ECB Preview: Lagarde In The Hot Seat As Euro Inflation Has Never Been Hotter

Submitted by Newsquawk

The ECB policy announcement is due Thursday, February 3 with the rate decision at 12:45GMT/07:45EST, and press conference from 13:30GMT/08:30EST. Policy settings are set to be left unchanged after the path of tapering was announced in December. Focus will be on the press conference and how the Bank characterizes the inflation outlook over the short and medium-term, especially after Euro area inflation just hit an unexpected all time high.

OVERVIEW: After a blockbuster release in December which saw the central bank announce a conclusion to PEPP at the end of March and subsequent beefed up APP, the upcoming meeting (not accompanied by economic projections) is set to see policymakers take stock of the Eurozone economic outlook whilst maintaining the current parameters of their policy tools. With the statement of the release set to be relatively unchanged, focus instead will fall on the accompanying press conference and how President Lagarde judges the inflationary outlook. With the Bank moving further away from its transitory inflation stance seen last year, ING judges that the ECB will need to convey its ability to tame inflationary pressures whilst avoiding a rush from “inflation patience” to “inflation panic”, as a move towards the latter could lead to an aggressive hawkish repricing in the market which is already at odds with ECB comms. Accordingly, it is no coincidence that a lot of the commentary in recent weeks has suggested that although the transitory narrative has moved on since last year, policymakers still expect inflation to decline throughout the coming year. It remains to be seen whether or not the ECB will leave the door open to a potential faster tapering of asset purchases under APP should inflation impulses prove to be more durable.

PRIOR MEETING: As expected, policymakers opted to stand pat on rates. As had been signaled by the ECB, purchases under PEPP will cease at the end of March 2022. Reinvestments were extended until 2024 and purchases under PEPP could also be resumed, if necessary, to counter negative shocks related to the pandemic. On APP, as of Q2 2022, monthly purchases will be beefed up to EUR 40bln from EUR 20bln and then subsequently lowered to EUR 30bln in Q3 and back down to EUR 20bln in Q4 “for as long as necessary to reinforce the accommodative impact of its policy rates”. Elsewhere, policymakers opted to maintain the linkage between APP and rate increases whereby the Governing Council expects net purchases to end shortly before it starts raising the key ECB interest rates. At the press conference, President Lagarde noted that although there are near-term headwinds, activity in the Eurozone is expected to pick up strongly in 2022. On inflation, Lagarde stated that in the medium-term, inflation is expected to come in below target. This was reflected in the subsequent staff economic projections which penciled in 2023 and 2024 inflation at 1.8%. In the near-term, 2021 was upgraded to 2.6% from 2.4% and 2022 to 3.2% from 1.7%. In terms of the policy decisions made, Lagarde revealed that more than one member did not agree on the parameters, but there was a very large majority. On rates, the President continued to reaffirm that rates are unlikely to rise in 2022. Following the press conference, ECB sources revealed that it was the Austrian, Belgian and German governors who disagreed with parts of the ECB’s decision. The hawks were reportedly unhappy with extending the PEPP reinvestment to 2024 and not setting an APP end-date. They also disagreed on the inflation outlook and some stressed risks were to the upside.

RECENT DATA: December CPI rose to 5.0% from 4.9%, whilst the core (ex-food & energy) ticked higher to 2.7% from 2.6%. The January headline metric is seen cooling to 4.4% from 5.0% with the core rate seen moving to the 2% mark. Q4 GDP slowed to 0.3% from the 2.2% growth seen in Q3 as the impact of Omicron and supply chain woes hampered growth. Timelier survey data from IHS Markit saw the EZ-wide Composite PMI slow to 52.4 from 53.3 with IHS noting “The Omicron wave has led to yet another steep drop in spending on many consumer-facing services at the start of the year, with tourism, travel and recreation especially hard hit”. On the employment front, the EZ-wide unemployment rate fell from 7.1% to 7.0% in December vs. a COVID peak of 8.4% in October 2020.

RECENT COMMUNICATIONS: Since the prior meeting, a speech on January 8th by Germany’s Schnabel drew a lot of attention by noting that the green transition poses upside risks to medium-term inflation and suggesting that rising energy prices could require the ECB to act on policy. Schnabel added there have not been signs so far of broader second round effects from higher inflation. Elsewhere, President Lagarde on several occasions has remarked that the ECB does not see inflation spiraling out of control and that supply bottlenecks will stabilize throughout the course of the year. Chief Economist Lane also envisages a decline in inflation in 2022 whilst flagging expectations that inflation will move below the target in 2023 and 2024, adding that he is not seeing behavior that would indicate above-target inflation in the medium-term. Weidmann’s replacement Nagel commented on the inflation outlook noting that risks are skewed to the upside and the price surge is not entirely as a result of temporary factors. At the more hawkish end of the spectrum, Latvia’s Kazaks suggested on January 5th that the ECB is ready to raise rates and cut stimulus if necessary, adding the ECB will take action if the inflation outlook picks up and an early 2023 rate hike is a possible scenario. Interestingly, Simkus of Lithuania said that Russian-related tensions are a bigger cause for uncertainty than Omicron.

BALANCE SHEET: In December, the ECB announced that purchases under PEPP will cease at the end of March 2022. Reinvestments were extended until 2024 and purchases under PEPP could also be resumed, if necessary, to counter negative shocks related to the pandemic. On APP, as of Q2 2022, monthly purchases will be beefed up to EUR 40bln from EUR 20bln and then subsequently lowered to EUR 30bln in Q3 and back down to EUR 20bln in Q4 “for as long as necessary to reinforce the accommodative impact of its policy rates”. Despite ongoing inflation angst in the Eurozone, there has been no indication from policymakers that the current plan is set to change. As it stands, UBS expects purchases under APP to conclude in Q1 2023. Although it will likely not be a feature for the upcoming meeting, there are clearly risks of an earlier than envisaged taper with policymakers likely to find the justification for continuing with asset purchases at current inflation levels a difficult one. Interestingly, in a recent research piece, ING found that EUR 187bln reduction in the ECB’s portfolio would impact 10Y Italian yields as much as a 25bp hike. At the other end of the spectrum, ING finds that German government bonds would care a lot more about a 25bp increase in the ECB’s deposit rate. So-much-so that quantitative tightening would largely be irrelevant in comparison.

RATES/TIERING/TLTRO: The ECB is expected to stand pat on rates with the deposit, main refi and marginal lending rates to be held at -0.5%, 0.0% and 0.25% respectively with policymakers at pains to communicate that 2022 is unlikely to see a move on rates by the Bank despite markets pricing in a 10bps hike to the deposit rate by November. As it stands, the ECB’s current forward guidance reads that policymakers expect APP “to end shortly before it starts raising the key ECB interest rates”. Some desks are of the view that the inclusion of the word “shortly” is too restrictive and in the event that the GC has fulfilled its inflation objective, removing the word “shortly” could allow a quicker conclusion to asset purchases without having to commit to a subsequent rate hike. However, it is doubtful whether such a development will take place at the upcoming meeting. In terms of the rate path, RBC see a first 10bp deposit rate hike in March 2023, followed by a 15bp rate hike in September. RBC assumes that the ECB would indicate at that point that they could also start lifting rates by 25bps at a later stage in 2024. Elsewhere, policymakers will need to make a decision on the future of its TLRO programme. UBS expects this to be more of a factor for its March or April meeting with the Bank of the view that “the ECB will offer another series of TLTRO auctions as of/after June, albeit on somewhat less attractive terms, with the TLTRO pricing rising from as low as 50bp below the depo rate to in line with the depo rate.”. On tiering, the current multiplier will likely be hiked from the current level of six at some point, however, this will likely not be a feature of the upcoming meeting.

PRESS CONFERENCE: With the statement of the release set to be relatively unchanged, focus instead will fall on the accompanying press conference which will offer President Lagarde an opportunity to take stock of recent economic developments. More specifically, markets will be eyeing how Lagarde judges the inflationary outlook. With the Bank moving further away from its transitory inflation stance seen last year, ING judges that the ECB will need to convey its ability to tame inflationary pressures whilst avoiding a rush from “inflation patience” to “inflation panic”, as a move towards the latter could lead to an aggressive hawkish repricing by the market which is already at odds with ECB comms. As it stands, markets fully price in a 10bps hike to the deposit rate by the October meeting, whilst ECB officials have been at pains to state that a hike is unlikely to take place until 2023. Lagarde will likely continue to suggest that this remains the plan, perhaps of greater interest will be whether or not she hints that asset purchases could be wound down at a faster rate than currently envisaged. ING suggests that doing this could help policymakers address the overall balancing act facing the ECB. From a more medium-term perspective, market participants will be cognizant of upside risks to the inflation outlook in lieu of recent comments from Germany’s Schnabel who cautioned that the green transition poses upside risks to medium-term inflation.

SocGen raises two questions that it is looking to be addressed by the ECB on the inflation outlook:

- 1) will core inflation be more closely anchored to the target than in the past?

- 2) how far away is a neutral policy stance?

SocGen suggests that the answer to these questions will be “contingent on the policymakers’ confidence that a shift has occurred, making tight labor markets generate higher wage growth”. SocGen does not believe that there will be sufficient evidence of this before the autumn.

Elsewhere, some elements of the Q&A will likely center on how the potential Ukraine-Russia conflict could impact the ECB’s near-term price outlook, however, Lagarde will likely try and play down these potential impulses given that there is great uncertainty over how the situation will play out.

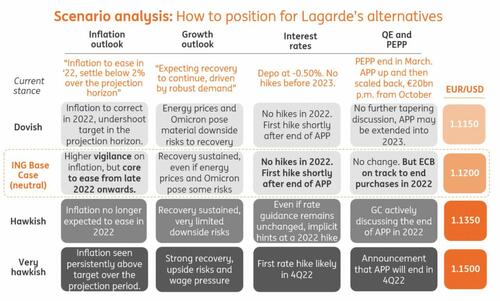

Finally, here is the familiar ECB cheat sheet from ING

Tyler Durden

Wed, 02/02/2022 – 22:50

via ZeroHedge News https://ift.tt/eJmVILl2R Tyler Durden