Exxon Extravaganza: Soaring Energy Prices Lead To Biggest Profit Since 2014, New $10 Billion Stock Buyback

In a time when tech stocks are crashing, the FAAMG “generals” are in danger of keeling over, and most stocks are on the cusp of or deep inside a bear market, one sector has been a shining light (of green) in an otherwise dismal (and red) landscape: energy.

… and no major company has benefited more from the energy renaissance than Exxon, which earlier today reported blockbuster earnings, solid guidance and threw in a $10 billion buyback to boot.

Unlike its comp Chevron which whiffed last week, Exxon released knockout Q4 earning, when it reported a fourth-quarter profit of $8.87 billion, the largest since 2014, while aggressive spending cuts helped the oil giant fully capitalize on surging energy demand and prices which allowed the top U.S. oil producer to swim in cash thanks to Biden’s “green” agenda which has been a disaster for the US consumer but a gift for US energy producers. As a result, the company generated the highest cash from operations since 2012 and distributed a whopping $15 billion to shareholders in 2021. The company slashed spending after demand cratered two years ago with earnings in recent quarters jumping above prior levels. The results come a day after Exxon disclosed yet another belt-tightening move, this time involving shuttering its corporate headquarters in suburban Dallas and consolidating those offices near Houston.

To be sure, and as the company’s earnings and soaring stock price confirm, whatever Exxon is doing is working:

- Earnings have soared to $23 billion, thanks to bottom-line savings of $2 billion.

- CapEx was contained to just $17 billion, far below historical levels.

- The company’s oil breakeven price is down to just $41, meaning with oil well over $80/bbl, Exxon is swimming in profits

- The company’s cash from operations soared to $48 billion, the highest in almost a decade

- Debt was reduced by a record $20 billion

- And while the dividend rose again in 2021, the big highlight from today’s report was the announcement of a new $10 billion buyback program.

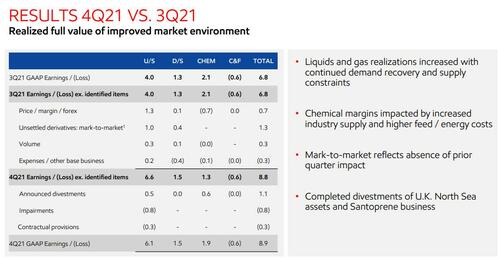

Taking a closer look at the company’s Q4 earnings, Exxon reported Q4 revenue of $84.97 billion, beating expectations of $76.67BN by more than $10 billion! It reported adjusted EPS of $2.05, above analysts forecast of $1.93 as operating profit in oil and gas production soared. In the same quarter a year ago, Exxon posted an adjusted profit of just three cents a share. Some more details from the quarter:

- Chemical prime product sales 6,701 kt, +0.9% y/y, estimate 6,692

- Downstream petroleum product sales 5,391 kbd, +12% y/y, estimate 5,291

- Production 3,816 KOEBD, estimate 3,740

- Crude oil, NGL, bitumen and synthetic oil production 2,385 KBD, estimate 2,362

- Natural gas production 8,584 MCFD, estimate 8,486

- Refinery throughput 4,118 KBD, estimate 4,046

- Total revenues & other income $84.97 billion, +83% y/y, estimate $74.67 billion

Natural gas sales provided the primary boost to fourth-quarter results as Exxon and other suppliers reaped hefty returns amid fuel shortages across Europe and parts of Asia. Escalating oil prices also proved a boon to the Western world’s largest crude explorer.

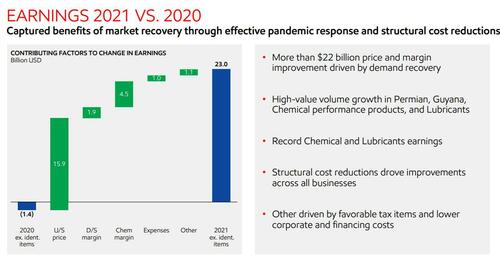

Remarkably, the company’s earnings were negative a year ago, and have soared to $23 billion in 2021, with the surge in oil prices contributing to $15.9 billion of this increase.

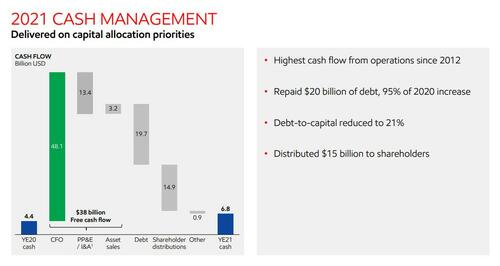

Even more stunning was the company’s cash flow:, which exploded by $48.1 billion in 2021 – the highest since 2012 – courtesy of surging oil prices. The company used this to pay down $20 billion in debt, reducing the debt-to-capital ratio to just 21%, and spend $15 billion on shareholder distributions.

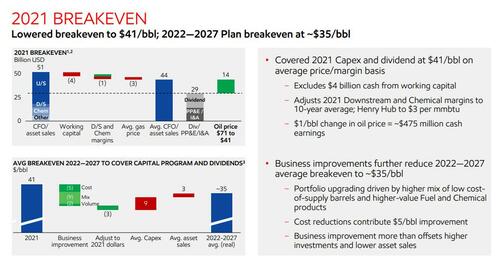

Last but not least, is Exxon’s remarkable reduction in oil breakeven prices which is now just $41, and for budgeting purposes (needed to cover capital program and dividends, it drops as low as $35).

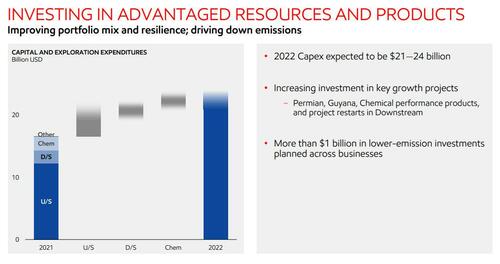

And having survived the period of turmoil since covid, the company is now looking to capture market share, announcing that it will boost spending on new oil wells and other projects by as much as 45%, projecting capex between $21-24 billion, narrowing the range from the previous guideline of spending between $20-25 billion.

CEO Darren Woods’ decision to reverse course on a pre-pandemic growth plan and hold capital spending at historically low levels means high commodity prices are translating directly into massive cash flow.

Hilariously, Exxon’s remarkable recovery would not have been possible without the sheer idiocy that is Biden’s “green” agenda and the ESG hypocrisy. So thank you “greens” for making Exxon one of the best creators of wealth in the past two years.

While some observers have raised concerns about Exxon’s long-term commitment to fossil fuels, in the near term the company is profitably harvesting older reserves and replacing them with high-margin barrels from new discoveries in places such as Guyana.

Exxon stock jumped premarket on the blowout earnings, rising as high as $77.50, the highest level since mid-2019. XOM shares have risen more than 20% this year, capping an almost 50% advance in 2021 for the best annual performance in at least four decades. We expect the stock to be trading in the triple digits in a quarter or two.

Tyler Durden

Tue, 02/01/2022 – 08:58

via ZeroHedge News https://ift.tt/VKWHJsuqg Tyler Durden