Atlanta Fed President Pours Gasoline On Fire With 50Bps Hike Comment, But There Are Reasons To Ignore It

Here we go again.

After we saw a veritable rollercoaster in market last week, after Powell’s shockingly hawkish FOMC presser which spooked Wall Street into predicting that 5 (as JPM and Goldman now expect), six or even seven rate hikes (as per the latest Bank of America forecast) are on deck in 2022 alone, tensions have also remained elevated after Powell refused to refute speculation of a 50bps rate hike this year.

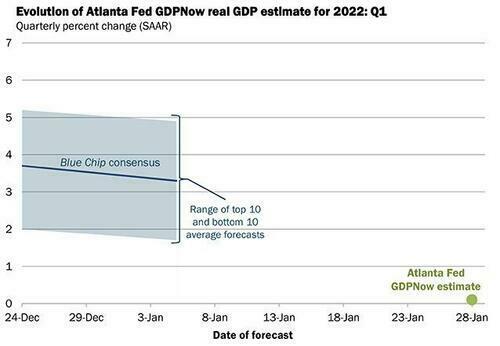

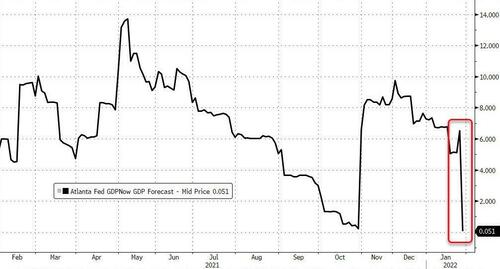

Of course, tensions eased on Friday after the latest set of dismal economic data, which led the Atlanta Fed to come out with a 0.1% Q1 GDP estimate which will turn negative in the coming days after just a few more incrementally negative datapoints…

… suggested that inflation will fade far sooner and the US economy will slide into contraction long before the Fed can hike even a handful of times, let along go the way to 2.50% or 3.00% or whatever strategists believe the neutral rate is these days. This, together with tens of billions in month end mutual fund rebalancing, sent futures soaring on Friday in the latest violent intraday reversal.

But with futures set to open in just a few hours, we may get another sharp drop at 6pm ET when traders punt risk after yet another Fed official – we would say hawk but that’s meaningless now that even the uber-doves have turned hawkish to appease Biden and his imploding approval rating…

Monetary policy 4 parts pic.twitter.com/eibcu5nNKo

— zerohedge (@zerohedge) January 28, 2022

… hinted at a 50bps rate hike in March.

In an interview with the Financial Times, Raphael Bostic, president of the Fed’s Atlanta branch, said the Fed could “supersize a rate increase to half a percentage point if inflation remains stubbornly high.“

Curiously, while not jumping on the latest Wall Street bandwagon calling for 5 or more hikes in 2022, Bostic instead stuck to his call for only three quarter-point interest rate increases in 2022, with the first coming in March, but he said a more aggressive approach was possible if warranted by the economic data.

That, the FT notes, could mean rate rises at each of the seven remaining policy meetings in 2022, or even the possibility of the Fed increasing the federal funds rate by half a percentage point, double its typical amount and a tool it has not used in roughly two decades.

“Every option is on the table for every meeting,” Bostic said on Friday. “If the data say that things have evolved in a way that a 50 basis point move is required or [would] be appropriate, then I’m going to lean into that . . . If moving in successive meetings makes sense, I’ll be comfortable with that.”

“I do think that a view has emerged that we have some meetings that we really just dial it in and that there’s no ability of action at, and that’s just never been my mindset.

Bostic added that he would be watching closely for a deceleration in monthly consumer price gains and further evidence that rising wages are not feeding meaningfully into higher inflation when thinking about his forecast for interest rates. Which means that the next CPI print will be especially important.

And, as we noted on Friday, the Atlanta Fed president said he was encouraged by the latest employment cost index (ECI) report, which was published on Friday and which showed a sequential decline, which prompted Bostic to expect a moderation in wage growth going forward.

That said, Bostic expressed little concern about the recent market gyrations, and said it was a natural response to a Fed that was beginning to withdraw its support.

“The reduction of accommodation should translate into tighter financial markets,” Bostic said. “The developments that we’ve seen on that front are comforting in the sense that markets are still functioning the way they’re supposed to, and they are responding to conditions in ways that are rational and appropriate.”

He said, however, that he was closely monitoring overnight borrowing markets, in particular, for signs of stress akin to the episode in 2018 when financial markets seized up as the Fed tightened monetary policy further despite fears of a growth slowdown.

Bostic, who also supports the Fed reducing its $9tn balance sheet “as quickly as” possible without impairing market functioning, said he was “optimistic” about how the economy was going to perform in the coming months, despite elevated inflation.

Throwing a bone to the market bulls, Bostic rejected claims that the Fed would raise interest rates far too aggressively and in a manner that would prove damaging.

“Our policy path is not a constriction path. It’s a less accommodative path,” he said. “If we do the three [interest rate increases] that I have in mind, that’ll still leave our policy in a very accommodative space. I don’t think there’s going to be a lot of constraint on growth as we remove these emergency actions.”

Of course, while the kneejerk response to Bostic is that this is another telegraphing of a 50bps hike, the reality is that all the Fed president is saying is what Powell said earlier, namely that the Fed will now have to be much more reactive to continued price pressures. And yes, while that could include faster rate hikes, it could also lead to a slowdown or even reversal if we hit a recession in the second half, something which BofA’s CIO Michael Hartnett has been pounding the table on in recent weeks…

Hartnett: “Fed won’t end up tightening many times as just few rates hikes & QT are enough to unwind excesses and threaten H2 recession”

He is usually 3-6 months ahead of the herd

— zerohedge (@zerohedge) January 28, 2022

… although the bigger danger, as Hartnett also revealed, is that the Fed will hike until the market breaks. Of course, if his own Atlanta Fed shows GDP has turned negative, we expect Bostic to be among the first to push back on aggressive tightening as the last thing the Fed will do is hike into a clear and present recession.

Meanwhile, even the sellside is starting to turn, with BofA writing on Friday that based on recent data trends, the “risk of a negative growth quarter” is “significant”, and the bank slashed its Q1 GDP forecast from 4.0% to just 1.0%.

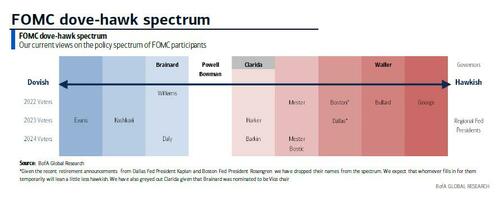

Economic conditions aside, there are at least two more fundamental reasons to ignore what Bostic has to say: first, he has always been among the Fed’s more outspoken hawks.

Secondly, even if Bostic is dead set on hiking into a recession (which he isn’t) he won’t have the opportunity to do so for years: as a reminder, he is a non-voter until 2024, by which point not only will the Republican part control Congress…

… but the US will likely already long be in a recession.

Finally, even if the Fed is using Bostic’s FT interview as a way to telegraph what is coming, there are almost two months until the March FOMC, and a lot can change by then, not least the next CPI print which if it comes (well) below expectations, will be viewed as a key dovish reversal by the market, especially if the current downbeat economic trends fail to reverse, pushing the economy straight into a contraction.

Tyler Durden

Sun, 01/30/2022 – 18:00

via ZeroHedge News https://ift.tt/pjqICvl3G Tyler Durden