Luongo: Bitcoin, 2022, & The Real Story Behind COVID-9/11

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

I don’t necessarily like to do so-called ‘annual prediction’ posts. Having written a ton of them for the newsletters I’ve written over the years, looking back on them is always a bit cringe-inducing. But 2021 was a crazy year and one where so much happened that changed the landscape it looks like one of those necessary evils for 2022.

In fact, I may wind up doing more than I normally do.

After being on Bitcoin Magazine’s Fed Watch podcast in December, I was asked to do a 2022 Predictions article for them.

It just dropped over there.

IS 2022 THE YEAR BITCOIN PROVES ITSELF ON THE WORLD STAGE?

It was a fascinating year for cryptos. One in which no matter how hard I tried, I couldn’t keep up with everything that happened. Going to Bitcoin 2021 in Miami and seeing the clash of OG bitcoiners with the gold rush mentality of the industry it reminded me of the best of times at your typical precious metals conference.

Hey, even Ron Paul was there, which is always a treat.

But that said, 2021 was as strange as any year I’ve ever experienced. The real clash wasn’t in the various crypto fiefdoms per se, but what the emergence of crypto as a full-fledged investible asset class meant that grabbed and held my attention all year.

It was beyond the regular bull market mentality that morphed into mania by mid-year. It was the realization that bitcoin and crypto would begin asserting its potential as a safe-haven asset that was finally proven to more than just us fringe Austro-libertarian types.

Because of this the responses from what Michael Malice calls The Cathedral and what I call The Davos Crowd is what the real story was in 2021.

Capital inflow to cryptocurrency grew as China forced out mining and sent that capacity to the U.S. Global economic disruptions thanks to COVID-19 forced radical rethinking of energy policy. Bitcoin was finally exposed as uneconomic subsidized electricity rates in China, for example.

So, given this immense growth in the public mindshare in 2021, the title seems a moot question at first blush. In many ways Bitcoin has already proven itself.

But 2021 was just the warm-up act for the real economic showdown in 2022 between the Great Powers. The old system is clearly failing. It is the way it fails which will inform geopolitical tensions worldwide. These will take center stage as the titans of that old financial and political order fight for dominance over a shrinking pile of capital.

In the middle, bitcoin stands ready to perform the vital role of intermediary and escape valve for potentially trillions in capital seeking a safe haven from that storm.

And it’s very obvious that Davos is scared to death of not having control over the outcome of this story.

Lock it Down, Tune it Up

I spent most of 2021 making the argument that despite the endless procession of headlines and edicts from Davos and its quislings in decision-making positions all across the West, they were making big gains but leaving themselves more exposed to counterattack than they ever have before.

From ridiculous lockdowns to vaccine mandates it was clear that what we were watching was a pre-planned script of second-rate screenwriters. It was a constant barrage of micromanaging public opinion via complicit media, stoking fear to create division to rob people of something far worse than their reason, their reason for living.

But as the year went along the truth about COVID-9/11, the efficacy of masks and the intimidation of the medical industry reached a peak. No matter how much more they squeezed, there was a large enough percentage of people all across the world who simply said, “You know what? No.”

No masks. No jab. No job. No problem. No. No. A thousand times, No.

Because when anyone resorts to the level of bullying, bribing, coercing and lying that these people have engaged in it reveals just how shallow their power truly is.

And it’s plain as day to anyone whose mind is still free.

Too many see this story for what it is, a story for this thing to be successful. A bad horror movie meant to keep the weak and the indebted in a constant fight or flight response, while everyday another person looks up and says, “What in the actual hell are you talking about?”

At some point in every scam the mark confronts the scammer and the scammer then has a choice. Double down or run. Davos still thinks they can double down. Dr. Fauci now thinks he can go out and tell the truth out loud and still have credibility.

But those with real credibility just speak the truth once and the narrative collapses:

Mark Jeftovic noted what I said weeks ago: Omicron would be the end of the COVID-9/11 scam:

Ironically, the fact that the dominant strain is now a head-cold version of COVID should be good news. However, for many this had become a religion.

There will be those who try to cling onto COVID tyranny for as long as possible and in doing so, they will perpetuate a state of hyper-normalization that will be self-defeating.

Hyper-normalization is a phrase coined by the UK documentarist Adam Curtis, and it describes a state where the prevailing establishment narrative is so absurd and demonstrably false that only the most brainwashed True Believers can cling to it. Only the most corrupt and self-seeking policy makers will attempt to perpetuate it. Those who do espouse it are typically the greatest beneficiaries of the dysfunctional zeitgeist.

If you step back and think about the Davos narrative over COVID you realize that this is a plan that says trust the people in charge while also destroying your faith in them. For the hyper-normal, skewering their statist religion will spur them to new heights of violence rather than face their shame.

Eventually, people just get tired of being jerked around by an invisible chain held by blue-checkmarked NPCs on Twitter and tune into the very people, mRNA vaccine developer Robert Malone, they were told they weren’t allowed to listen to.

I told you when he signed the big Spotify deal that Joe Rogan would blow up Davos’ Death Star.

Lies are expensive. The truth sells itself.

Because, eventually, there is a limit to threatening people for disobeying. Eventually people call the bluff.

Eventually people show up en masse and deliver a big “NO.”

The mayor of Napoli prohibited any noisy celebrations on NYE.

This was Napoli’s response. pic.twitter.com/gekdkSl82I

— Pepe Escobar (@RealPepeEscobar) January 1, 2022

The Patchwork Tyranny

COVID-9/11 was simply a means to an end. That end is nothing less than a reset of an immoral financial architecture that has squandered the capital and heritage of the entire West in the vain hope of salvaging the power and prestige of old European money. While Davos sold the Great Reset to that old money and the politicians to save their privilege they would have to fully destroy everything else, namely their subjects, and Build it Back Better.

It was badly premised on the idea that Communism would have worked if only the U.S. and Europe had joined Mao and Stalin during the last major cycle. It was never going to work. There’s too much wealth in the world to pull that off and technology is advancing too rapidly for them to control how we use it to our advantage versus theirs.

So, today we are witness to the willful destruction of some of the oldest cultures in the West, purposefully impoverishing hundreds of millions while simultaneously poisoning them to cull the herd of the unwanted. While we in control group of their grand experiment continue sitting back with our arms crossed saying, “No.”

They get weaker. We get stronger.

What happens in 2022 is Davos getting their plans implemented in a rough patchwork of tyranny. They’ll take the wins where they can get them — Germany, California, Canada, Australia, etc. — and hope it is enough to keep the program moving forward.

But having exposed themselves this badly those that have refused to date will not be bowed. They have nothing left to lose. And the costs of enforcement of this plan are rising too rapidly for it to be maintained.

Bitcoin Fixed Some of This, Too

This is why I think 2021 wasn’t Bitcoin’s year. 2022 is.

2022 is the year that Bitcoin becomes the means by which trillions in capital flee the chaos as Davos splinters, their control over important nodes of economic dynamism slips further and the people have the choice put in front of them clearly.

Your keys, your money. Their keys, your servitude.

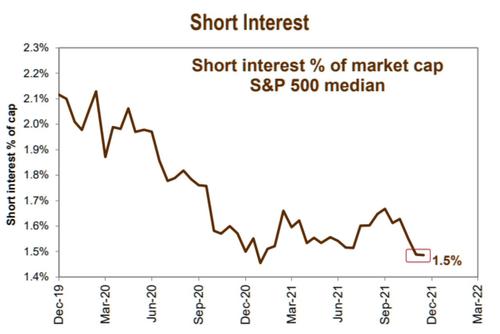

Because we’ve reached that proverbial crossroads in time where more beatings ensures morale never improves, instead it hardens into something cold and implacable. As those places most under Davos’ control sink into ever-widening gyres of madness, the capital flight from them will be beyond anything the world has experienced in nearly a hundred years.

No amount of arm-twisting and rule changes will hold back this tidal outflow. It’s already begun. Capital is like water.

And if Europeans are forbidden from moving their money out through normal means, buying property in Florida is always a good bet, then they will use whatever is at hand.

Crypto is definitely one of those escape valves, it’s the thing that ECB President Christine Lagarde fears more than anything else.

So, for my 2022 predictions, it all boils down to the following:

Bitcoin, along with gold, will assert themselves as the premier custodial assets for a world in chaos. Debt will become the dirtiest word in the English language over this period of history.

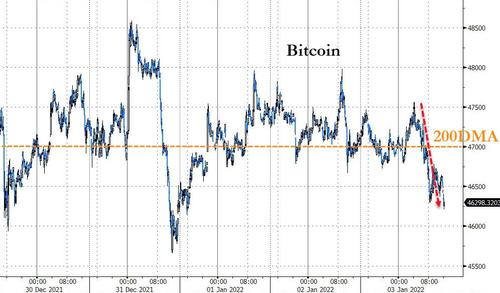

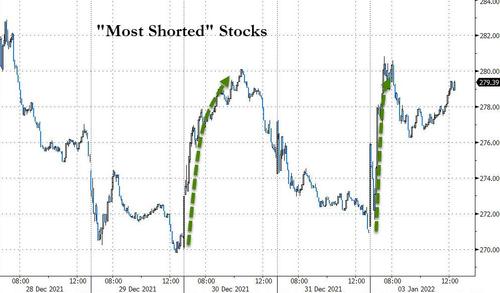

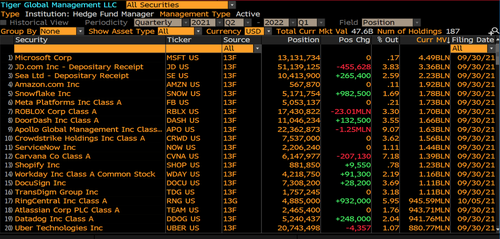

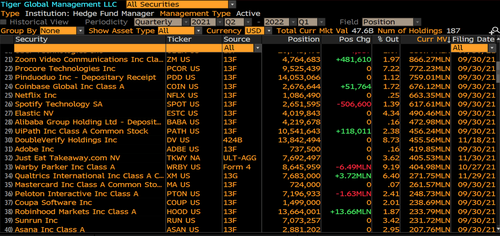

The trade in both gold and crypto will be volatile and choppy as day-to-day U.S. dollar funding needs will create false moves up and down. The Fed will defend the dollar. Bitcoin will peak and likely fall later in the year as the crisis in Europe reaches its zenith and the four-year bitcoin cycle asserts itself. It will be a titanic fight.

But the early trend will be the same as 2021, up. During the height of the crisis that emerges, bitcoin should be the premier asset of choice which investors flee into.

The groundwork for this capacity was laid in 2021. 2022 is the year it gets utilized. For capital that can’t move into bitcoin and for central banks who need to diversify reserves, gold will remain their asset of choice. Gold will play catchup in 2022 to bitcoin.

Because capital flows to where it is treated best. And despite the volatility, there are fewer places on earth that have the capacity to treat capital better today than Bitcoin.

* * *

Join my Patreon if you like saying No.

BTC: 3GSkAe8PhENyMWQb7orjtnJK9VX8mMf7Zf

BCH: qq9pvwq26d8fjfk0f6k5mmnn09vzkmeh3sffxd6ryt

DCR: DsV2x4kJ4gWCPSpHmS4czbLz2fJNqms78oE

LTC: MWWdCHbMmn1yuyMSZX55ENJnQo8DXCFg5k

DASH: XjWQKXJuxYzaNV6WMC4zhuQ43uBw8mN4Va

WAVES: 3PF58yzAghxPJad5rM44ZpH5fUZJug4kBSa

ETH: 0x1dd2e6cddb02e3839700b33e9dd45859344c9edc

DGB: SXygreEdaAWESbgW6mG15dgfH6qVUE5FSE

Tyler Durden

Mon, 01/03/2022 – 17:00

via ZeroHedge News https://ift.tt/3mSQhgq Tyler Durden