Key Events This Week: ECB, BOE, Payrolls, Euro CPI And Earnings Galore

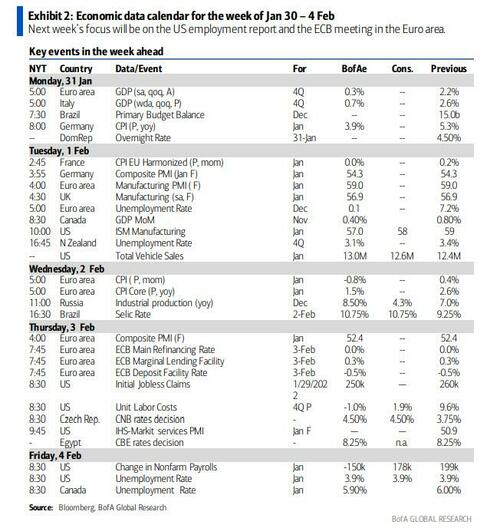

It’s a relatively busy week with several key central bank announcements, notably from the ECB and BOE, as well as European CPI updates and the US payrolls report on Friday.

Starting with the ECB, Deutsche Bank economists now expect a policy rate liftoff in December 2022 of 25bps, a view apparently shared by the market this morning. They’re also anticipating a faster pace of tightening, with 25bp hikes in the deposit rate per quarter from December 2022, until rates reach +0.5% in September 2023. In terms of what it means for this February meeting, they write in their preview that they expect the slow, step-by-step pivot to exit will continue. Their view is that President Lagarde will reiterate the ECB’s capacity to act once the inflation criteria in the rates guidance are met, whilst at the same time differentiating the needs of the Euro Area from the US.

The other central bank decision that day is from the Bank of England, where expectations are for the BoE to follow up their December rate hike with another 25bps increase, taking the Bank Rate to 0.5%. Furthermore, the MPC should confirm that any APF reinvestments will cease from here on out, resulting in around £38bn falling out of the Bank’s balance sheet this year.

The data highlight in a busy week will be payrolls Friday. Economists expect nonfarm payrolls to have grown by a relatively subdued +150k in January, with the unemployment rate remaining at a post-pandemic low of 3.9%. Clearly Omicron will impact this data, so it’ll be tough to get a clear read though but Fed Chair Powell has already said that his personal view is that labor market conditions were consistent with maximum employment, “in the sense of the highest level of employment that is consistent with price stability.” The JOLTS report tomorrow will also be a good indicator of the tightness of the labor market and one we’ve preferred to payrolls as a lead indicator during the pandemic.

Otherwise, Wednesday’s flash CPI reading from the Euro Area for January will be interesting. Our economists expect that year-on-year inflation will subside to +4.3% from its peak of +5.0% in December, which was also the fastest pace since the formation of the single currency.

On the earnings side, we’ll get an array of reports this week as the season continues in full flow, including 111 companies from the S&P 500 and a further 56 in the STOXX 600. Among the highlights: ExxonMobil, PayPal, UPS, Starbucks, General Motors and UBS tomorrow. Then on Wednesday we’ll hear from Alphabet, Meta, AbbVie, Novo Nordisk, Thermo Fisher Scientific, Novartis, Qualcomm, T-Mobile US, Santander, Sony and Spotify. On Thursday, releases include Amazon, Roche, Eli Lilly, Merck & Co., Shell, Honeywell and Ford. Finally on Friday, there’s reports from Bristol Myers Squibb, Sanofi and Aon.

Finally, there’ll be a continued focus on the trajectory of oil prices over the week ahead, particularly with the OPEC+ group meeting on Wednesday to discuss a March production increase. With inflation running at multi-decade highs in numerous countries and Brent Crude having surpassed $90/bbl at points in trading over the week just gone for the first time since 2014, oil prices are likely to remain a significant issue for policymakers over the coming months. For YoY comparisons, Oil was around $55 this time last year.

Day-by-day calendar of events, courtesy of Deutsche Bank

Monday January 31

- Data: Euro Area Q4 GDP, Italy Q4 GDP, Germany preliminary January CPI, US January MNI Chicago PMI, Dallas Fed manufacturing index, Japan December jobless rate (23:30 UK time)

- Central Banks: Fed’s Daly speaks

Tuesday February 1

- Data: Global manufacturing PMIs, France preliminary January CPI, Germany January unemployment change, Italy December unemployment rate, UK December mortgage approvals, Euro Area December unemployment rate, Canada November GDP, US January ISM manufacturing, December JOLTS job openings, construction spending

- Central Banks: Reserve Bank of Australia monetary policy decision

- Earnings: ExxonMobil, PayPal, UPS, Starbucks, General Motors, UBS

Wednesday February 2

- Data: Euro Area January flash CPI, Italy preliminary January CPI, US January ADP employment change

- Central Banks: Central Bank of Brazil monetary policy decision

- Earnings: Alphabet, Meta, AbbVie, Novo Nordisk, Thermo Fisher Scientific, Novartis, Qualcomm, T-Mobile US, Santander, Sony, Spotify

Thursday February 3

- Data: Global services and composite PMIs, Euro Area December PPI, US weekly initial jobless claims, January ISM services index, December factory orders

- Central Banks: ECB monetary policy decision, Bank of England monetary policy decision, US Senate Banking Committee holds confirmation hearings for Fed governor nominees

- Earnings: Amazon, Roche, Eli Lilly, Merck & Co., Shell, Honeywell, Ford

Friday February 4

- Data: Germany December factory orders, France December industrial production, January construction PMIs from Germany and UK, Euro Area December retail sales, US January change in nonfarm payrolls, unemployment rate, average hourly earnings

- Central Banks: BoE’s Broadbent and Pill speak

- Earnings: Bristol Myers Squibb, Sanofi, Aon

* * *

Finally, focusing on just the US, the key economic data releases this week are the ISM manufacturing report on Tuesday and the employment situation report on Friday. There are a few speaking engagements from Fed officials this week, including the Fed Board nominees’ confirmation hearings before the Senate Committee on Banking, Housing, and Urban Affairs on Thursday.

Monday, January 31

- 09:45 AM Chicago PMI, January (GS 62.0, consensus 61.8, last 64.3): We estimate that the Chicago PMI declined to 62.0 in January from 64.3 in December, reflecting sequential weakness in other manufacturing surveys and an Omicron-related sentiment drag.

- 10:30 AM Dallas Fed manufacturing index, January (consensus 8.5, last 8.1)

- 11:30 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will be interviewed as part of a Reuters Breakingviews event. In an interview on January 12th, Daly stated that she saw “rate increases coming, as early as March,” and that the economy was “very close” to what she “would consider full employment.” Earlier this week, Chair Powell stated that the FOMC was “of a mind” to increase the federal funds rate in March, and hinted at the possibility of hikes at consecutive meetings this year. We now expect that the Fed will hike five times in 2022, with consecutive hikes in March and May, and start balance-sheet normalization in June.

Tuesday, February 1

- 09:45 AM Markit manufacturing PMI, January final (consensus 55.0, last 55.0)

- 10:00 AM Construction spending, December (GS +1.0%, consensus +0.6%, last +0.4%): We estimate a 1.0% increase in construction spending in December.

- 10:00 AM ISM manufacturing index, January (GS 58.2, consensus 57.5, last 58.7): We estimate that the ISM manufacturing index declined 0.5pt to 58.2 in January, reflecting the pullback in other business surveys but a rebound in the supplier deliveries component related to Omicron.

- 10:00 AM JOLTS job openings, December (consensus 10,300k, last 10,562k)

- 05:00 PM Lightweight motor vehicle sales, January (GS 14.5mn, consensus 12.70mn, last 12.44mn)

Wednesday, February 2

- 08:15 AM ADP employment report, January (GS flat, consensus +200k, last +807k): We expect a flat reading for ADP payroll employment in January. Our forecast assumes a smaller drag from Omicron than in the official payroll data, reflecting differences in methodology. However, we also expect a drag on the ADP data from rebounding jobless claims, which is an input to their model.

Thursday, February 3

- 08:30 AM Initial jobless claims, week ended January 29 (GS 245k, consensus 250k, last 260k); Continuing jobless claims, week ended January 22 (consensus 1,600k, last 1,675k): We estimate initial jobless claims declined to 245k in the week ended January 29.

- 08:30 AM Nonfarm productivity, Q4 preliminary (GS +3.2%, consensus +3.2%, last -5.2%); Unit labor costs, Q4 preliminary (GS +1.2%, consensus +1.0%, last +9.6%): We estimate nonfarm productivity growth of 3.2% in Q4 (qoq saar) and unit labor cost—compensation per hour divided by output per hour—growth of 1.2%.

- 09:45 AM Markit US services PMI, January final (consensus 50.9, last 50.9)

- 10:00 AM ISM services index, January (GS 60.0, consensus 59.0, last 62.0): We estimate that the ISM services index declined 2.0pt to 60.0 in January. Our forecast reflects an Omicron-driven pullback in the employment and business activity components partially offset by a boost to the headline from slower supplier deliveries.

- 10:00 AM Factory orders, December (GS -1.0%, consensus -0.2%, last +1.6%); Durable goods orders, December final (last -0.9%); Durable goods orders ex-transportation, December final (last +0.4%); Core capital goods orders, December final (last flat); Core capital goods shipments, December final (last +1.3%): We estimate that factory orders decreased by 1.0% in December following a 1.6% increase in November. Durable goods orders declined by 0.9% in the December advance report, and core capital goods orders were flat.

- 10:00 AM Fed Board Nominees Raskin, Cook, and Jefferson’s confirmation hearings: Former Fed Governor Sarah Bloom Raskin, Michigan State Professor Lisa Cook, and Davidson Professor Philip Jefferson will appear before the U.S. Senate Committee on Banking, Housing, and Urban Affairs for their confirmation hearings for their nominations to the roles of Vice Chair for Supervision (Raskin) and Governor (Cook and Jefferson). The new nominees have generally expressed dovish policy views, but the continuity in Fed leadership and pressing nature of the current inflation overshoot likely mean that their near-term monetary policy impact will be limited. We see a potentially larger shift in the Federal Reserve’s regulatory agenda, as Raskin generally supported greater bank regulation.

Friday, February 4

- 8:30 AM Nonfarm payroll employment, January (GS -250k, consensus +150k, last +199k); Private payroll employment, January (GS -275k, consensus +150k, last +211k); Average hourly earnings (mom), January (GS +0.6%, consensus +0.5%, last +0.6%); Average hourly earnings (yoy), January (GS +5.3%, consensus +5.2%, last +4.7%); Unemployment rate, January (GS 3.9%, consensus 3.9%, last 3.9%): We estimate nonfarm payrolls declined by 250k in January (mom sa). Our forecast reflects a large and temporary drag from Omicron on the order of 500-1000k, as survey data indicate a surge in absenteeism during the month. Dining activity also slowed sharply, and Big Data indicators are consistent with an outright decline in nonfarm payrolls. However, the number of end-of-year layoffs was below normal, and this should partially offset the Omicron drag (the BLS seasonal factors assume ~3mn net job losses in the month of January). We also estimate a 50k rebound in education employment (public and private), reflecting fewer janitors and support staff departing for winter break.

- We estimate an unchanged unemployment rate of 3.9%, reflecting a decline in household employment offset by a drop in labor force participation due to the virus wave. We estimate a 0.6% rise in average hourly earnings (mom sa) that boosts the year-on-year rate by six tenths to 5.3%, reflecting positive calendar effects, a boost from composition effects, and potentially larger-than-normal annual raises for some production and nonsupervisory workers.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 01/31/2022 – 09:05

via ZeroHedge News https://ift.tt/wGAolIuiQ Tyler Durden