that the Fed will quickly shift to 25bp hikes at every meeting.

- Could the markets force them to do more? On the margin more aggressive pricing in the markets could nudge the Fed along. For example, if the markets start to price in a high likelihood of a 50bp move in March, the Fed could see that as a “free option” to start faster. However, the Fed is still in charge of the narrative. The sell-off in the bond market in recent weeks has been driven by more hawkish commentary out of the Fed. Powell is quite adept at dodging questions at his press conferences, but this week he left no ambiguity about the hawkish shift at the Fed, driving the repricing.

- How will the economy and markets handle hikes? Clearly risk assets are vulnerable. One way to view the recent stock market correction is that with the Fed no longer in deep denial, markets have caught on to the idea that inflation is a problem and the Fed is going to do something about it. As the Fed pivot continues—and the bond market prices in more hikes—we could see more volatility. However, the stock market is not the economy. The fundamental backdrop for growth remains solid regardless of whether stocks are flat or down 20%. Even the hikes we are forecasting only bring the real funds rate slightly above zero at the end of next year

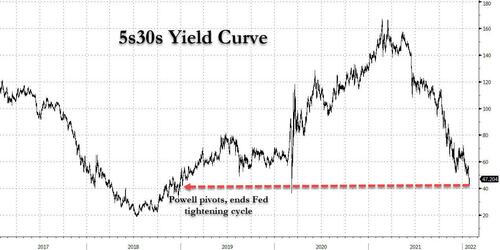

Then there is the question whether we worry about an inverted yield curve (spoiler alert: yes)?

As BofA notes, historically the yield curve slope — for example, the spread between the funds rate and 10-year Treasuries — has been the best standalone financial indicator of recession risk. However, as now everyone seems to admit (this used to be another “conspiracy theory” not that long ago), “the yield curve is heavily distorted by huge central bank balance sheets and US bond yields are being held down by remarkably low yields overseas, “according to Harris. As such, in an attempt to spin the collapse in the yield curve, the chief economist notes that if Fed hikes lead to smaller-than-normal pressure on long-end yields that is good news for the economy, not bad news (actually this is wrong, but we give it 2-3 months before consensus grasps this).

And while Harris caveats that the Fed could hike even more, going so far as throwing a 50bps rate increase in March “if the drop in the unemployment rate remains fast or if inflation cools much less than expected”, we think risks are tilted much more in the opposite direction, namely Harris’ downside scenario, where he writes that “our old forecast could prove correct if we have misjudged the fragility of the economy or if there is a serious shock to confidence from events abroad.” Actually not just abroad, but internally, and if stocks continue to sink, the direct linkage between financial conditions and the broader economy will express themselves quickly and very painfully.

Bottom line: yes, inflation is a big problem for Biden, but a far bigger problem for the president and the Democrats ahead of the midterms is the US enters a recession with a market crash to boot. While this particular scenario remains relatively remote on Wall Street’s radar, we are confident that as Q1 progresses and as data points continue to deteriorate and disappoint, there will finally be a shift in both institutional and Fed thinking, that protecting the economy from an all out recession (if not worse) will be even more important than containing inflation, which as we noted previously is driven by supply-bottlenecks, not demand, which the Fed doesn’t control anyway.

Meanwhile, as David Rosenberg points out today, stocks are already in a bear market…

In the span of four weeks, six negative daily Dow reversals of 1%+. This happened 99% of the time in the past in 1987 (crash); 1990 (recession), 1997-98 (Asian crisis); 2000-03 (tech wreck/recession), 2008-09 (GFC), 2018 (Powell!). All either ~20% corrections or 30%+ bear markets

— David Rosenberg (@EconguyRosie) January 28, 2022

… and absent some assurances from the Fed, we could be looking at another Lehman-style crash in the coming months, especially if BofA’s forecast of seven hikes in 2022 is confirmed.

In short, for all the posturing and rhetoric, we always go back to square one, best summarized in the following tweet:

Patience: the faster we crash, the faster the Fed buys everything

— zerohedge (@zerohedge) January 21, 2022

Tyler Durden

Fri, 01/28/2022 – 11:10

via ZeroHedge News https://ift.tt/3HefD0m Tyler Durden