Britons Face “Steep Drop In Quality Of Life” As UK Gov’t Scrambles To Avert Energy Crisis With Subsidy Plan

Finally, observers of British politics have something else to talk about besides ‘Partygate’.

In an effort to stave off an epidemic of what one CNBC host called “energy poverty”, Her Majesty’s Government has subsidize the energy costs borne by millions of British households as decades of energy policies that overemphasized reliance on imported natural gas – prices of which have soared over the last year – in favor of dirtier, but abundant, sources like coal have brought the British economy to the brink of an energy crisis.

Energy bills are expected to drastically spike in the coming months after Ofgem, Britain’s energy sector regulator, announced on Thursday that it would be raising its price cap on household energy bills by 54% starting April 1, a record-breaking increase instituted to stop power utilities from sinking into bankruptcy in the face of surging LNG prices. That’s on top of a 12% hike approved back in October.

The average household’s annual energy bill is currently between £1,277 ($1,730) and £1,370 in the UK, and the increase could saddle millions of families with enormously increased costs for heating and electricity.

As a result, HMG has decided to issue direct subsidies to the British people to prevent millions from being squeezed as a result of what have now been exposed as unwise energy policy decades in the making that has shifted Britain’s reliance on abundant coal that’s widely available within the UK to imports of the “cleaner” LNG.

Speaking before the House of Commons on Thursday, Chancellor Rishi Sunak proclaimed that “just as the government stood behind the British people through the pandemic…so we will help people deal with one of the biggest costs they now face – energy.”

To accomplish this, the government will step in to subsidize the energy bills to the tune of about £350 for nearly 30MM British households, at a cost quoted by Sunak of roughly £9 billion. That will – according to Sunak – cover roughly half of the expected ~£700 annual increase in heating and energy costs expected to be borne by the average household. More than half of British households are on adjustable-rate energy plans, which make them especially vulnerable to price hikes.

HMG will also impose a scheme to spread the cost of higher bills out over a longer period of time to make them more manageable. This will be enacted in the form of an upfront discount of £200 per household. Finally, a small tax rebate rounds out the government’s plan. The payments through energy suppliers will apply across England, Scotland and Wales, but not Northern Ireland which operates under a different regulator.

But how did the UK get to this point?

Sunak unsurprisingly tried to pin the blame entirely on developments in global energy markets far removed from Britain’s control. But as many pointed out in response to the decision, that’s not exactly accurate. Britan’s leaders have for decades pushed LNG, wind, solar and – to a much lesser extent – nuclear (the only truly stable source of power aside from fossil fuels) over coal, it’s most abundant natural power source. As a result of soaring demand, the government’s gas reserves have plummeted, leaving Britain’s economy especially vulnerable to natty gas prices.

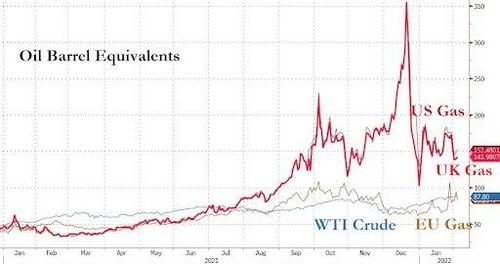

Consumers in the US are groaning about WTI crude at almost $90/barrel, but surging natty gas prices in Europe have squeezed European nations – which mostly import their gas and oil from Russia.

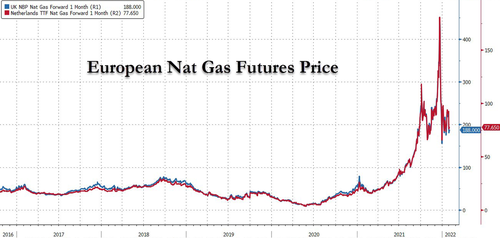

UK natty gas prices have nearly quadrupled over the last year.

To put it in terms that Americans might understand: at their current levels, natty gas prices in the UK are equivalent to US crude reaching $141

But CNBC’s Brian Sullivan quickly pointed out that the UK largely brought this problem on itself: “The government is trying to help consumers out because poor policies that the government made have led to big price hikes on those consumers,” said CNBC’s Brian Sullivan. “So many of these power companies and utilities are losing so much money…every utility in the UK is going to raise prices.”

And with the Bank of England hiking interest rates to help combat soaring prices, Sullivan observed that the British people might soon face the largest drop in their standard of living in decades.

“It’s all happening at the same time and what’s it’s going to do is result in a steep drop in the quality of life for millions of people in England…I hate to be blunt about it but that’s the truth.”

Watch the full clip below:

PS: These huge energy price hikes in UK are coming at same time as raging inflation + income tax hikes + national insurance increases.

UK overall standard of living could take decades-like hit in coming years. https://t.co/jQoFUOTsoI

— Brian Sullivan (@SullyCNBC) February 3, 2022

Tyler Durden

Fri, 02/04/2022 – 02:45

via ZeroHedge News https://ift.tt/6KEY9fn Tyler Durden