Authored by Wolf Richter via WolfStreet.com,

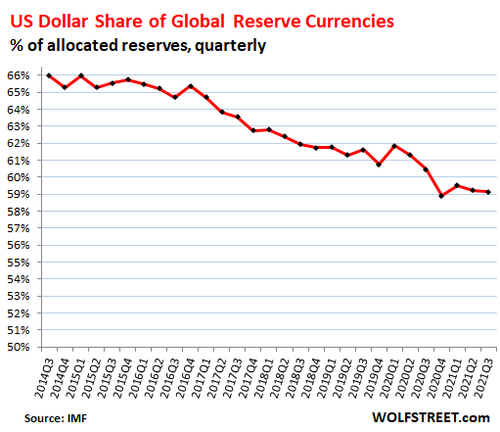

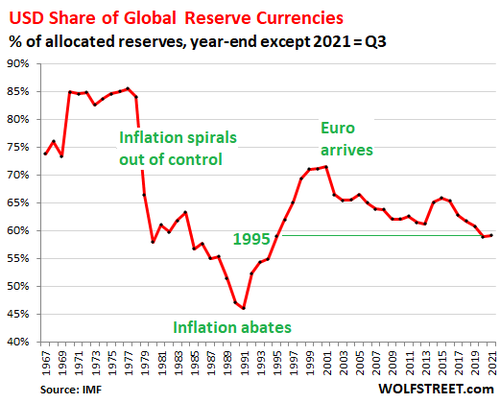

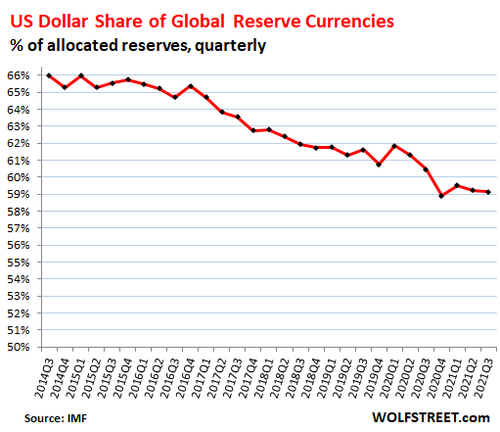

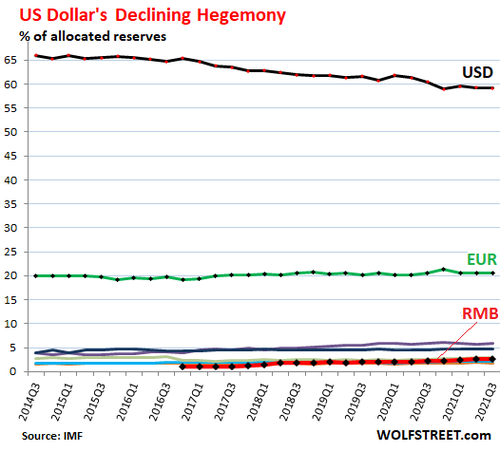

The global share of US-dollar-denominated exchange reserves declined to 59.15% in the third quarter, from 59.23% in the second quarter, hobbling along a 26-year low for the past four quarters, according to the IMF’s COFER data released today. Dollar-denominated foreign exchange reserves are Treasury securities, US corporate bonds, US mortgage-backed securities, and other USD-denominated assets that are held by foreign central banks.

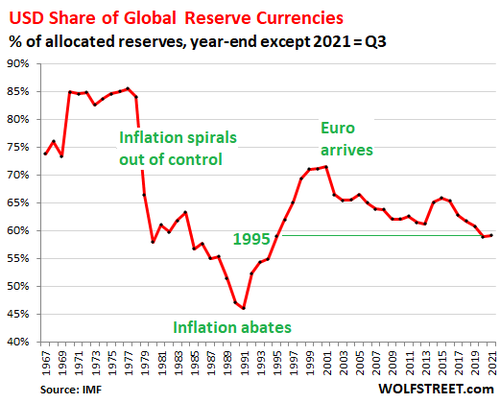

In 2001 – the moment just before the euro officially arrived as bank notes and coins – the dollar’s share was 71.5%. Since then, it has dropped by 12.3 percentage points.

In 1977, when inflation was raging in the US, the dollar’s share was 85%. And when it looked like the Fed wasn’t doing anything about inflation that was threatening to spiral out of control, foreign central banks began dumping USD-denominated assets, and the dollar’s share collapsed.

The plunge of the dollar’s share bottomed out in 1991, after the inflation crackdown in the early 1980s caused inflation to abate. As confidence grew that the Fed would keep inflation more or less under control, the dollar’s share then surged by 25 percentage points until 2000 when the euro arrived.

Since then, over those 20 years, other central banks have been gradually diversifying away from US dollar holdings (year-end data, except for 2021 = Q3):

Not included in global foreign exchange reserves are the assets held by a central bank in its own currency, such as the Fed’s holdings of dollar-denominated assets, the ECB’s holdings of euro-denominated assets, or the Bank of Japan’s holdings of yen-denominated assets.

Impact of exchange rates on exchange reserves.

The exchange rates between the US dollar and other currencies impact the dollar-value of non-dollar reserves. So for example, the value of China’s holdings of euro-denominated bonds is expressed in USD to make it compatible with all the other holdings. All holdings that are denominated in non-dollar currencies are expressed in USD, and those USD-entries for non-USD assets move also with the exchange rates.

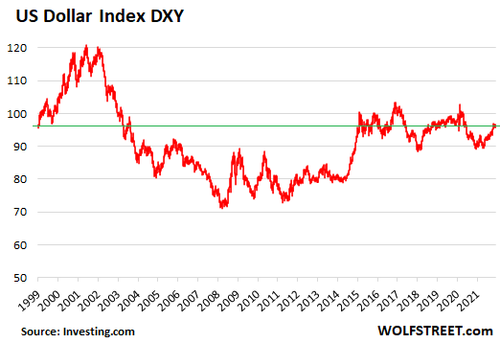

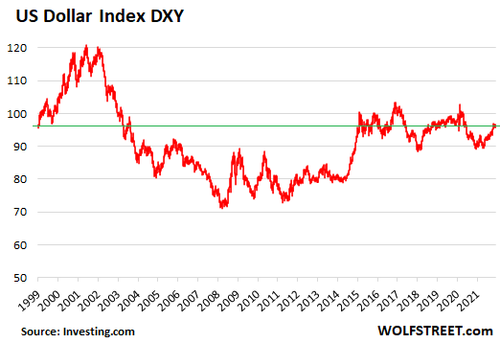

But the exchange rates of the major currency pairs have been remarkably stable over the past two-decades-plus, despite swings in between, as seen by the Dollar Index (DXY), that is now back where it had been in 1999.

So, exchange rates had little or no impact on the substantial decline of the dollar’s share of foreign exchange reserves.

That decline was mostly due to central banks diversifying away from dollar-denominated holdings in favor of non-dollar holdings – getting perhaps a little nervous about the twin deficits int he US – but they’re doing so very slowly to avoid toppling this whole house of cards.

Euro’s 20th Birthday.

On January 1, 2022, euro bank notes and coins will celebrate their 20th birthday. I still have my “Starter Kit” in its original plastic bag because the introduction of the euro at the time in a handful of countries was a huge event in the history of currencies and took decades to prepare for. Now the Eurozone encompasses 19 countries with a population of 340 million people.

The idea of the euro was sold to the inhabitants of the EU with the stated and often expressed goal of “parity” with the dollar: parity as global reserve currency, as trading currency, and as financing currency.

When the euro was formed, local-currency debt and equity instruments, previously issued in local currency, were converted to euro-denominated assets, and coupon interest and dividends were then paid in euros, etc. The currencies that went into the euro, such as the Deutsche mark, had already been reserve currencies. As these assets were converted to euros, so were central-bank holdings of German government bonds and the like. So as a reserve currency, the euro didn’t start from zero. It picked up where the members’ currencies left off.

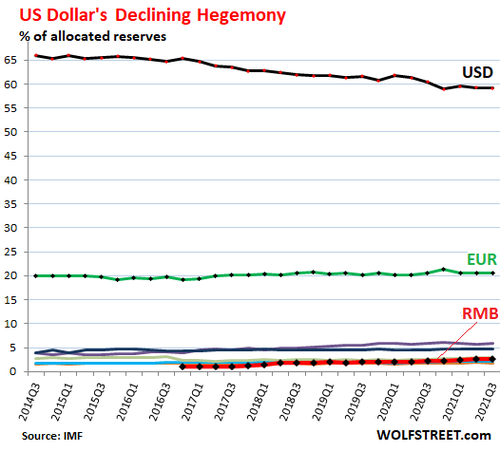

Since the Euro Debt Crisis, the euro’s share of global reserve currencies has been stuck at around 20%, and the dream of “dollar parity” has vanished. But it is the undisputed second largest reserve currency.

The rest of the reserve currencies are minor entries at the bottom in the chart, including the Chinese renminbi, the bold red line:

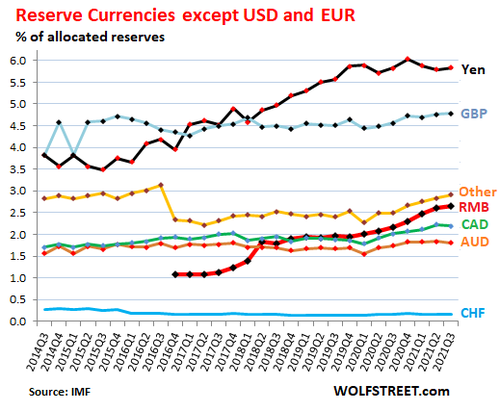

The minor reserve currencies:

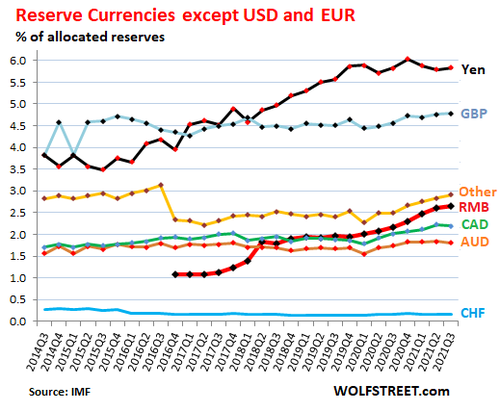

To see what they’re doing at the bottom of the chart, I magnified the left-hand scale to the range of 0% to 6%.

The yen, the third largest reserve currency, surged from 2015 and hit a share of 6.0% in Q4 2020. Despite the hoopla around Brexit, the share of the British pound (GBP), the fourth largest reserve currency, has remained roughly stable.

The share of the Chinese renminbi (RMB) has been growing in baby steps and in Q3 reached a share of 2.66%, tiny compared to the global trade prowess of China’s economy. The IMF elevated the renminbi to an official global reserve currency in October 2016 by including it in the basket of currencies that back the Special Drawing Rights (SDRs). But the RMB, while freely convertible for trade purposes, is still not freely convertible under China’s capital account. And central banks remain leery of it.

Over the past four years, the share of the RMB has grown by 1.54 percentage points. At that rate, it would take the RMB over 50 years to reach a share of 25%.

Reserve currencies and trade deficits and surpluses.

The US dollar’s status as the dominant global reserve currency has enabled the huge twin-deficits that are displayed in all their glory by the US government’s ballooning public debt, now close to $30 trillion, and by Corporate America’s relentless offshoring of production leading to the monstrous and ever-growing US trade deficits.

But the Eurozone has had a large trade surplus with the rest of the world in recent years – particularly with the US, including a trade surplus of $183 billion in 2020. The Eurozone’s trade surplus demonstrates in reality that an economic area with a large trade surplus can also have one of the top reserve currencies, debunking old theories that a large reserve currency must be associated with a large trade deficit. But as the US situation makes amply clear: Having the dominant reserve currency enables and encourages the US to run up its twin deficits.

* * *

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely.