US Manufacturing Weakens More In Jan: Job Creation Crashes As Prices Paid Spikes

With US macro data serially disappointing this year so far, analysts expected both Markit PMI and ISM surveys of the manufacturing sector to show further slowing in January.

-

January Markit US Manufacturing PMI fell from 57.7 in December to 55.5 at the final print of January (very slightly higher than the flash PMI print of 55.0) – that is the weakest print since Oct 2020.

-

January ISM US Manufacturing fell from 58.8 to 57.6 (very very salightly better than the 57.5 expected) – that is the weakest since Nov 2020.

Source: Bloomberg

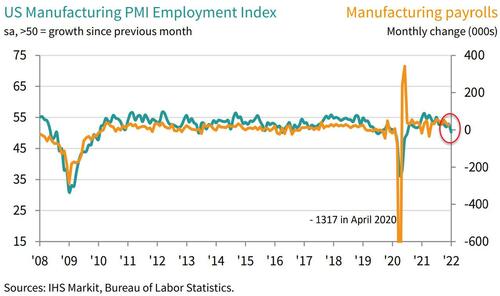

Output and new order growth slowed in January, amid supply and labor shortages; and in another poor sign ahead of Friday’s payrolls data, Markit notes that the rate of job creation eases to softest in 18-month sequence of growth.

That implies a contraction in manufacturing jobs in January.

Panellists also frequently mentioned that growth of employment was hampered by challenges retaining staff and labor shortages.

Chris Williamson, Chief Business Economist at IHS Markit said:

“The Omicron outbreak has hit manufacturing hard, exacerbating existing headwinds by subduing demand, creating further supply chain issues and causing widespread staff shortages, often through absenteeism due to the surge in COVID-19 infections. The steep downturn in the survey data are indicative of manufacturing production falling in January.

“However, the overall impact on supply chains from Omicron has been less marked than in prior covid waves, and raw material price pressures have come down as the global supply crunch appears to be improving. Hence manufacturers are upbeat about the outlook, with future output expectations rising to the highest for over a year to suggest that the current downturn may prove short-lived.”

Most notably however was the major rebound in ISM Prices Paid index – which has been closely watched for signs that he inflation wave is rolling over.

ISM Prices Paid surged from 68.2 to 76.1 (with expectations of a further small decline to 67.0), and New Orders also slowed to their weakest since June 2020.

Source: Bloomberg

That was the largest advance in Prices Paid since the end of 2020 and was probably a reflection, at least in part, of higher crude oil prices.

No room for maneuver there for The Fed.

Tyler Durden

Tue, 02/01/2022 – 10:08

via ZeroHedge News https://ift.tt/IhtqwWvoP Tyler Durden