Large, Peer-Reviewed Research Study Proves Ivermectin Works Against COVID-19

The results are in from the world’s largest study of ivermectin for COVID-19.

Researchers in Brazil found that regular use of ivermectin as a prophylactic agent was associated with significantly reduced COVID-19 infection, hospitalization and mortality rates.

The study was conducted in Itajaí, a port city in the state of Santa Catarina, between July and December 2020. Study authors include FLCCC physicians Dr. Flavio Cadegiani and Dr. Pierre Kory. Lead author Dr. Lucy Kerr was approached by the mayor of Itajaí, after the city began to experience a severe outbreak of COVID.

The entire population of Itajaí was invited to participate in the program, which involved a medical visit to compile baseline, personal, demographic, and medical information. In the absence of contraindications, ivermectin was offered as a preventative treatment, to be taken for two consecutive days every 15 days at a dose of 0.2 mg/kg/day.

Of the 223,128 citizens of Itajaí considered for the study, a total of 159,561 subjects elected to participate: over 70% opted to take ivermectin, and 23% chose not to.

Reduced infection and hospitalization rates

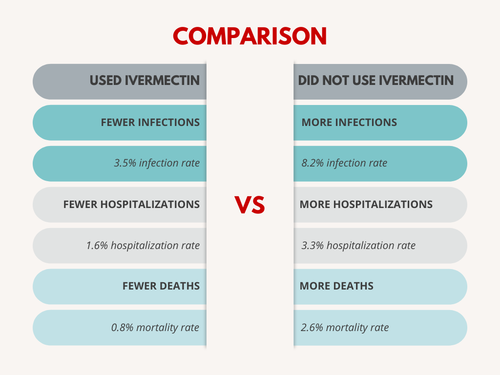

The study found a 44% reduction in COVID-19 infection rate in favor of the group that took ivermectin (3.5% versus 8.2%).

In cases where a participating citizen of Itajaí became ill with COVID-19, they were recommended not to use ivermectin or any other medication in early outpatient treatment. Of those who did become infected, two equal-sized, highly matched groups (one that used ivermectin as a prophylaxis and one that did not) were compared. The regular use of preventative ivermectin led to a 68% reduction in COVID-19 mortality (0.8% versus 2.6%), and a 56% reduction in hospitalization rate (1.6% versus 3.3%).

Study methods

Since vaccines were not available at the time, and few prophylactic alternatives existed in the absence of vaccines, Itajaí initiated a population-wide government program for COVID-19 prophylaxis. This was a prospective observational study that allowed subjects to self-select between treatment vs. non-treatment. The use of ivermectin was optional and based on patients’ preferences, given its benefits as a preventative agent was unproven.

To ensure the safety of the population, a computer program was developed to compile and maintain all relevant demographic and clinical data. All subjects were weighed to be able to accurately calculate the correct dose of ivermectin. In addition, a brief medical evaluation was conducted to record past medical history, comorbidities, use of medications and contraindications to drugs.

The following variables were analyzed and adjusted as confounding factors or used for balancing and matching groups for propensity score matching:

-

Age

-

Sex

-

Previous diseases (myocardial infarction and stroke)

-

Pre-existing comorbidities (type 2 diabetes, asthma, chronic obstructive pulmonary disease, hypertension, dyslipidemia, cardiovascular diseases, cancer [any type], and other pulmonary diseases)

-

Smoking

Patients who presented signs or the diagnosis of COVID-19 before July 7, 2020, were excluded from the sample. Other exclusion criteria included contraindications to ivermectin and age (subjects below 18 years of age were excluded).

During the study, subjects who were diagnosed with COVID-19 underwent a specific medical visit to assess clinical manifestations and disease severity. All subjects with symptoms were recommended not to use ivermectin, nitazoxanide, hydroxychloroquine, spironolactone, or any other drug claimed to be effective against COVID-19. The city did not provide or support any specific pharmacological outpatient treatment for subjects infected with COVID-19.

Intriguing findings

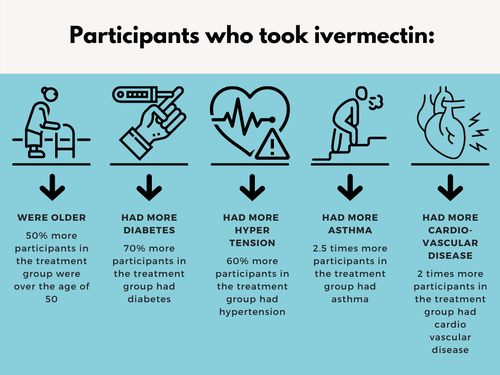

Interestingly, the group who self-selected to take ivermectin was older and had more comorbidities than the group who opted for no treatment. These results show that prophylactic ivermectin may be a mitigating factor in groups with higher risk of morbidity.

The belief that preventative and early treatment therapies would cause people to relax their caution of remaining socially distanced, leading to more COVID-19-related infections, is not supported here.

The data demonstrate that using preventative ivermectin significantly lowers the infection rate, and that benefits outweigh the speculated increased risk of changes in social behaviors.

Tyler Durden

Mon, 01/24/2022 – 23:50

via ZeroHedge News https://ift.tt/3rMaC8G Tyler Durden