Oil Entering “Political Intervention Territory” Goldman Warns; Could Force OPEC+ To Boost Output

Exxon – a name we have been bullish on since early 2020 – finally exploded today after reporting blockbuster earnings, and has helped move the entire energy sector even deeper into the green YTD amid a devastated stock market landscape…

… a move which when stripped of noise, has been due to just one thing: the ascent of oil (thank you Biden “Green” agenda and ESG for crushing energy capex spending and sending prices soaring) ever since its historic plunge in deep negative territory (at least for the WTI front contract) on April 20, 2020.

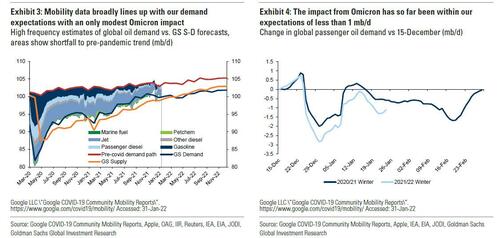

Drilling into this move, which has helped push inflation higher and send Biden’s approval rating to the toilet, Goldman’s commodity strategist Damien Courvalin writes today that Brent oil prices have rallied past $90/bbl (hitting the bank’s 1Q22 forecast), “driven by tight fundamentals, with steep inventory draws leaving the market with concerning low inventory levels across a range of petroleum products and regions.”

It is in this context that OPEC+ meets this Wednesday (February 2) to set their production plans for March, with the group so far notably quiet on their decision, and even following today’s meeting of the OPEC+ Joint Technical Committee it did not discuss an output hike of more than 400K, the baseline that has been the norm for the past few months.

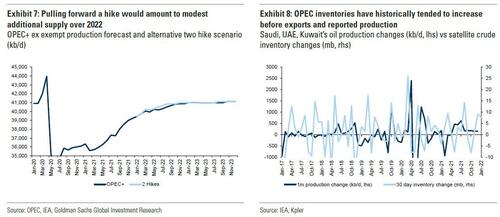

And with oil fast approaching $100, or what Goldman calls “political intervention territory” Courvalin writes that while he had assumed a roll-over of the monthly 0.4 mb/d quota hike, he views “growing potential for a faster ramp-up at this meeting, given the pace of the recent rally and the likely pressure from importing nations (with prices above the small coordinated SPR releases last November).” Additionally, the producers’ group “may also be growing more concerned by the hawkish central bank shift that could lead to slower global growth and oil revenues later this year.”

The producers’ group may also be growing more concerned by the hawkish central bank shift that could lead to slower global growth and oil demand revenues this year. In fact, the recent crude builds seen in OPEC+ may portend a larger hike than expected, with similar precedents before significant production increases (e.g. Jun-18, Nov-18, Mar-20) when exports then surged.

Uncertainties also arise as a result of the current geopolitical tensions: the US has reportedly reached out to oil and gas exporters in case Russian oil exports are restricted (a low probability event in Goldman’s view) should further escalations occur in Ukraine. Such a supply increase would, however, likely be difficult from an OPEC+ alliance perspective given many members’ inability to ramp-up and the required consensus for hikes.

This is most notably the case for Russia, whose support has further been critical in all OPEC+ decisions over the last five years. Similarly, growing odds of a potential return of Iran exports would likely argue against a large increase in output. Yet, Russia’s efforts in brokering a deal between Iran and the US could point to potential de-escalation of Ukrainian tensions, potentially including an increase in oil supply.

All in, the vampire squid nonetheless sees potential for an accelerated increase in output – either by bringing forward the April quota increase forward or through a Saudi-led temporary increase in exports given Russia’s inability to increase production in recent months due to winter seasonality.

And while Goldman acknowledges that the potential outcome remains evenly balanced between an accelerated response and a status quo increase, the “oil market would likely respond more negatively to the former given the 33% uninterrupted rally over the past two-months.”

How much of a response?

Goldman’s models point to a $3/bbl impact if OPEC+ brought forward the April hike (worth 0.2 mb/d additional supply through Dec-22) or even less if Saudi increase output by 0.5 mb/d for three months.

The bank sees four additional elements that could lead to higher oil price volatility through March, beyond such an OPEC+ announcement:

- renewed SPR headlines,

- the inevitable easing of gas-to-oil substitution as winter ends,

- headlines on progress of an Iran deal, and

- the seasonally expected inventory builds.

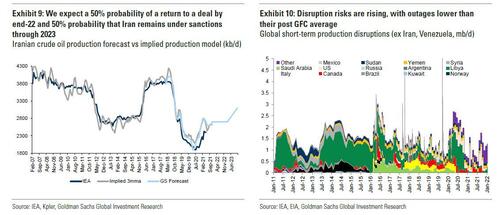

While Courvalin’s base case assumes only a 50% probability of an Iran deal by the end of this year…

… an increase in bearish headlines on Iran deal progress would likely hit sentiment in a market desperate for spare capacity.

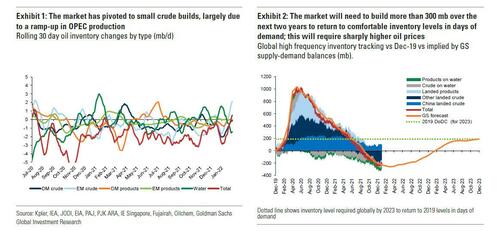

Finally, the bank’s high-frequency tracking of inventories has pivoted into a small surplus for the first time since a brief period in Jan-21, during the European Alpha Covid wave. Crude builds in China and some OPEC+ producers (where Omicron has spread sequentially) have so far kept DM markets and petroleum products drawing but could eventually rattle the bullish narrative.

Still, even a downside case scenario should OPEC+ boost output beyond the priced in 400bp/d would not change Goldman’s bullish view as it simply represents a shift in the risk-reward of being long oil this week.

Courvalin continues:

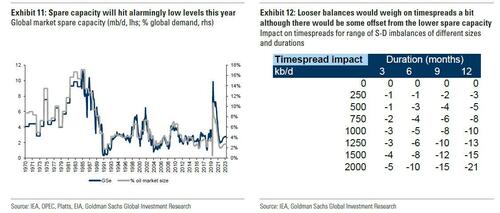

Oil has just posted a two-month rally that ranks in the top 99.7% of Sharpe ratio in the last twenty years.Importantly, time-spreads still look relatively undervalued vs. our expectations of OECD inventories even after the rally, and we continue to forecast $105/bbl Brent prices will be needed in 2023, with risks asymmetrically higher. Stock levels are still incredibly tight, even if we build slightly now in the shoulder demand season. The market needs to build more than 300 mb to return stocks to normal levels in days of demand over the next 18-24 months.

This remains the central thesis for Goldman’s bullish oil view – after a record long deficit, much higher oil prices are needed to replenish oil’s buffers. To that end, spare capacity remains critically low, with concerns around Russia’s, Kuwait’s, and Iraq’s productive capacity likely to materialize by summer, when demand seasonally ramps up and international travel reopens.

Finally, the shale producer guidance through the early earnings releases is running well behind Goldman assumptions (Chevron, Murphy and Hess): “a disappointment in either of these balancing mechanisms would require an even larger rally than we forecast, as by that point, it is demand destruction that will be required to finally rebalance the market.”

Translation: just like in 2008, only a recession can halt the relentless surge in oil, incidentally something we discussed two weeks ago in “Shades Of 2008 As Oil Decouples From Everything.”

Courvalin concludes that the “rapid decline in Covid cases, the strength of demand so far this year and initial earnings releases of US producers, guiding production below expectation, all reinforce our conviction in the need for sharply higher prices.” He also notes that he still sees rising disruption risks as an offset to a potential faster return of Iran production.

The bottom line: Goldman sees the outcome of tomorrow’s OPEC+ meeting as “evenly balanced” between a continuation of the current output plan for March and a bigger increase. What do others think? Here are three additional takes from Energy Aspects, RenCap and Bloomberg:

RenCap analyst Alexander Burgansky

- Russia’s crude oil and condensate production is set to keep rising until August to around 11.4m b/d, after which it will remain at that level until year-end

- Russia’s oil-production growth is seen at 8% in 2022, a “uniquely high” rate for the oil industry

- Russia’s gas output to continue experiencing long-term growth, thanks to new projects led by Gazprom Neft and Rosneft

- Gazprom’s share of Russia’s domestic gas market may fall below 60% after 2023

Energy Aspects report

- Demand for low-sulfur fuel oil in northeast Asia from utilities has been strong in January, helping to keep the Asian market tight

- On the supply side, China’s output of LSFO is set to increase as “majors are ramping up LSFO production in line with Beijing’s aim to further develop Zhoushan as a bunkering hub”

- VGO “continues to be bid on bunker blending demand, while robust product margins continue to incentivise European refiners to import the feedstock” in the ARA area

Bloomberg

- China looks set to receive significantly less crude at its ports in the next few weeks

- With more than half of Bloomberg’s oil tanker trackers now published for January exports, the Asian country is on course to receive almost 1.6m b/d less crude than it did in December

- Observed crude exports are on course to be down slightly — to 26.4m b/d, a decrease of about 275k b/d — for the combined flows from 13 countries or regions. There was a large declines from Libya and UAE while a slump from Angola drove down overall flows from West Africa

Tyler Durden

Tue, 02/01/2022 – 14:29

via ZeroHedge News https://ift.tt/3eukRy5Cs Tyler Durden