“Peak Rationality” Hit In 1980, And Since Then It’s Been All About “Emotion”

By Nicholas Colas of DataTrek Research

We have a two-fer for Story Time this week. The first is a reminder to never buy a new 52-week low, a lesson we first learned watching a highly skilled investor try to bottom-tick Enron. The second is a review of a new academic paper that tracks the use of “rational” versus “emotional” words in English language books and periodicals from 1850 to the present day. “Peak rationality” was in 1980 according to this work, and “emotion” has been making a strong comeback ever since. Markets reflect societal trends, so any wonder “meme stocks” happened?

#1: Never buy a stock or investment theme making new 52-week lows. We often mention this piece of market wisdom, but today I (Nick) will discuss it in a little more detail. It has taken me decades of experience to understand all the nuances of this old trader’s aphorism, so here is my highlight reel on the topic.

The first time I realized the power of this rule was watching a close friend and institutional money manager buy Enron in 2001 as the stock was collapsing. You probably recall how this once high-flier imploded during a wave of accounting scandals that eventually led to its bankruptcy. My friend, a CPA with an MBA, thought he had a handle on the company’s fair value after doing a lot of work on the name. He didn’t. He bought every new 52-week low until his firm’s risk manager forced him to sell what had become a huge loss. He left the business shortly thereafter, never to return.

Now, that’s an extreme example, but it does highlight many of the problems inherent in buying any financial asset that is making new lows:

- Who knows more about a stock – the fresh-faced investor buying the new low or the existing owner who is selling the new low? I think it is more often the seller, especially if it is an institution. They’ve likely met with management and done other due diligence. If they are willing to take the loss at a new low, one must believe that is very likely a well-considered decision.

- Price momentum is one of the few time-proven factors in investing. Yes, it is deeply rewarding to catch major inflection points. But it is easier to follow the herd once a trend has started. We tend to prefer easy to hard when it comes to making money in markets.

- Say you break with this wisdom and do buy a new 52-week low, and then the stock makes a series of fresh new lows. You double – and then triple – down, buying on further declines. No matter how mentally disciplined you are, this position will take up more and more of your mental bandwidth. And that’s time you won’t have to find new ideas or manage the rest of the portfolio.

At the risk of stating the obvious, there are many 52-week lows swimming around global equity markets these days. These include the Russell 2000, the ARK Innovation ETF and other products from the same firm (ARKW, ARKF, ARKG, ARKQ), MSCI China, MSCI South Korea, Japan’s Nikkei 225, clean energy ETFs (ICLN, QCLN, FAN, TAN), and US IPO ETFs (IPO). Obviously, we recommend staying on the sidelines with respect to any of the assets until their prices stabilize for at least a few weeks.

Takeaway: don’t make investing or trading harder than it has to be. That’s not our saying; we heard Steve Cohen tell traders that many times during our time at the old SAC Capital. One way to follow that sage advice is to respect the tape.

* * *

#2: Since we make our living with the written word, we were intrigued by a recently published academic paper titled, “The rise and fall of rationality in language”. Published on the Proceedings of the National Academic of Sciences (PNAS) website, the authors examined the frequency with which words associated with “rationality” appear in written work relative to those associated with “emotion”. There is a link to the full paper at the end of this section.

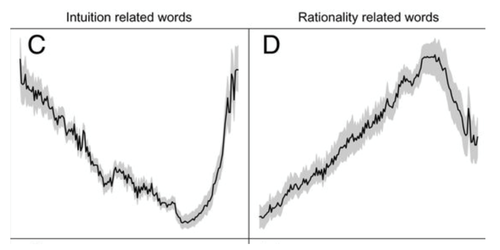

Using data from Google Ngram’s collection of millions of English language books and periodicals and scanning for 5,000 words that express either rationality or emotion, the researchers found that:

- From 1850 to 1980 the use of “rational” words (such as “determine” or “conclusion”) rose. The authors theorize that the rising status of science and technology and their socioeconomic benefits “gradually permeated culture, society, and its institutions ranging from education to politics”.

- After 1980, and especially after 2007, words signifying “emotion” (such as “feel” and “believe”) staged a rapid rise in popularity in written English. The authors put forth several theories, summarized by this statement: “Perhaps a feeling that the world is run in an unfair way started to emerge in the 1970s when the results of neoliberal policies became clear and became amplified with the rise of the Internet and social media.”

These charts from the paper show the frequency of use trend lines for each category from 1850 to the present day:

Takeaway: one need only look at the meme stock craze of the last year to see the powerful role emotions can play in markets over the short term, and this paper puts some useful historical and societal context around that phenomenon. Capital markets do not exist in a vacuum, but rather reflect back an image of the individuals and institutions that set prices within them. The DataTrek approach is to be as fact (“Data”) based as possible. The “Trek” is hard enough already without having to carry any emotional baggage. Don’t make things harder than they have to be…

Sources:

The rise and fall of rationality in language (Scheffer, van de Leemput, Weinans and Bollen, 2022): https://www.pnas.org/content/118/51/e2107848118

Tyler Durden

Sun, 01/30/2022 – 11:30

via ZeroHedge News https://ift.tt/RQ2FUlETA Tyler Durden